This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEGAO0VM_L.jpg

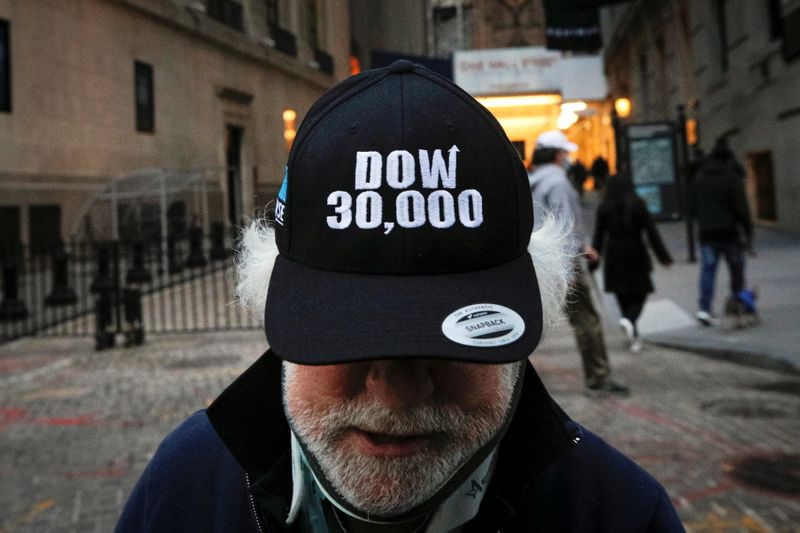

(Reuters) – Futures linked to the S&P 500 and the Dow were subdued on Wednesday, a day after the blue-chip index crossed 30,000, with focus turning to the weekly jobless claims report for clues on whether an economic recovery was gathering pace.

The Labor Department’s report is expected to show jobless claims dipped slightly last week, although new restrictions in several states to control COVID-19 infections could again slow the labor market’s rebound from a recession.

Hopes of a vaccine and recent data suggesting business activity would bounce back next year have lifted Wall Street’s main indexes to record highs this month and set the benchmark S&P 500 on course for its best November ever.

Market participants said they expected U.S. stocks to climb even higher, with a recent Reuters poll showing the S&P 500 is poised to climb another 9% between now and the end of 2021. The index has surged 66% since the coronavirus-led crash in March and is up about 12.5% so far this year.

As investors returned to cyclical sectors such as industrials and energy, which are set to benefit most from an economic recovery, the S&P value index gained about 11% this month after underperforming the benchmark index all year.

However, on Wednesday, futures linked to the Nasdaq 100 outperformed those tied to the S&P 500 and the Dow, indicating that technology mega-caps could be favored as traders also await other crucial economic indicators due later in the day.

At 6:53 a.m. ET, Dow e-minis were down 63 points, or 0.21%, S&P 500 e-minis were down 2.75 points, or 0.08%, and Nasdaq 100 e-minis were up 30.5 points, or 0.25%.

Trading volumes are expected to be light ahead of the Thanksgiving Day holiday on Thursday.

Among individual stocks, Gap Inc (NYSE:GPS) edged lower in premarket trading as the apparel retailer missed quarterly profit expectations on Tuesday.