This post was originally published on this site

The stock market was wrapping up a historic November rally on Monday, but if history is a guide, what’s shaping up to be the largest monthly gain on record for the small-capitalization Russell 2000 and big advances by other major indexes point to a potentially choppy stretch ahead, prominent Wall Street analysts warned.

“The ramp has become a little too extreme,” wrote Tony Dwyer, chief market strategist at Cannacord Genuity, in a Monday note, pointing to a National Association of Active Independent Manager Exposure Index reading of 106.1, the highest since the gauge’s Aug. 26, 2020, and Dec. 13, 2017 peaks.

Dwyer said he considers any reading above 90 as high, while a figure above 100 marks “excessive optimism.” At the same time, other sentiment gauges are also hitting multiyear highs.

The rising sentiment comes at the end of a month that saw investors cheer as three, separate COVID-19 vaccine treatments saw strong results in late-stage trials. Market participants looked ahead to 2021 and the prospect for potential cures to allow at least a gradual return to normalcy, prompting a rally in stocks, particularly shares of companies that have been largely left behind by the pandemic.

Read: Why the stock market’s COVID vaccine-inspired rally could soon face a big test

The shift in leadership away from large-cap tech and internet-related highfliers that have dominated the market’s recovery from a pandemic-induced bear market earlier this year, benefited small-cap stocks in particular.

The Russell 2000 RUT, -1.77% remained up nearly 19% for November, putting the small-cap gauge on track for its biggest monthly gain since its inception more than 40 years ago. It was far outpacing the large-cap benchmark S&P 500 SPX, -0.46%, which was up more than 10% and on track for its biggest monthly rise since April, while the tech-heavy Nasdaq Composite COMP, -0.05% was up around 11.3%.

The Dow Jones Industrial Average DJIA, -0.90% last week traded and closed above 30,000 for the first time, and was on track for a November advance of 11.6%. All the major indexes scored record highs in November.

And while December is historically a strong month for equities, the strength of those November gains suggests a note of caution would be in order, analysts said.

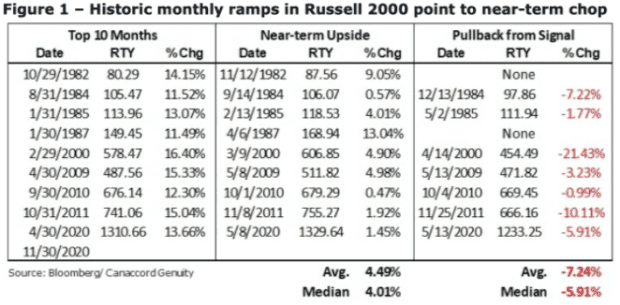

Dwyer said that when it came to the small-caps, a look back at the data found a monthly gain of 11.5% or more for the Russell 2000 was typically followed by a retracement of near-term gains. That means investors could have bought it cheaper over the coming weeks or months, with the index seeing a median drop of 5.9% from the monthly close (see table below).

Canaccord Genuity

Also, when the 10-week rate-of-change for the Russell relative to the S&P 500 hit +10, it suggested “a period of near-term relative indigestion for small vs. large” cap stocks, he said.

What about the broader market? Sam Stovall, chief investment strategist at CFRA, noted that November’s “seasonal optimism” has tended to extend into December. Since 1945, the S&P 500 has seen an average December return of nearly 1.5% — third best of the year. What’s more December has risen 73% of the time, for the highest frequency of advance for any month. And in postelection Decembers, the S&P 500 has risen 83% of the time.

But there’s a rub. Stovall warned that if the S&P 500 logs a November gain of more than 10%, history suggests, but doesn’t guarantee, that December gains will be muted.

“There have been 11 times since WWII that any month of the year rose by 10% or more. Even though the following month was higher by an average of 0.70%, which was essentially the same return for all months since 1945, it advanced in price just 45% of the time versus the traditional 60% frequency for all months,” he wrote.

Looking at November alone, when the S&P 500 has gained 5% or more, which has occurred 14 times since 1945, December’s price rise and the frequency of gains were also below average, Stovall found.

But perhaps more noteworthy, the Dow, S&P 500 and Russell 2000 recorded simultaneous all-time highs on Nov. 24. Simultaneous highs for all three indexes have occurred more than 200 times since the Russell’s debut in 1979, Stovall noted.

The subsequent 22-trading-day period (roughly one calendar month), on average, produced a flat return for the S&P 500, which rose only 50% of the time, he found, versus a typical 63% frequency of advance (see chart below).

CFRA

“So while the equity market may continue on its course of confidence that a soon-to-be-released COVID-19 vaccine will allow global economies to reopen in earnest in 2021, history hints that December’s return may be subpar as stocks catch their breath from their recent postelection sprint,” Stovall said.