This post was originally published on this site

Affirm Holdings Inc. topped revenue expectations for its latest quarter and issued an upbeat forecast, but shares slipped in after-hours trading Thursday.

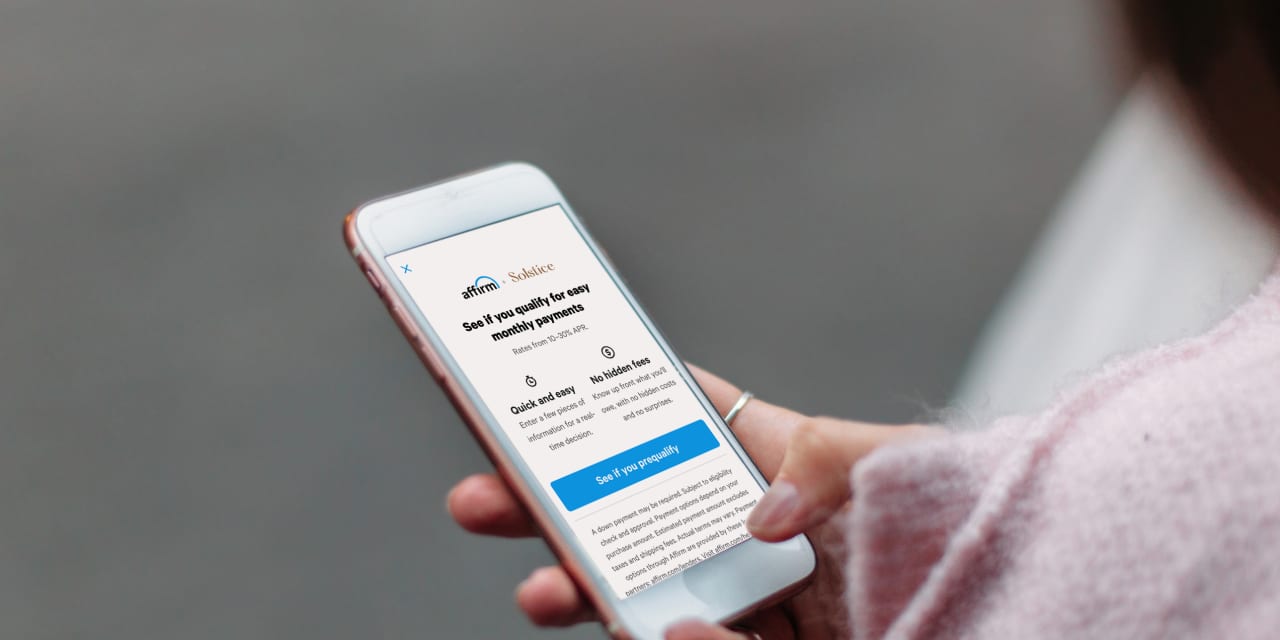

The company, which allows people to split purchases into installments, generated a fiscal second-quarter net loss of $31.6 million, or 45 cents a share, compared with $31 million, or 92 cents a share, in the year-earlier quarter. Analysts surveyed by FactSet were modeling 81 cents a share in GAAP earnings.

Affirm’s AFRM, +2.76% revenue rose to $204.0 million from $130 million, while analysts had been projecting $189.4 million. Affirm’s gross merchandise volume rose to $2.1 billion from $1.3 billion, above the FactSet consensus, which called for $1.7 billion.

Shares were off more than 6% in after-hours trading.

Chief Executive Max Levchin told MarketWatch that the company saw a greater diversification of revenue among its merchant partners in the latest quarter. While Peloton Interactive Inc. PTON, +0.99% accounted for 30% of revenue in the September quarter, it was responsible for 24% in the December period. This indicated to Levchin that the company is “growing our non-Peloton user base faster while also happily growing with Peloton” as Affirm both grew volume within its existing merchant base and added new partners.

Affirm had 4.5 million active customers as of the quarter, up from 3.6 million as of the June quarter.

The report was Affirm’s first since going public a month ago.

The company forecast fiscal third-quarter revenue of $185 million to $195 million, while analysts were projecting $189 million. Affirm expects gross merchandise volume of $1.80 billion to $1.85 billion, above the FactSet consensus, which called to $1.75 billion.

For the full fiscal year, Affirm called for $760 million to $780 million in revenue and $7.25 billion to $7.35 billion in GMV. Analysts were expecting $747 million and $6.79 billion in GMV.

Affirm shares are up about 180% from their initial-public-offering price of $49.