This post was originally published on this site

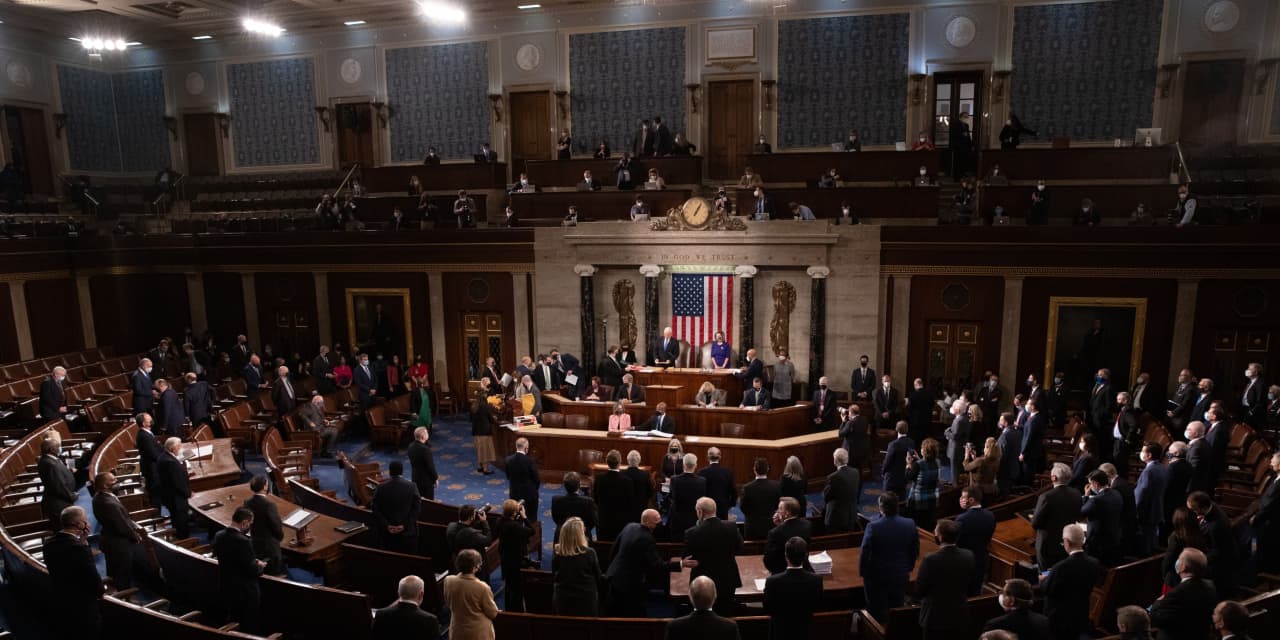

U.S. stock benchmarks traded higher Thursday morning after Congress confirmed the election of Joe Biden, and President Donald Trump, for the first time, promised an orderly transition of government after protesters broke into the Capitol building disrupting proceedings on Wednesday afternoon.

The protests in Washington, which lead to the deaths of four people, including a woman shot by Capitol Police, marked one of the darker days in American democracy and yielded swift responses from world and business leaders, who condemned the overrun of the Capitol.

How are stock benchmarks performing?

- The Dow Jones Industrial Average DJIA, +0.76% was up 143 points, or 0.5%, at 30,975.

- The S&P 500 index SPX, +1.36% was trading 28 points to reach 3,776, a gain of 0.8%, putting the broad-market index in record territory and a stone’s throw from an intraday record peak.

- The Nasdaq Composite Index COMP, +2.05% climbed 166 points, or 1.3%, to reach 12,905.

On Wednesday, the Dow and small-capitalization Russell 2000 ended at record highs but off their best levels of the day as equity markets pared gains somewhat amid the chaos in Washington.

- The Dow closed up 437.80 points, or 1.4%, to end at a record 30,829.40

- The small-cap Russell 2000 RUT, +1.13% gained 4% to end at a record 2,057.92.

- The S&P 500 gained 21.28 points, 0.6%, to close at 3,748.14.

- The Nasdaq Composite Index COMP, +2.05% finished lower by 78.17 points, or 0.6%, at 12,740.79.

What’s driving the market?

Equities were heading higher early Thursday as investors looked past the violence that played out in Washington on Wednesday during the usually ceremonial process of confirming a presidential election victory.

The positive tone to trading in stock index futures early in the day suggests that investors are expressing “relief from yesterday’s political theatrical event,” Peter Cardillo, chief market strategist at Spartan Capital Securities, said in a Thursday research note.

Read: Why the stock market rallied even as a violent mob stormed the Capitol

“There should be no mystery as to why the markets didn’t care about what happened in the [Capitol] yesterday, however disturbing, disgraceful, and embarrassing it was. It’s because it has no bearing on the direction of the economy, earnings and interest rates. It’s that simple,” wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group.

President Trump’s Twitter account was locked by Twitter, so he tweeted a message via his social-media director Dan Scavino, suggesting that he acknowledges his election defeat and pledges an orderly transition of power. “Even though I totally disagree with the outcome of the election, and the facts bear me out, nevertheless there will be an orderly transition on January 20th.”

Prominent business leaders, however, voiced concerns that the rioting on the Capitol undercut the integrity of U.S. democracy. “This is not who we are as a people or a country,” wrote JPMorgan Chase CEO Jamie Dimon in a statement. “We are better than this. Our elected leaders have a responsibility to call for an end to the violence, accept the results, and, as our democracy has for hundreds of years, support the peaceful transition of power,” he said, among many voices denouncing the violence.

The demonstrations, led by rioters wearing pro-Trump attire, came as some lawmakers planned to submit objections to the typically ceremonial certification of the November election, alleging voter fraud in some states. However, both the House and the Senate ultimately rejected challenges to results in Arizona and Pennsylvania, and no senators signed on to challenges in Georgia and other states.

The events of Wednesday nearly overshadowed a Senate runoff election victory by Democrat Jon Ossoff in Georgia, which cemented Democratic control of Congress after Democrat Raphael Warnock also won his Georgia Senate race against a GOP incumbent.

The political wins raise the prospect of additional coronavirus fiscal relief measures and other legislation that could boost the U.S. economy after Biden is sworn in on Jan. 20.

Meanwhile, on the economic front, a weekly report on initial state jobless claims dipped by 3,000 to 787,000 for the week ended Jan. 2, while the U.S. trade deficit widened in November.

The trade gap expanded to $68.1 billion from $63.1 billion in the prior month. Economists surveyed by the Wall Street Journal had forecast a deficit of $67.3 billion.

Looking ahead, a non-manufacturing or services sector report from the Institute for Supply Management is due at 10 a.m. ET.

Which stocks are in focus?

- Shares of Tesla Inc. TSLA, +4.69% were in focus on Thursday after RBC Capital Markets analyst Joseph Spak ended his bearish call on the electric-vehicle maker, upgrading it to sector perform from underperform.

- DXC Technology Co.’s stock DXC, +9.13% were up nearly in premarket trading Thursday after Reuters reported that Atos SE ATO, -5.77% has made a bid for the information technology company.

- Conagra Brands Inc. shares CAG, -1.82% rose in Thursday premarket trading before pulling back to a 0.2% rise after the food company reported fiscal second-quarter earnings and sales that beat expectations.

- Constellation Brands Inc. shares STZ, +6.68% rose in premarket trade Thursday, after the company beat estimates for its fiscal third quarter. The company posted net income of $1.281 billion, or $6.55 a share, in the quarter to Nov. 30, up from $360.4 million, or $1.85 a share, in the year-earlier period.

- Bed Bath & Beyond Inc. shares BBY, +1.97% slid about 10% in premarket trade Thursday, after the retailer posted weaker-than-expected sales and profit for its fiscal third quarter as the pandemic continued to weigh.

- Walgreens Boots Alliance Inc. stock WBA, +4.80% rose in Thursday trading before the opening bell after the pharmacy retailer reported fiscal first quarter adjusted earnings per share and sales that beat the Street.

- Shares of Victoria’s Secret parent L Brands Inc. LB, +2.69% rose in premarket trade Thursday before surrendering those gains, after the company said holiday sales exceeded its expectations and offered consensus-beating guidance for fourth-quarter per-share earnings.

- Shares of Plug Power PLUG, +29.37% rose in premarket trade after reaching a deal for SK Group to make a $1.5 billion strategic investment and form a joint venture company in South Korea.

- Las Vegas Sands LVS, -0.29% said Thursday that Chairman and Chief Executive Sheldon Adelson, a major Republican donor, is taking a medical leave of absence after resuming his cancer treatment.

- Wayfair Inc. W, +1.74% said Thursday that it has raised wages for all U.S. employees to at least $15 per hour, effective Jan. 3, 2021.

- LVMH Moët Hennessy Louis Vuitton SE MC, +2.43% said Thursday it has completed the acquisition of the iconic jewelry store Tiffany & Co., after the deal hit some roadblocks during the pandemic.

How are other markets faring?

- The 10-year Treasury note TMUBMUSD10Y, 1.072% was up 3 basis points at 1.07%, as traders bet on stronger inflation and more debt issuance, both of which would erode the value of outstanding bonds. Bond yields rise as prices fall.

- Oil futures traded higher Thursday. Crude for February delivery CLG21, -0.02% was up 0.2% to $50.74 a barrel, a day after closing above $50 a barrel for the first time in 11 months.

- Gold futures GC00, +0.20% rose 0.4% after settling 2.3% lower Wednesday as bond yields gained.

- The pan-European Stoxx 600 Europe index SXXP, +0.48% traded 0.4% higher, while London’s FTSE 100 UKX, -0.18% was trading 0.2% higher.

- In Asia, Hong Kong’s Hang Seng Index rose 0.2%, while the Shanghai Composite SHCOMP, +0.71% gained 0.6% and Japan’s Nikkei 225 NIK, +1.60% rose 1.6%.

- The ICE U.S. Dollar Index DXY, +0.41%, a measure of the U.S. currency against a basket of six major rivals, was up 0.2%.