This post was originally published on this site

Bitcoin BTCUSD, +0.51% took out yet another record high on Wednesday and is now up about 300% for the year. Not to be outdone, Ethereum ETHUSD, +0.62% has banged out a gain of more than 700% over the past 12 months.

No doubt, it’s a great time to be part of the HODL crowd.

OK, Berkshire Hathaway BRK.A, +0.08% BRK.B, +0.03% billionaire Warren Buffett, having once dismissed bitcoin as “rat poison squared,” definitely isn’t one of those HODLers, but an investor known as 10ke on Reddit is, and he claims that he just saw his account hit the seven-figure mark.

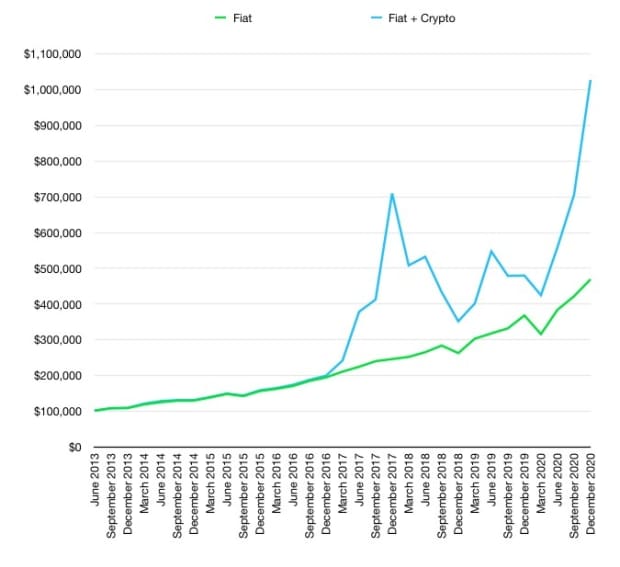

“This is the top, kids. I’m a millionaire,” he wrote, pointing to this chart illustrating how his portfolio has exploded over the past seven years:

If 10ke’s viral post is to be believed, he bought into bitcoin at $1,000 in 2013 and took an Ethereum position in 2017 when it was trading around $10. He’s held them ever since. As it stands now, his crypto portfolio comprises 60% Ethereum, 20% bitcoin and the rest in alt coins.

He has no intention of selling until he hits the $5 million mark. At that point, he plans on unloading 80% of his nest egg, quitting his job and buying his house. “I’ll hodl 20% forever,” 10ke wrote.

The comments section on Reddit included armchair quarterbacks urging him to consider a more conservative approach. “Take some off the table and you wont regret it later on,” RokMeAmadeus advised. “BTC’s support level will prob be much lower after this parabolic pump. My two cents.”

But 10ke wasn’t having it.

“Mentally, it won’t bother me if everything drops 80% and I end up bagholding for years again. … So it’s easy for me to not sell anything to make myself feel better,” he wrote. “I won’t regret it if tomorrow BTC goes back down to $10K. I *would* be totally devastated though if I sold, even a portion, and watched the price continue to rise.”

At last check, bitcoin was distancing itself from $10,000, changing hands above $28,800. Ethereum was up nearly 1% at $749. Meanwhile, stocks were faring well as 2020 wound down, with the Dow Jones Industrial Average DJIA, +0.24% closing the day with a 74-point gain. The Nasdaq Composite COMP, +0.15% and S&P 500 SPX, +0.13% were also in the green.