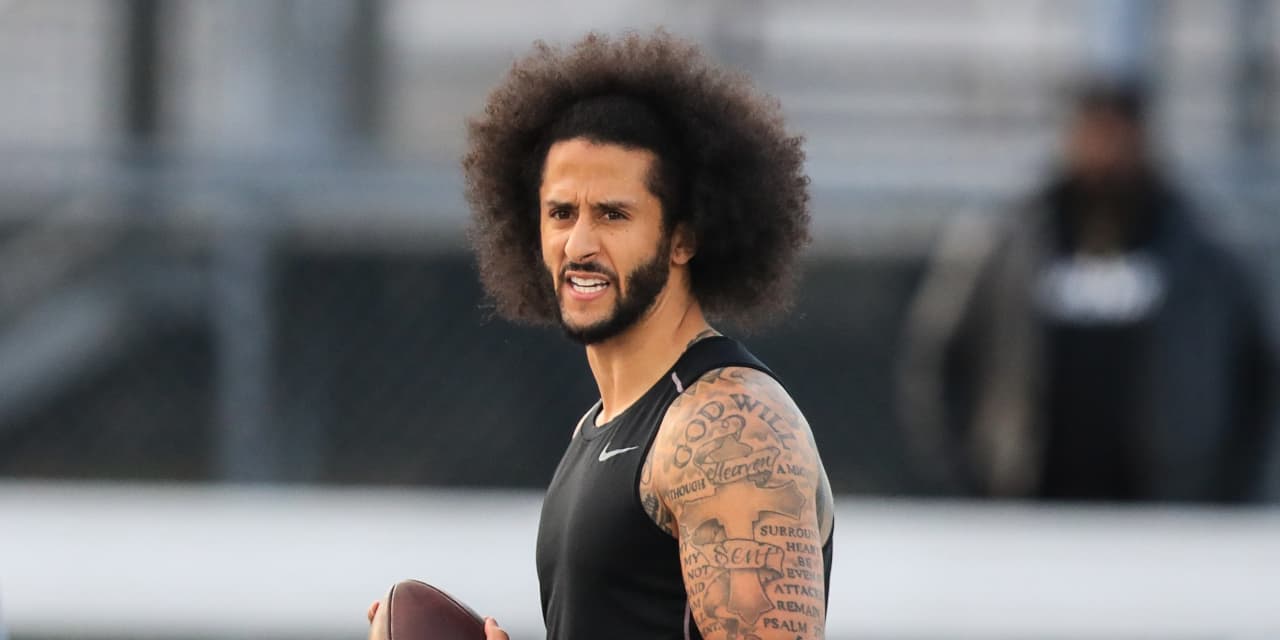

Former NFL quarterback Colin Kaepernick is the latest to create a special purpose-acquisition company, seeking to raise up to $287.5 million in an initial public offering.

According to a filing with the Securities and Exchange Commission, Kaepernick — the former San Francisco 49ers quarterback who took a knee during the national anthem to protest systemic racism and hasn’t played in the NFL since 2016 — is the co-sponsor and co-chairman of Mission Advancement Corp., working in partnership with The Najafi Cos., a private equity firm.

Mission Advancement will focus on racial justice and diversity issues, and aims to acquire a consumer business with an enterprise value around $1 billion.

“The mission of the Najafi/Kaepernick partnership is to identify, acquire and advance a company with the aim of creating meaningful financial and societal value,” the filing said. “We believe Mr. Kaepernick’s substantial business experience combined with his long-term leadership on racial equity and justice issues will support our success in identifying a prospective target company and adding transformational value to the combined entity.”

The filing noted Kaepernick has worked with global brands such as Nike NKE, -1.13%, Disney DIS, -0.94%, Netflix NFLX, +2.03%, Apple’s AAPL, -0.66% Beats by Dre, Medium, Electronic Arts EA, +2.56%, Amazon’s AMZN, -0.54% Audible, and Ben & Jerry’s in recent years.

As an indication of its mission, the company’s board of directors is 100% Black, Indigenous and people of color, and is majority female. Directors include Google marketing executive Attica Jaques, former Apple executive Omar Johnson and Birchbox co-founder and CEO Katia Beauchamp.

SPACs are blank-check companies that have exploded in popularity in recent years. They are essentially empty-shell companies that look for a company to acquire and take public, in a process quicker than a traditional IPO. So far this year, there have been 131 SPACs that have raised a collective $39.9 billion, according to SPAC Research. That’s already about half as many SPACs as in all of 2020.

23andMe Inc. said last week it will go public via a merger with a SPAC owned by Richard Branson, and hedge fund Elliott Management is reportedly considering creating a SPAC.

Billionaire investor Sam Zell on Tuesday said the SPAC craze reminds him of the late 1990s. “This is rampant speculation again, very much like the dot-com boom,” he told CNBC in an interview.

While he said SPACs can be very effective, Zell said he worries many are built on shaky financial fundamentals.