This post was originally published on this site

Investors are observing the U.S. stock market’s assault on fresh record highs with a certain measure of unease—and perhaps for a good reason.

The pandemic is still at or near full-strength, although hope remains strong that effective vaccines will quell the spread. A hoped-for recovery in the second half of the year seems a ways away and Federal Reserve Chairman Jerome Powell said as much during a webcast talk hosted by the Economics Club of New York on Wednesday.

“Workers and households who struggle to find their place in the post-pandemic economy are likely to need continued support,” Powell said. “The same is true for many small businesses that are likely to prosper again once the pandemic is behind us.”

Read: The stock market is echoing 2009-10 — and that means a pullback could be near, analysts warn

In other words, easy-money policies, with interest rates at or around 0%, will remain in force for the foreseeable future.

Set against the expectations of trillions of dollars of further government aid spending championed by the Biden administration, it is no wonder that pockets of euphoria amid superlow interest rates have materialized.

From special-purpose acquisition company, or SPACs, which have been the vehicle du jour to bring companies to public markets, to meme stocks represented by bricks-and-mortar businesses with a questionable future in the middle of the COVID health crisis like GameStop Corp GME, -0.39%. , AMC Entertainment Holdings AMC, -2.24%, signs of froth in the system appear to be prevalent.

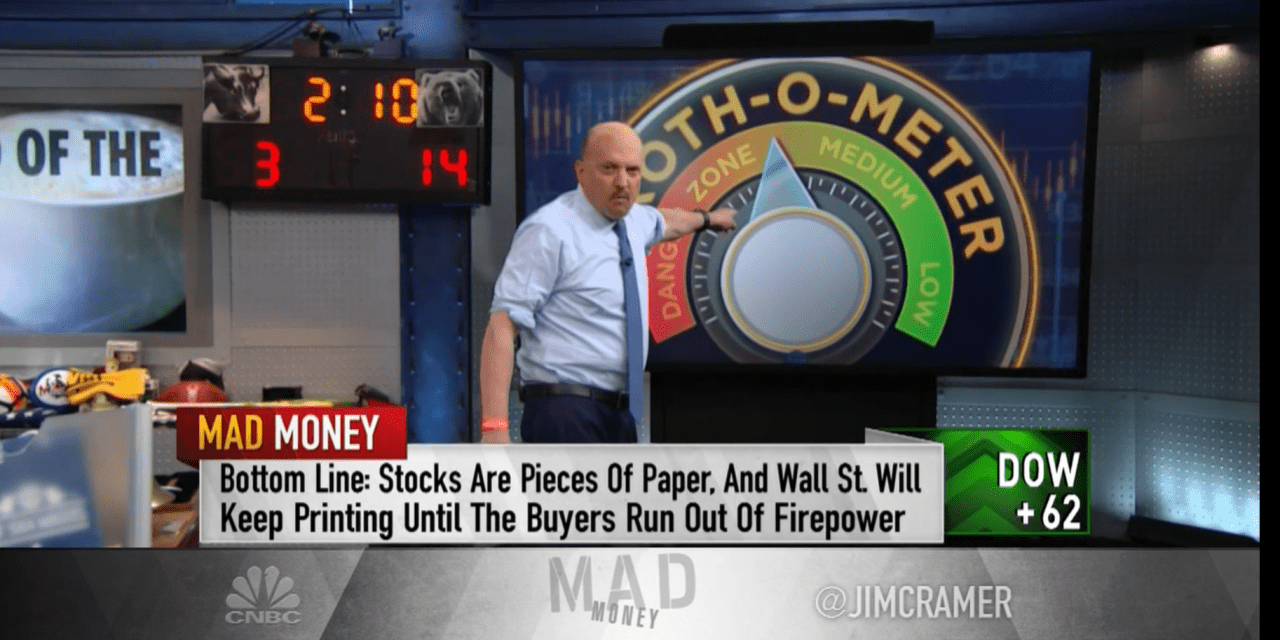

That is perhaps whyJim Cramer, host of CNBC’s “Mad Money,” on his show on Wednesday described markets as on uncertain footing to say the least.

“You wouldn’t know it from the sedate action in the averages” Cramer said, adding that the stock market is on “a highway to the danger zone.”

He cautioned that investors should exercise a modicum of caution: “I am not saying sell everything. I am simply begging you to exercise some discipline and sell something because nobody ever got hurt taking a profit.”

Cramer isn’t alone. The appetite for stories on MarketWatch and our sister publication Barrons.com about potential market corrections and bubbles have been ravenously consumed. And that is not out of some sort of schadenfreude, or a sense of reveling in the possibility of a downturn, but because there is so much angst around this rebound from a COVID-19 economic demolition with few modern day playbooks for the road to recovery.

A couple of weeks ago, the market was gripped with genuine fear that a downturn might be at hand, spurred by a collective uprising from individual investors and powered by social-media platforms Reddit and Discord, but the market has powered back after momentarily losing grip on year-to-date gains.

Now investors are piling into (and out of) pot stocks, at a furious pace, with stocks of companies like Tilray Inc. TLRY, -49.68%, Aphria APHA, -35.82% and the exchange-traded fund ETFMG Alternative Harvest ETF MJ, -24.62% seeing violent shifts in momentum.

Amid that fervor, the Dow Jones Industrial Average DJIA, -0.02% is up 2.4% over the roughly 28 trading days of 2021, the S&P 500 index SPX, +0.17% has gained nearly 4% and the Nasdaq Composite Index COMP, +0.38% is enjoying an 8.5% year-to-date turn so far.

Cramer said that investors are getting too greedy. Perhaps, investors have been overeager.

However, CNN’s fear and greed index is only a few points over neutral at 56, far from the extreme levels that tend to indicate that excess is building up in the system.

Thomas Lee of Fundstrat Global Advisors, told CNBC on Thursday, during the business networks “Halftime Report,” said that he’s not seeing signs of euphoria and, while pockets of excess are prevalent in “meme” trading trends and in pot stocks, they are not suggestive of inflated values throughout the system.

Analysts like Morgan Stanley’s Michael Wilson said that he thinks the markets are fragile but may only see halting pullbacks of around 5% and Keith Lerner, chief market strategist at Truist Advisory Services, said that the market isn’t giving itself enough credit for the solid earnings reports that have thus far been released for the fourth quarter.

“Although there are frothy segments of the market that are detached from fundamentals, we don’t see bubble conditions more broadly,” Lerner wrote in a research report dated Tuesday.

At the end of the day, maintaining a prudent investing stance is the best way to approach these or any markets.

Timing the market is tough task and it is impossible to know precisely when markets will fall into a danger zone a la Kenny Loggins:

And even if problems arise in the market, it is hard to know how long they will last and which areas will be the hardest hit. Such was the case with this pandemic, when markets blasted off their March 2020 lows and have yet to retrace significantly.

That may suggest that long-term, consistent investing is a road to riches rather than a highway to danger.