This post was originally published on this site

Since the pandemic’s start, a person’s home might have morphed from the place where they eat and sleep to their fitness center, speakeasy, school and place of work as well.

But come tax time this year, they shouldn’t necessarily bank on their home being the source of a job-related tax write-off that can be worth $1,500 and possibly even more.

It’s understandable why taxpayers readying their 2020 returns might be eyeing the home office deduction, which provides tax breaks for people who do their work from home.

Seven in 10 people who can do their work from home told the Pew Research Center they are working from home all or most of the time, according to a survey released in December.

Eight in 10 people who are able to work from home said they expect it will be a permanent arrangement, according to a separate TurboTax survey from December.

But just 31% of those people think they’ll be eligible for the home office deduction.

So who can claim it and who cannot? Here’s a look at what to know about the home office deduction.

Self-employed taxpayers and independent contractors can take the federal deduction

“There’s good news and bad news,” Barbara Weltman, the owner of Big Ideas for Small Business, explained to MarketWatch. If you’re an employee filing taxes between 2018 and 2025, you cannot claim the deduction, she said.

Prior to passage of the 2017 Tax Cuts and Jobs Act, employees could possibly include unreimbursed business expenses if they worked from home at the convenience of their employer. But the tax code overhaul paused that ability until the provisions sunset at the end of 2025.

Self-employed taxpayers and independent contractors still can claim the deduction, according to the Internal Revenue Service.

People making money in the gig economy can also potentially claim the credit, the IRS added.

“You could be an employee and a gig worker on side. … That side job is eligible for the home office deduction,” said Roy Goldberg, a certified public accountant based in Rancho Palos Verdes, Calif.

A handful of states will let employees take deductions on home office expenses in their state income taxes. These states are Alabama, Arkansas, California, Hawaii, Minnesota, New York and Pennsylvania, according to Peter DeGregori, managing partner of Vertical Advisors, an accounting firm based in Newport Beach, Calif.

I’m eligible. Now how do I claim it?

First off, the deduction applies when a taxpayer uses a part of their home “exclusively and regularly as a principal place of business for a trade or business,” according to the IRS.

Regular work use of a certain part of the home — like a spare bedroom or an unattached garage — might be the easy part. Exclusive use might be a lot trickier.

“A home office deduction was only allowed for a room or section of the residence that was used exclusively for business. So a living room that is used for an office but twice a year for Thanksgiving and Christmas technically wouldn’t qualify,” said DeGregori.

The IRS mention of exclusive use isn’t fair in DeGregori’s view, but he also says to keep it in context. The risk of an audit could be slim for many people taking the deduction “as long as the numbers aren’t outrageous.”

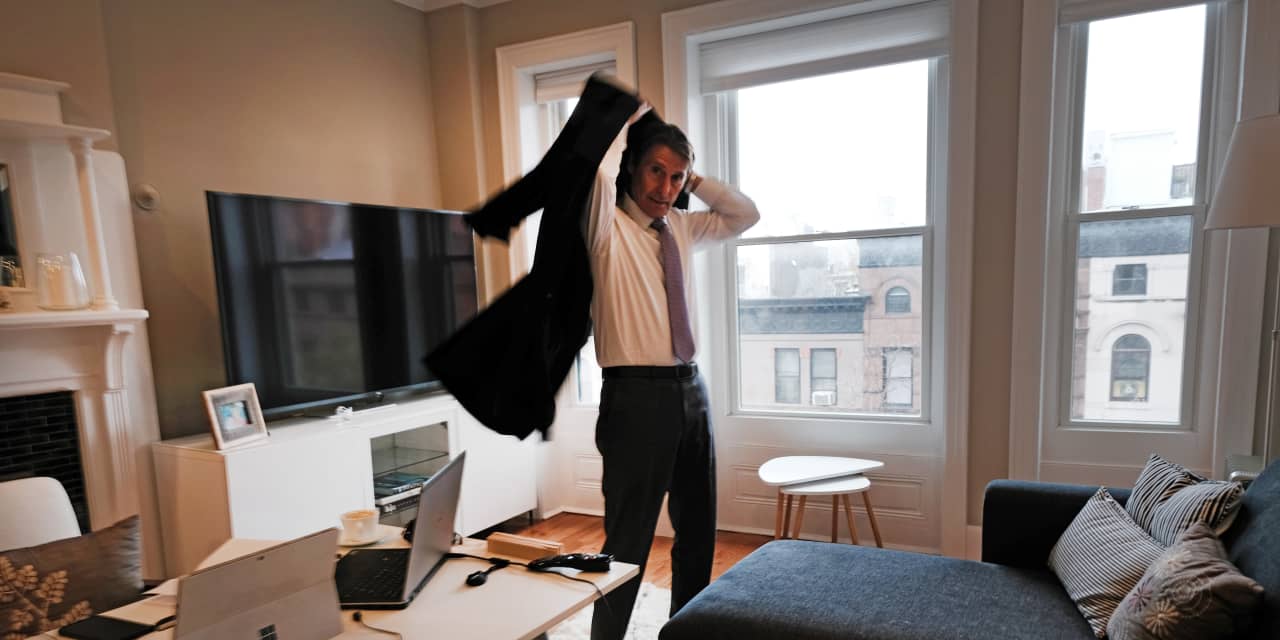

Still, it’s not a bad idea to take a picture of your workspace for your records, just in case any potential audit notice on 2020 returns pops up later.

In Goldberg’s four decades of tax work, there’s been one time when an IRS official checked out a taxpayer’s home office during an audit — and the agent gave the OK upon review. “You can always take a picture of [the home office space]. The IRS is not going to look at it,” Goldberg said.

People claiming the deduction may ‘want it quick and easy’ but perhaps fight the urge

The tax break comes in two flavors, a simplified deduction and a more complex one.

The simplified method provides a deduction of up to $1,500. For taxpayers going down this route, the Schedule C form will ask for the total square footage of a home and then it will ask for the square footage of the home used for business. The IRS applies a formula of $5 per square foot, so that could be a potential break for someone with a home office space of 300 square feet or less.

That may be a little skimpy, according to MarketWatch tax columnist Bill Bischoff. But one advantage to the simplified method is that the filer doesn’t need to keep proof of the home office expenses, he added.

The other way of calculating the deduction can be a “major tax saver,” Bischoff said.

It might help to apply the calculating method to real life.

Early in the pandemic, Rentcafe.com calculated average apartment space per person. Louisville, Ky. apartment dwellers had the most average space per person, with 731 square feet per person, the apartment search website said. A Louisville apartment averaged 936 square feet in size.

For simplicity’s sake, let’s suppose there’s a self-employed Louisville taxpayer with a 1,000-square-foot apartment and a 400-square-foot extra bedroom used as office space.

Forty percent of the space is devoted to a home office, so a person seeking the home office deduction can tally up things like their rent, utilities, renters’ insurance and improvements to the apartment. Forty percent of that sum equals the sought-after deduction.

If a person owns the home, they can tack on costs like property taxes and mortgage interest, Goldberg noted.

IRS Form 8829 is where you show your math in claiming the deduction, said Goldberg, who’s personally been working from home for 10 years.

Items like computers and chairs in the home office don’t go towards the deduction, he added. But they can count towards deductible business expenses.

It might be the case that some taxpayers are leaving money on the table when opting for the simplified method, Goldberg said. “A lot of people do it just out convenience and are not familiar with Form 8829. They just want it quick and easy,” he said.

But Goldberg says it’s worth doing the math to compare the potential tax break offered by the simplified method and the one offered by the full formula.