This post was originally published on this site

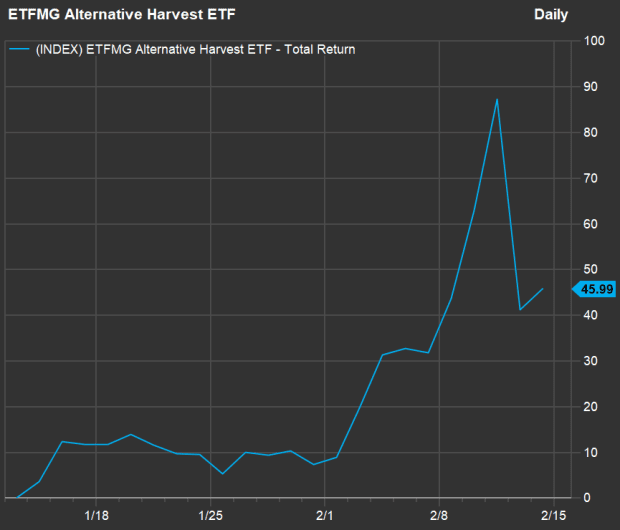

In case anybody needed a reminder that stocks are risky, don’t always go straight up and huge losses can be real, consider cannabis stocks. On Feb. 11 they dropped as much as 50%.

Look at this one-month chart, which seems as if it could be a one-year chart for the ETFMG Alternative Harvest ETF MJ, +0.24%, the largest exchange traded fund in the sector:

(FactSet)

There are many small-cap stocks — not only in the cannabis sector — that are making big “candle sticks” like that as they make 10%-30% moves intraday.

The stock market seems to remain a random number generator. Some random small-cap stock might be worth $17 one day, $37 the next day, $79 the next morning and then close at $44. This is not investing. These are random numbers generated by a four-letter symbol machine.

Here’s another example of how random these numbers are right now, as subscribers in the chat room ask me this type of question over and over, as so many startup companies come public at huge valuations:

“Cody, if Rivian and Lucid Motors go public, how much valuation will you give each of them. I just heard that Rivian is seeking a $50 billion valuation. Lucid claimed to have [a] superior 900-volt electrical system. Both seem almost ready to start pushing products out.”

I have no idea how to value these companies. We’ll need to see some revenue, some gross-margin projections and so on. Remember that when we bought Tesla Inc. TSLA, -1.23% two years ago, that after a couple years of struggling to crank out the Model 3, it was being valued at $30 billion and trading at just over one times revenue.

Nowadays, many of these startup electric-vehicle companies are being assigned valuations that rival Tesla’s at that time but without the revenues or factories or established brands or burgeoning charging networks or anything. Is Lucid Motors, without any revenue or gross margins or unit sales yet currently valued at close to $10 billion, really worth 25% as much as Ford Motor Co.’s F, -0.31% current $44 billion valuation?

Rivian is clearly a great company. Amazon.com Inc. AMZN, -0.01% invested in Rivian’s stock on the cheap a couple years ago and promised to buy a ton of vehicles from the company. I’d like to invest in Rivian at a fair price that includes a margin of safety and lots of potential upside. I don’t know what that means yet, because we need to get more financials and insights into the business model before I generate a random number for you.

“Discipline: an orderly or prescribed conduct or pattern of behavior.”

I often talk about discipline when it comes to investing and trading. Discipline sounds like an outdated concept in this market. But discipline never goes out of style for long. Discipline will be back.

Cody Willard is a columnist for MarketWatch and editor of the Revolution Investing newsletter. Willard or his investment firm may own, or plan to own, securities mentioned in this column.