This post was originally published on this site

Shares of Apple Inc. sank to a one-month low Wednesday, and broke below two key chart levels in the process, after the technology behemoth’s two largest shareholders disclosed that they trimmed their stakes.

The stock AAPL, -1.76% shed 1.8% to $130.84, enough to pace the Dow Jones Industrial Average’s DJIA, +0.29% decliners. It closed at the lowest price since Jan. 19.

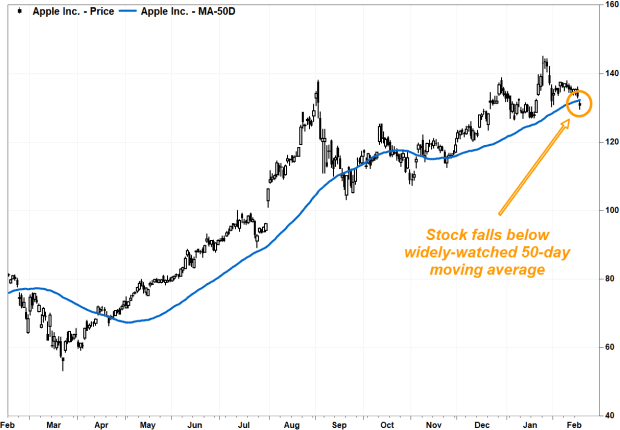

The stock also closed below its widely watched 50-day moving average (50-DMA) for the first time since Nov. 24. Many chart watchers view the 50-DMA as a guide to the short-term trend, with trades above it suggesting an upward bias and trades below it warning of potential weakness. The 50-DMA extended to $131.59 on Wednesday, according to FactSet.

FactSet, MarketWatch

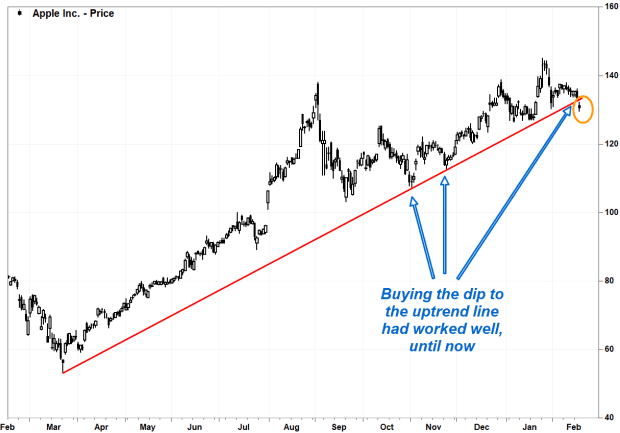

But perhaps more worrisome for bulls, the stock has broken below the uptrend line that defined its recovery off the March lows. The trendline extended to roughly $133.35 on Wednesday.

Many technicians use uptrend lines as a place to buy a stock on a dip. The fact that Apple’s uptrend line was marked by three intraday lows since the start of the line indicates that strategy had worked fairly well, until Wednesday.

The Dow Theory of market analysis, which has remained relevant on Wall Street for over a century, says a trend remains in place until it has given signs that it has reversed. So a break of an uptrend line suggests that a new downtrend may have just begun.

Read more: Don’t dis the Dow Theory just because it’s over 100 years old.

FactSet, MarketWatch

The stock’s selloff comes after Warren Buffett Berkshire Hathaway Inc. BRK.B, -0.01% disclosed late Tuesday that it owned 887.14 million Apple shares, or 5.28% of the shares outstanding, as of Dec. 31. That’s down from the 944.30 million shares, or 5.55% of the shares outstanding, it owned as of Sept. 30. Berkshire Hathaway remained Apple’s second-largest shareholder.

But despite the share sales were effectively a rebalancing, as the value of Berkshire Hathaway’s stake in Apple rose to $117.71 billion as of Dec. 31 from $109.36 billion on Sept. 30, as Apple’s stock surged 14.6% during the fourth quarter.

Meanwhile, Apple’s largest shareholder, The Vanguard Group Inc., trimmed its stake in Apple by 25.51 million shares. Vanguard owned 1.26 billion shares, or 7.48% of the shares outstanding on Dec. 31, down from 1.28 billion shares, or 7.53% of the shares outstanding, on Sept. 30.

Separately, Epic Games, the developer for the “Fortnite” videogame, said Wednesday it filed an antitrust complaint against Apple with the European Commission. Epic Games alleges that Apple has “not just harmed but completely eliminated competition” on the distribution and payments of apps on the Apple App Store.

Apple’s stock has gained 9.6% over the past three months, while the Nasdaq-100 Index NDX, -0.54% has rallied 14.4% and the Dow has tacked on 7.4%.