This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXMPEB5R043_M.jpg

Investing.com — Global X’s newest thematic bet is on disruption and high growth markets.

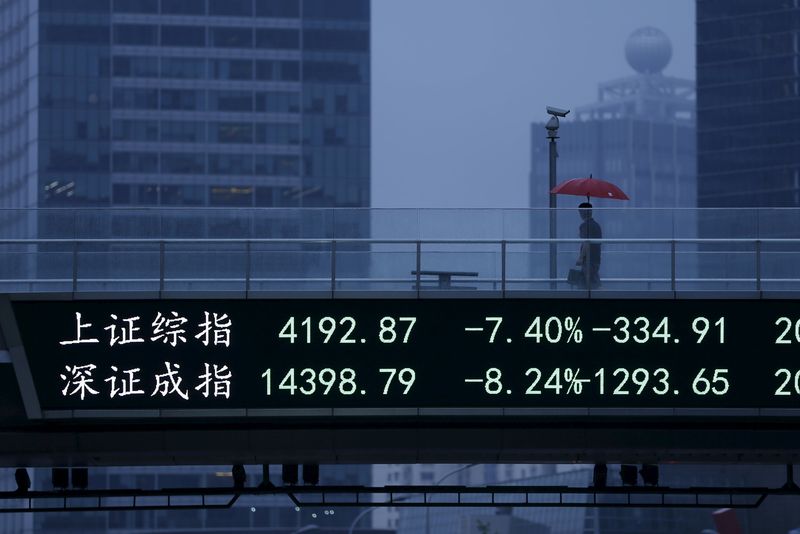

The Emerging Markets Internet & E-commerce ETF (EWEB) launched on Alibaba ‘s (NYSE:BABA) Singles Day on Nov. 11 and focuses on companies that derive the bulk of their revenue from internet and e-commerce in emerging markets. Alibaba, in fact, is one of the top holdings among 50 in the fund, which leans heavily toward Asia and more specifically, China.

That has to do with the rise of e-commerce in the country along with the increase in smartphone and internet penetration, demographics and the size of the Millennial population, said Chelsea Rodstrom, a research analyst at Global X ETFs. China’s policies also support making it a global innovator. And then there’s the potential market boom ahead, whereas in the U.S., internet penetration is 90%, in China it’s closer to 53%.

“These economies are moving from adopters of the latest technology to leapfrog, to jump over and acquire the latest technology and become innovators,” Rodstrom said in a phone interview.

EWEB is Global X’s latest bet on thematic funds as it taps into an ever-expanding demand for exchange traded funds. The market for ETFs has grown from about $4 trillion last year to almost $5 trillion today, and is expected to grow to between $30 trillion and $50 trillion by 2030. ETFs offer lower costs, liquidity and tax efficiency than traditional funds. While ETFs often track indexes, Global X has focused on themes, creating its own basket of companies in areas like genomics and biotechnology, cybersecurity and education. The fund joins the Global X Thematic Growth suite of 24 ETFs and more than $7 billion in assets under management.

EWEB tracks the Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index, with Asia representing a number of the holdings.

“Asia Pacific region and Southeast Asia are probably the highest growth areas,” Rodstrom said. Many of the companies are actively expanding globally, either through mergers and acquisitions or partnerships, diversifying and mitigating any possible individual country risks. And emerging markets can be a roller coaster ride for investors, with economies subject to government interference and political instability.

Such companies have nonetheless outperformed their U.S. counterparts. Rodstrom points to the fact that in 2018, 74% of global growth was attributable to emerging market economies, driven in large part by a rapidly growing middle class of internet-connected consumers. The consumption of emerging markets is expected to be responsible for 84% of the world total by 2023.

“Investors interested in emerging markets understand the reasons why they have higher growth potential but a lot of investors probably don’t recognize how much emerging markets contribute to global growth,” Rodstrom said. “This is a way to get access to higher growth.”