This post was originally published on this site

U.S. retail sales results for the month of January show the positive impact that federal stimulus funds had on spending, but also indicate the importance of an additional government infusion of cash.

“The outlook for the year ahead is complex. From a demand perspective, there is enough firepower in the economy to maintain good growth through the next couple of months. However, stellar growth will rely on more stimulus being passed,” wrote Neil Saunders, managing director at GlobalData.

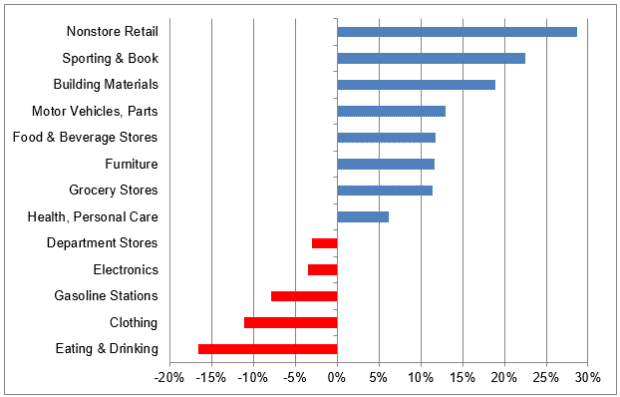

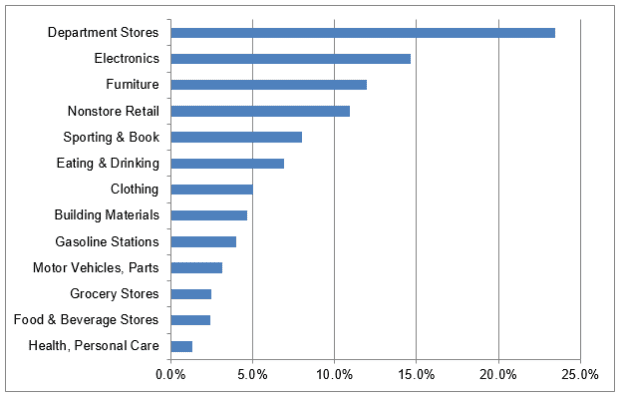

Retail sales were up 5.3%, with sporting goods up 8% month-over-month seasonally adjusted and up 22% unadjusted year-over-year; furniture and home goods up 12% month-over-month seasonally adjusted and up 9.3% unadjusted year-over-year; and apparel and accessory receipts were up 5% month-over-month seasonally adjusted but down 11.3% unadjusted year-over-year.

See: U.S. retail sales leap 5.3% in January as stimulus checks help to boost economy

January 2021 Retail Sales: year-over-year % Change, Mizuho

“Consumers and the economy as a whole remain in good shape despite unprecedented adversity over the past year, and congressional action has been a lifeline for households and businesses disproportionately impacted by the pandemic,” said Matthew Shay, chief executive of the National Retail Federation.

Across the board, experts say stimulus money and the rollout of vaccine distribution were critical. While there are cheers for the January results, maintaining growth will require more.

“The January data suggest that the picture is improving,” said Cailin Birch, global economist at The Economist Intelligence Unit, adding that the anticipation of a sizeable relief package under the new Biden administration is likely bolstering confidence.

President Joseph Biden and Congress are currently working out the details for another aid package, with $1,400 stimulus checks, or more, a possibility for some Americans.

“That said, the positive headline data continues to mask weakness among a broad swathe of consumers–particularly low-income households, which make up a smaller share of overall spending, but have been disproportionately hit by the rise in unemployment. We expect consumer spending growth among these households to remain soft in 2021, preventing a sharper economic recovery,” Birch said.

And: Biden, labor leaders to talk coronavirus aid, infrastructure at White House meeting

January 2021 Retail Sales: month-over-month % Change, Mizuho

Different sectors of the retail industry could have different outcomes in the near term as spending shifts.

“The overall growth disguises a very mixed performance across segment… Some segments are doing extremely well while others struggle mightily,” wrote Scott Hoyt, head of consumer economic research at Moody’s Analytics.

“The outlook is mixed. More stimulus is a clear plus. However, while it remains some months off, at some point re-openings could become a negative for retail as they facilitate a shift in spending back towards services.”

Read: A pandemic paradox: Americans’ credit scores continue to rise as economy struggles — here’s why

Moody’s expects retail sales in 2021 to rise “a healthy” 3% to 5%, according to Mickey Chadha, a vice president at the organization.

The SPDR S&P Retail ETF XRT, -0.78% has soared 76% over the past year. The Consumer Discretionary Select Sector SPDR Fund XLY, +0.57% is up 29.4%. And the benchmark S&P 500 index SPX, -0.03% is up 16.1% for the period.