This post was originally published on this site

U.S. stocks are set to start the new year in positive fashion, after ending a volatile 2020 on a new high.

Investors once again seem to be shrugging off the worsening COVID-19 picture, instead focusing on vaccine rollouts across the world. Hospitalizations in the U.S. reached a record 125,544 on Sunday, according to the COVID-19 tracking project, while the U.K. has now recorded 50,000 new cases for six consecutive days, with tougher restrictions set to be announced.

However, the U.K. began rolling out the vaccine from drug company AstraZeneca and the University of Oxford on Monday, boosting sentiment. The FTSE 100 UKX, +2.66% led the way, rising 2.5% as higher metals prices GC00, +2.11% HG00, +2.15% SI00, +3.59% helped the mining sector.

After rallying at the end of 2020, with record highs for the Dow and S&P 500, the three major benchmark U.S. stock indexes were set to make gains on the first trading day of the new year.

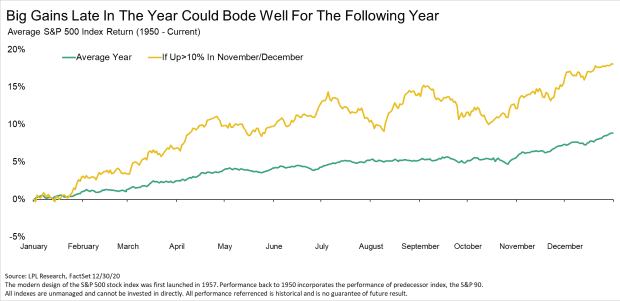

In our call of the day, LPL Financial chief market strategist Ryan Detrick said the strong year-end rally in 2020 could have “bulls smiling” in 2021.

The S&P 500 SPX, +0.64% rose more than 14% in November and December, ending a tumultuous year at a new all-time high of 3,756.07 — gaining 16.3% in 2020. Detrick said a 10% or more gain in the final two months of the year has led to a higher S&P 500 the following year every single time since World War II. “In fact, January was also higher every single time as well, so maybe this strong rally is a clue for higher prices into [2021].”

On the five previous occasions the index has climbed more than 10% in November and December — 1954, 1962, 1970, 1985 and 1998 — the S&P 500 has gained an average of more than 18% the following year. The index also climbed in all five Januarys, rising an average 3%.

The below chart shows what a year typical looks like after a 10% or more November/December rally. “Once again, strong returns are the playbook historically,” Detrick added.

Source: LPL Research, FactSet

The markets

U.S. stock futures YM00, +0.50% ES00, +0.49% NQ00, +0.50% pointed higher early on Monday, with the Dow Jones Industrial Average DJIA, +0.65% set for a 150-point gain at the open. European stocks started the year on the front foot, buoyed by the rollout of vaccines across the continent. Asian markets also rose to start the new year amid global optimism. The U.S. dollar index DXY, -0.48% slipped 0.3% to 89.51 — the lowest level since April 2018.

The buzz

Democratic lawmakers called on Sunday for swift and serious action to be taken against President Donald Trump, after he was heard in a leaked audio tape pressuring Georgia’s Republican secretary of state to “find” more votes to reverse his election loss in the state.

The runoff elections for two U.S. Senate seats in Georgia take place on Tuesday, which will decide whether the Democrats or Republicans control the Senate.

Industrial conglomerate Teledyne Technologies TDY, +0.23% said it has agreed to buy thermal-imaging camera supplier Flir Systems FLIR, +0.05% in a cash-and-stock deal valued at about $8 billion.

Shares of U.K. gambling company Entain ENT, +29.51%, formerly GVC Holdings, surged 26% on Monday, after rejecting a proposed 1,383 pence per share bid from MGM Resorts MGM, +1.03% that valued the company at £8.09 billion ($11.06 billion).

Bitcoin BTCUSD, -7.82% soared to a record high of $34,000 over the weekend, before plunging 11% early on Monday to $29,800.

A U.K. judge ruled on Monday that Julian Assange, the founder and publisher of WikiLeaks, should not be extradited to the U.S.

Health care insurer Centene Corp. CNC, +1.88% said on Monday it has agreed to acquire Magellan Health Inc. MGLN, +0.58% for $95 a share, in a deal with an enterprise value of $2.2 billion.

Carl Icahn has sold over half his stake in Herbalife Nutrition Ltd. HLF, +0.54% and is relinquishing his seats on the nutritional-supplements company’s board, taking a step back from a long-time investment he fiercely defended against an onslaught from rival activist investor William Ackman.

Random reads

South Korea’s population falls for first time in its history.

Swan rescued after hours stuck on frozen loch.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.