This post was originally published on this site

Some of this year’s best-performing stocks would have been obvious plays if only investors had known about the COVID-19 pandemic in advance.

But now it’s time to look ahead and find which companies might fare best when life returns to normal. Ride-sharing companies Uber Technologies Inc. and Lyft Inc. might be excellent investments during the economic recovery that is expected to begin in 2021.

On Thursday, Wedbush analyst Dan Ives wrote in a note to clients that the “first phase” of the stock market’s reaction to the pandemic was “largely played out.” This is the period during which shares of tech giants have soared, including Amazon.com Inc. AMZN, -0.09%, up 68% this year, and Netflix Inc. NFLX, +1.52%, up 53%.

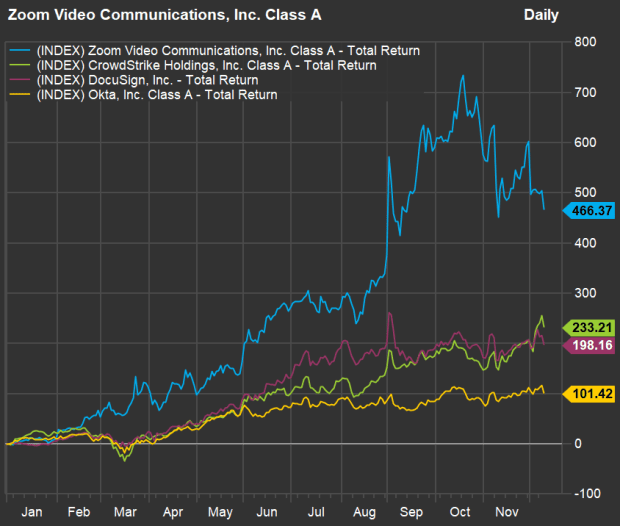

Shares of companies best-positioned to take advantage of the work-at-home trend have also been on fire:

These stocks that have benefitted so much from the work-at-home trend in 2020 were all downgraded by J.P. Morgan analyst Sterling Auty on Dec. 9.

FactSet

Zoom Video Communications Inc. ZM, +3.27%, CrowdStrike Holdings Inc. CRWD, +8.32%, DocuSign Inc. DOCU, +0.73% and Okta Inc. OKTA, +6.63% were all downgraded on Dec. 9 to neutral from overweight ratings by J.P. Morgan analyst Sterling Auty, who wrote in a note to clients that there may be a “sector rotation and potential performance headwinds for these types of stocks.”

Ives believes the work-from-home and FAANG stocks (Facebook Inc. FB, -0.29%, Apple AAPL, +1.20%, Amazon, Netflix and Google holding company Alphabet Inc. GOOG, -0.49% GOOGL, -0.57% ) can “continue to be the right path for at least the next six-12 months.” But for the “second phase,” which includes an expected economic rebound in 2021 as vaccines help quell the virus, he recommends a “laser focus on recovery tech stories.”

Those include Uber UBER, +1.04% and Lyft LYFT, +1.22%.

Here’s how the two ride-sharing stocks have performed this year:

Uber’s stock has soared this year, while Lyft has recovered more slowly for a relatively modest gain. Analysts expect Uber’s sales in 2021 to exceed its pre-pandemic sales in 2019. (FactSet)

Ives expects a return to office commuting and other travel next year to help put both companies “on a clearer path to profitability.”

Here are sales figures for the ride-sharing companies for 2019, with estimates for 2020, 2021 and 2022, which underscore the much better performance for Uber’s stock this year. Scroll the table to see all the data:

So Uber is expected to book five times as much revenue this year as Lyft. Uber is also expected to increase sales enough in 2021 to exceed its pre-pandemic sales in 2019. Lyft is not expected to achieve that until 2022.

Both companies are expected to show high double-digit sales growth numbers over the next two years.

Among sell-side analysts polled by FactSet, the consensus estimate is for Uber to continue running at a GAAP loss until the fourth quarter of 2022. Among the analysts, 80% rate Uber “buy” or the equivalent. However, the consensus price target is $51.65, below the closing price of $53.79 on Dec. 9. Wall Street analysts typically use 12-month price targets, which may be too short a period for Ives’ thesis to play out.

Lyft is expected by analysts to continue posting quarterly GAAP net losses through 2022. Among the analysts, 61% rate the stock a buy, with a consensus price target of $44.89, below Lyft’s closing price of $47.53 on Dec. 9.

Don’t miss: 20 electric vehicle stocks besides Tesla and Nio that analysts expect to rise the most over the next year