This post was originally published on this site

As you bring in the new year, it may help you to think along these lines: “Things will be better tomorrow.” It may take longer than that, but after so much personal loss during a pandemic that has affected nearly everyone, there is hope that during 2021 the crisis will end.

With so much on your mind, reconsidering your streaming services may be overlooked. But money saved is money in your pocket. Mike Murphy continually monitors the competing streaming services for cost and quality. Here are his tips for saving as much as possible on streaming services in 2021 while watching everything you want.

More: What will streaming bring in 2021? Here are 5 things to watch

Are your stimulus checks taxable?

Andrew Keshner answers this and many other questions springing from the second round of stimulus checks from Congress.

FactSet

Market timers warn of a coming decline…

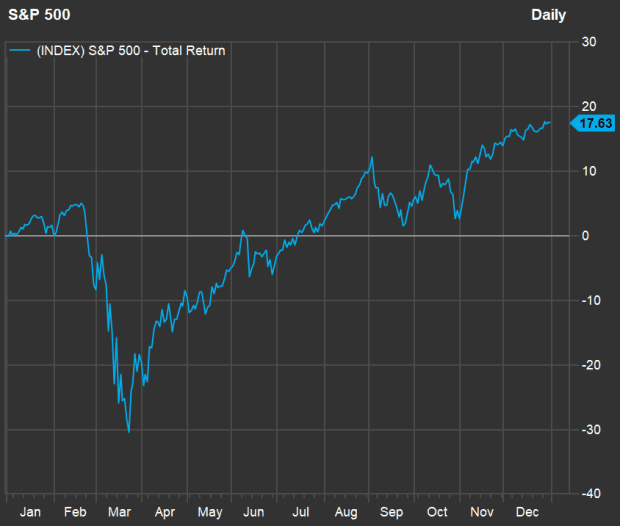

Above is a chart of the S&P 500 index’s SPX, -0.10% total return for 2020. The comeback from the March doldrums has been breathtaking. Meanwhile, the weighted forward price-to-earnings ratio for the index has increased to 22.6 from 18.3 at the end of 2019.

Mark Hulbert explains how investors’ enthusiasm in a bull market can signals a decline in stock prices.

Plus: Is Tesla the next AOL? It’s time to start thinking ‘old economy, not new economy,’ strategist says

Then again…

William Watts explains why predictions of a 2000-style market plunge may be premature — they are missing one critical ingredient.

More than 110,000 independent restaurants have closed in the U.S. during the pandemic, according to the National Restaurant Association .

Getty Images

An industry rebound play for 2021

Tonya Garcia explains why analysts are enthusiastic about restaurant chains’ prospects to grow market share as the U.S. heads toward a post-pandemic economy.

2020 stock-market winners, losers and expected rebounds for 2021

When stocks crashed in March, you probably didn’t expect the broad U.S. stock indexes to be setting new records in December, but 2020 has been a remarkable year.

- Here’s a list of the top performing stocks of 2020 in the S&P 500, Nasdaq-100 Index and Dow Jones Industrial Average.

- These are 15 high-flying stocks that at least doubled in 2020, but aren’t included in those three big indexes.

- And here are the 20 worst-performing S&P 500 stocks of 2020, many of which are expected by analysts to see double-digit rebounds in 2021.

Other stock pickers name their favorites for 2021

Michael Brush interviews investment newsletter writers who name 10 overlooked stocks they expect to outperform in 2021.

Your “green” mutual fund or ETF may hold shares of oil or coal producers.

Getty Images

Is your ESG fund really doing what you want it to do?

ESG stands for environmental, social and corporate governance — areas that may concern you an investor. One easy way to be an ESG investor is to select an ESG mutual fund or exchange-traded fund. But some only apply ESG with a light touch. You need to look beyond the ESG label, as Debbie Carlson explains.

Family money squabbles

Quentin Fottrell — MarketWatch’s Moneyist — helps readers with difficult questions about relationships and financial conflicts. At times he digs deeper into possible psychological underpinnings of a conflict. Here are recent popular Moneyist stories:

The Big Tech stampede from Silicon Valley

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice