This post was originally published on this site

Even as the U.S. economy deteriorates in the face of another coronavirus onslaught, there’s plenty of reason for hope as the new year approaches.

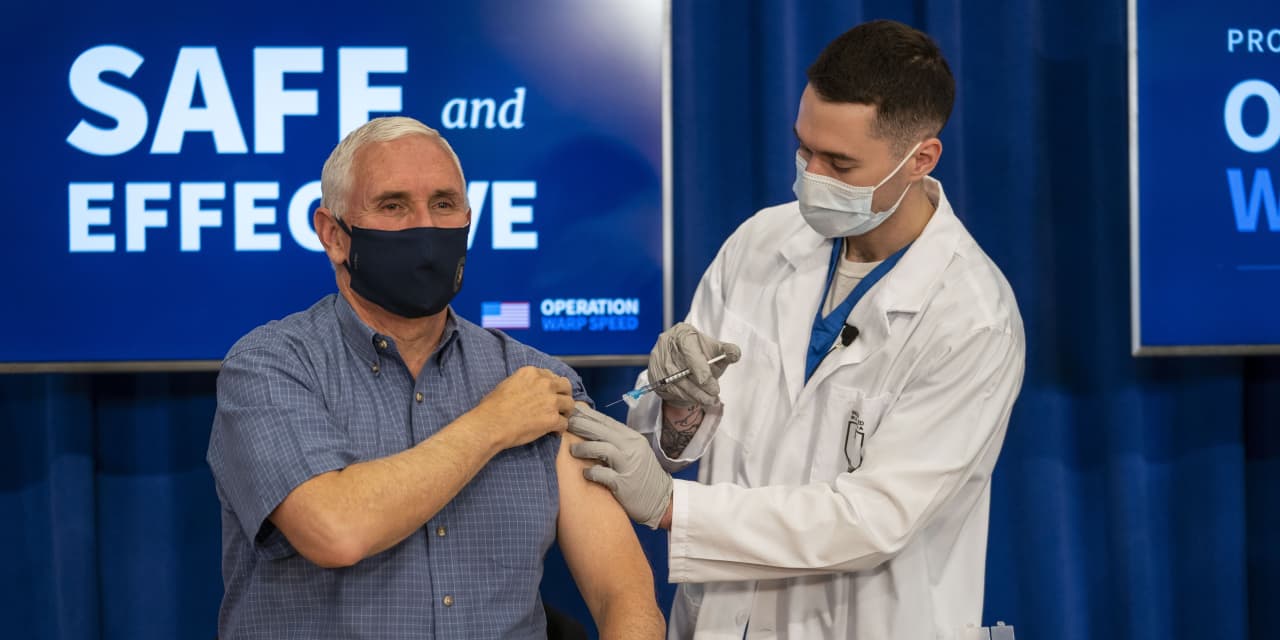

The start of a massive effort to vaccinate Americans against the virus is the chief source of optimism. The promise of an effective treatment will allow the U.S. to gradually return to normal in 2021 and undo the damage to the economy seen this year.

Adding to the good cheer is a deal in Congress, after months of bitter political recriminations, to provide nearly $1 trillion in aid for millions of unemployed Americans and thousands of struggling businesses. Not long ago a deal seemed out of reach.

” For once, Congress has surprised on the upside, delivering more and earlier than expected,” said Aneta Markowska, chief economist at Jefferies LLC and reigning MarketWatch forecaster of the month.

The immediate path of the economy, however, is still laden with obstacles.

Layoffs are on the rise again, consumer spending has softened and key business segments such as restaurants and retailers are struggling to cope with fresh government restrictions aimed at limiting the spread of the virus.

Read: Americans stick near home again due to coronavirus resurgence

A flurry of indicators next week leading up the Christmas holiday will provide another window into how much the economy has been affected by the record increase in coronavirus cases.

At the top of the list is a key measure of business investment included in the report on durable goods orders known as “core orders.”

See: MarketWatch Economic Calendar

Investment in the goods-producing part of the economy has posted surprisingly strong gains in the past six months, rising to a one-and-a-half-year high in October, as companies look past the current pandemic to brighter times in 2021.

Manufacturers have been more insulated from the pandemic than service-oriented companies that deal directly with consumers, but they’ve also been stung by the latest outbreak. More workers are calling in sick or staying home to take care of relatives and companies can’t find enough people to fill open jobs.

Still, the manufacturing industry is set to lead the U.S. recovery in 2021, especially if the global economy recovers as well and American exports bounce back.

A pair of surveys on the attitude of consumers, meanwhile, will also clue investors in on how worried they are about the coronavirus pandemic. Even if consumers are very anxious right now, though, the arrival of vaccines and more federal aid are likely to lift their spirits early in the new year.

The weekly report on jobless benefit claims, published the day before Christmas, probably won’t give Wall Street DJIA, -0.35% anything to cheer about.

New claims, a rough measure of layoffs, jumped to a nearly four-month high in mid-December as restaurants and other service-oriented businesses laid off workers temporarily or closed for good.

The increase in jobless claims put more pressure on Congress to finally agree to a new aid package. The bill likely to approved is expected to include extended unemployment compensation and up to $300 extra a week in extra federal benefits.