This post was originally published on this site

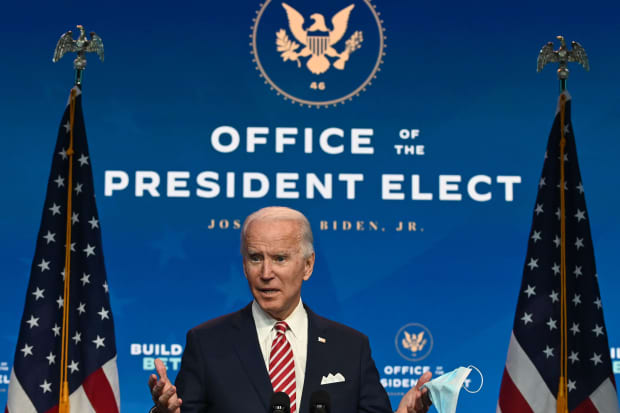

Here are some strategies to consider to lower your 2020 tax bill and hopefully position you for tax savings in future years too, in light of President-elect Joe Biden’s tax proposals.

Photo by ROBERTO SCHMIDT/AFP via Getty Images

With year-end rapidly approaching and the general election finally over, it’s time to consider moves that will lower your 2020 tax bill and hopefully position you for tax savings in future years too. This column is Part One of my list of suggested year-end strategies. But first, we need to address the remaining post-election uncertainties and why they matter for individual taxpayers. Here goes.

Post-election uncertainties are still with us

Joe Biden will be the next president. That much of the cake is baked. However, two Georgia Senate seats are still up for grabs in runoff elections that will take place in early January. The GOP has apparently locked up 50 seats and will retain control of the Senate if they win at least one of the runoffs. I think that’s likely, and my privately-held predictions have been on the money so far. If I’m wrong, VP-elect Kamala Harris will be the Senate tie-breaker. But even if I am wrong, some Democratic Senators who will be up for reelection in 2022 will be reluctant to support an agenda that tilts very far to the left.

Ditto for the more-than-a-few Democratic House members who will be at-risk in 2022 and therefore on the GOP hit list. Note that the composition of the House will apparently be closer to 50/50 when the final results are in.

Federal tax outlook for 2021-2022

For the reasons explained above, I think the federal tax picture for 2021 and 2022 will be largely unchanged and maybe even completely unchanged. Major proposed changes that are not taxpayer-friendly, including rate increases, will probably be a hard sell, but some minor anti-taxpayer changes could pass. And there could be some proposed taxpayer-friendly changes that get bipartisan support and are easily sold. See the side bar below for more details.

If I’m right about all this, the usual time-honored year-end tax planning strategies will work again this year. If I’m wrong and tax rate increases and other unfavorable changes take effect next year, sorry about that. I gave you my best guesses. With those thoughts in mind, onward to some specific year-end strategies.

Game the standard deduction

The Tax Cuts and Jobs Act (TCJA) almost doubled the standard deduction amounts. For 2020, the basic standard deduction allowances are:

* $12,400 if you are single or use married filing separate status.

* $24,800 if you and your spouse file jointly.

* $18,650 if you are a head of household.

* Slightly higher standard deductions are allowed to those who are 65 or older or blind.

Here’s the plan. If your total itemizable deductions for 2020 will be close to your standard deduction amount, consider making enough additional expenditures for itemized deduction items before year-end to exceed the standard deduction. Those prepayments will lower this year’s tax bill. Next year, your standard deduction might be a bit bigger thanks to an inflation adjustment, and you can claim it then. Or it could be smaller, if major tax-increase legislation passes, which I think is unlikely.

* The easiest deductible expense to prepay is included in the house payment due on January 1. Accelerating that payment into this year will give you 13 months’ worth of itemized home mortgage interest deductions in 2020. Although the TCJA put new limits on these deductions, you’re probably unaffected. But ask your tax adviser to be sure.

Next up on the prepayment menu are state and local income and property taxes that are due early next year. Prepaying those bills before year-end can decrease your 2020 federal income tax bill, because your itemized deductions total will be that much higher. However, the TCJA decreased the maximum amount you can deduct for state and local taxes to $10,000 or $5,000 if you use married filing separate status. So, beware of that limitation.

Warning: The state and local tax prepayment drill can be a bad idea if you will owe the dreaded alternative minimum tax (AMT) for this year. That’s because write-offs for state and local income and property taxes are completely disallowed under the AMT rules. Therefore, prepaying those expenses may do little or no tax-saving good if you will be in the AMT zone. Thankfully, changes included in the TCJA took millions of taxpayers out of AMT danger, but not everybody. Ask your tax adviser if you’re in the clear for this year or not.

* Consider making bigger charitable donations this year and smaller donations next year to compensate (more about charitable donations later). That could cause your itemized deductions to exceed your standard deduction this year.

* Finally, consider accelerating elective medical procedures, dental work, and expenditures for vision care. For 2020, you can deduct medical expenses to the extent they exceed 7.5% of your adjusted gross income (AGI), assuming you itemize. Next year, the deduction threshold is scheduled to rise to 10% of AGI, but I doubt Congress will allow that to happen.

Carefully manage gains and losses in taxable investment accounts

If you hold investments in taxable brokerage firm accounts, consider the tax advantage of selling appreciated securities that have been held for over 12 months. The federal income tax rate on long-term capital gains recognized in 2020 is “only” 15% for most folks, although it can reach the maximum 20% rate at high income levels. The add-on 3.8% net investment income tax (NIIT) can also bite at high income levels. So, the true maximum rate for high-income individuals is 23.8%: the advertised 20% top rate plus 3.8% for the unadvertised NIIT.

To the extent you have capital losses this year or capital loss carryovers from earlier years, selling winners by year-end will not result in any tax hit. In particular, sheltering net short-term capital gains with capital losses is a tax-smart move because net short-terms gains will otherwise be taxed at your higher ordinary income rate of up to 37%, plus another 3.8% if the NIIT bites. Ouch.

What if you have some loser investments that you would like to unload? Biting the bullet and taking the resulting capital losses this year would shelter capital gains, including high-taxed short-term gains, from other sales this year.

If selling some losers would cause your 2020 capital losses to exceed your 2020 capital gains, the result would be a net capital loss for the year. No problem. That net capital loss can be used to shelter up to $3,000 of 2020 income from salaries, bonuses, self-employment income, interest income, royalties, and whatever else ($1,500 if you use married filing separate status). Any excess net capital loss is carried forward to next year and beyond.

In fact, having a capital loss carryover could turn out to be a pretty good deal. The carryover can be used to shelter both short-term gains and long-term gains recognized next year and beyond. This can give you extra investing flexibility in those years, because you won’t have to hold appreciated securities for over a year to get a lower tax rate. You’ll pay 0% to the extent you can shelter gains with your loss carryover. If there are future tax rate increases (which I think are unlikely through at least 2022), capital loss carryovers into future years could turn out to be really valuable.

The last word

Since we are talking about 2020, nothing is completely certain, including year-end tax planning strategies that will turn out to work. But I think what we say here is good advice, all things considered. Meanwhile, please stay tuned for Part Two of our menu of year-end tax planning strategies for individuals. Coming soon.

Side bar: The outlook for proposed Biden tax changes for individuals

Higher maximum rate

The pre-election Biden tax plan would raise the top individual federal income rate on ordinary income and net short-term capital gains back to 39.6%, the top rate that was in effect before the Tax Cuts and Jobs Act (TCJA) lowered it to 37% for 2018-2025. Biden also said he would generally raise taxes on folks with incomes above $400,000 without supplying specifics.

Outlook: Don’t bet on these changes.

Itemized deductions

The pre-election Biden plan would limit the tax benefit of itemized deductions to 28% for upper-income individuals. In other words, each dollar of allowable itemized deductions could not lower your federal income tax bill by more than 28 cents, even if you are in the proposed 39.6% maximum tax bracket.

Outlook: Don’t bet on this change.

For upper-income individuals, Biden would reinstate the pre-TCJA rule that reduces total allowable itemized deductions above the applicable income threshold. Allowable deductions are reduced by 3 cents for every dollar of income above the threshold.

Outlook: Ditto.

Biden would eliminate the TCJA’s $10,000 cap on itemized deductions for state and local taxes.

Outlook: There might be bipartisan support for this change.

Higher maximum rate on long-term capital gains

Upper-income individuals would face higher capital gains taxes under the Biden plan. Under current law, the maximum effective federal income tax rate on net long-term capital gains and qualified dividends recognized by individual taxpayers is 23.8%, as explained in the main body of this column. Under the Biden plan, net long-term gains (and presumably dividends) collected by those with incomes above $1 million would be taxed at the same 39.6% maximum rate that is proposed for ordinary income and net short-term capital gains. With the 3.8% NIIT add-on, the maximum effective rate on net long-term gains would 43.4% (39.6% plus 3.8%). That would be almost double the current maximum effective rate of “only” 23.8%.

Outlook: Don’t bet on this change.

Higher social security taxes for upper-income individuals

Under current law, the 12.4% Social Security tax hits the first $137,700 of 2020 wages or net self-employment income. Employees pay 6.2% via withholding from paychecks, and employers pay the remaining 6.2%. Self-employed individuals pay the entire 12.4% out of their own pockets via the self-employment (SE) tax. For 2020, the 12.4% Social Security tax cuts out once 2020 wages or net SE income exceed the $137,700 ceiling. For 2021 and beyond, the Social Security tax ceiling will be adjusted annually to account for inflation. As things currently stand, the 2021 ceiling will rise to $142,800.

The Biden tax plan would restart the 12.4% Social Security tax on wages and net SE income above $400,000. This is the so-called donut hole approach to increasing the Social Security tax. Over the years, the donut hole would gradually close as the lower edge of the hole is adjusted upward for inflation while the $400,000 upper edge of the hole remains static.

Outlook: Don’t bet on this change.

Elimination of basis step-up for inherited assets

Under current law, the federal income tax basis of an inherited capital-gain asset is stepped up fair market value as of the decedent’s date of death. So, if heirs sell inherited capital-gain assets, they only owe federal capital gains tax on the post-death appreciation, if any. This provision can be a huge tax-saver for greatly-appreciated inherited assets — such as personal residences that were acquired many years ago for next to nothing and are now worth millions. The Biden plan would eliminate this tax-saving provision.

Outlook: Don’t bet on this change — although there could be bipartisan support for imposing it on larger estates, say those in excess of $10 million.

Elimination of real estate tax breaks

The Biden tax plan would: (1) eliminate the $25,000 exemption from the passive loss rules for rental real estate losses incurred by middle-income individuals, (2) eliminate Section 1031 like-kind exchanges that allow deferral of capital gains taxes on swaps of appreciated real property, (3) eliminate rules that allow faster depreciation write-offs for certain real property, and (4) eliminate qualified business income (QBI) deductions for profitable rental real estate activities.

Outlook: Don’t bet on these changes.

Increased child and dependent care credits

Under current law, parents can collect a credit of up to $2,000 for each under-age-13 qualifying child. This is a refundable credit, which means you don’t have to have any federal income tax liability to collect the credit. In other words, the child credit is “free money.”

Under current law, another credit of up to $2,100 is allowed to cover expenses to care for a qualifying dependent, including an eligible child, or up to $4,200 for expenses to care for two or more qualifying dependents. In most cases, however, an income limitation reduces the maximum allowable credit to $1,200 or $2,400 for two or more qualifying dependents.

The Biden tax plan would increase the maximum refundable child credit to $4,000 for one qualifying child or $8,000 for two or more qualifying children. Families making between $125,000 and $400,000 would receive reduced credits. Apparently, the same rules would apply to an enhanced credit for expenses to care for qualifying dependents.

Biden would also establish a new credit of up to $5,000 for informal caregivers.

Outlook: There could be bipartisan support for some or all of these changes.

New credits for homebuyers and renters

The Biden plan would create a new refundable tax credit of up to $15,000 for eligible first-time homebuyers. The credit could be collected when a home is purchased, rather than later at tax-return filing time. Biden would also establish a new refundable tax credit for low-income renters. The credit would be intended to hold rent and utility payments to 30% of monthly income.

Outlook: There could be bipartisan support for these changes.