This post was originally published on this site

GameStop shares have been on a frenzied tear, trading like companies multiples its size.

On Wednesday, shares of GameStop GME, +126.13% shares rose 141%, pushing the company’s market value to an eye-popping $25 billion from a little over $1 billion at the start of the month and $10 billion at the end of Tuesday’s action.

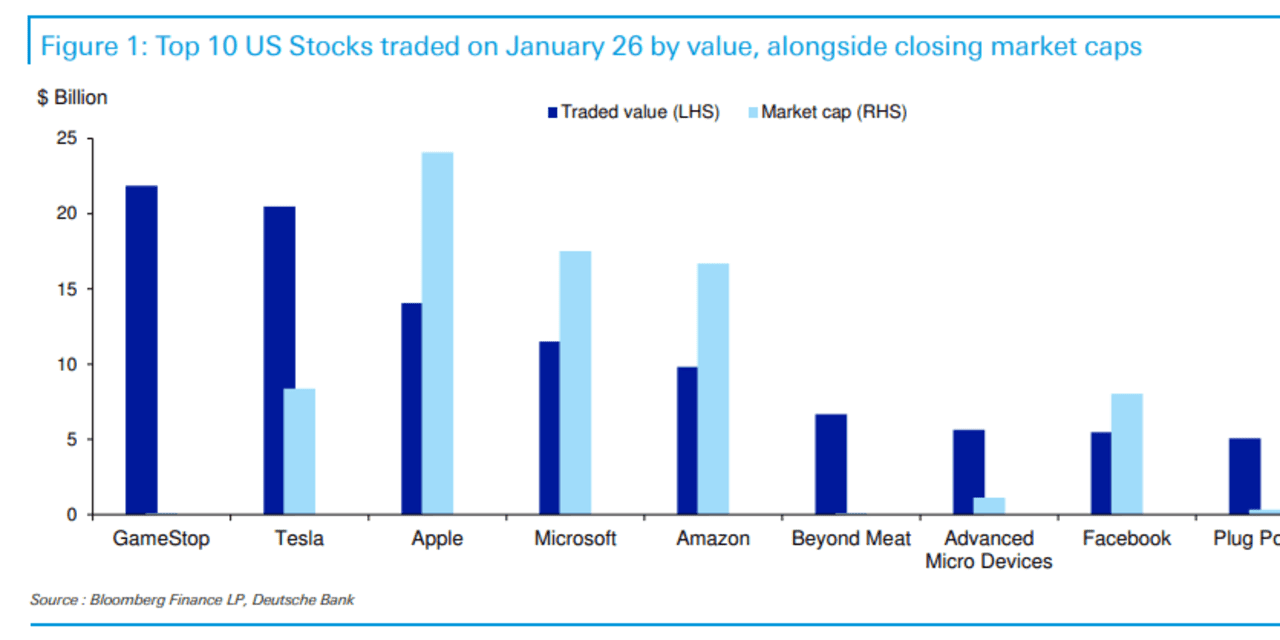

The parabolic ride higher for GameStop, driven by a klatch of investors congregating on sites like Reddit’s WallStreetBest forum, has made the company the most traded stock in the U.S., according to Deutsche Bank data.

In fact, Deutsche Bank’s strategist Jim Reid said that more GameStop shares traded by value yesterday than either Tesla Inc. TSLA, -0.14% or Apple AAPL, +0.14%, a pair of companies that dwarf GameStop by market value.

Electic-vehicle maker Tesla is a roughly $840 billion company while Apple is a $2.4 trillion behemoth.

Still, that didn’t stop some 178,588,000 million shares changing hands, while comparatively, 98 million shares of Apple changed hands and 23 million shares of Tesla traded, according to Dow Jones Market Data.

The 20-day rolling average volume for GameStop shares is 54.5 million, while the average rolling volume for Apple is 111 million and Tesla’s is 38 million, as of Tuesday.

The rise in GameStop’s shares is potentially minting millionaires among the individual investor crowd but many short selling investors, those betting that the bricks-and-mortar company, which operates more than 5,000 retail video game stores in the U.S., Canada and Europe, was going to eventually lose value have been forced to unwind their bearish bets, accelerating the stock’s rise.

Hedge fund Melvin Capital closed out its short position in GameStop fund manager Gabe Plotkin told CNBC’s Andrew Ross Sorkin on Tuesday, noting that the position was closed out Tuesday afternoon following a huge loss.