This post was originally published on this site

In this image courtesy of the Henry Ford Health System, volunteers are given the Moderna mRNA-1273 Coronavirus Efficacy vaccine on August 5, 2020, in Detroit, Michigan.

Henry Ford Health System/Agence France-Presse/Getty Images

Executives at drugmakers Pfizer PFE, -1.29% and Moderna MRNA, +0.61% say their COVID-19 vaccine candidates could be ready, at least for limited use, by the end of the year. It will be good — make that, great — news for the economy if the vaccines are effective enough that face-to-face interactions can once again resume without much fear of spreading, or contracting, the new coronavirus. But in the stock market, it won’t universally be good news, as some companies have thrived during the current pandemic.

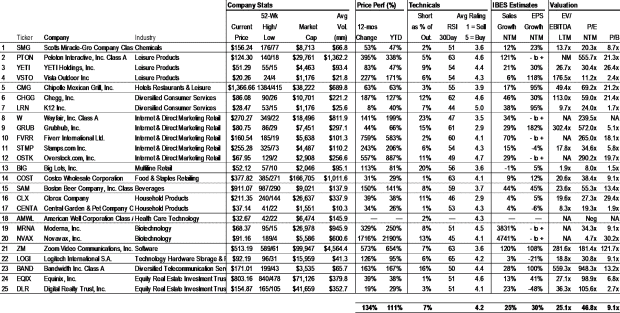

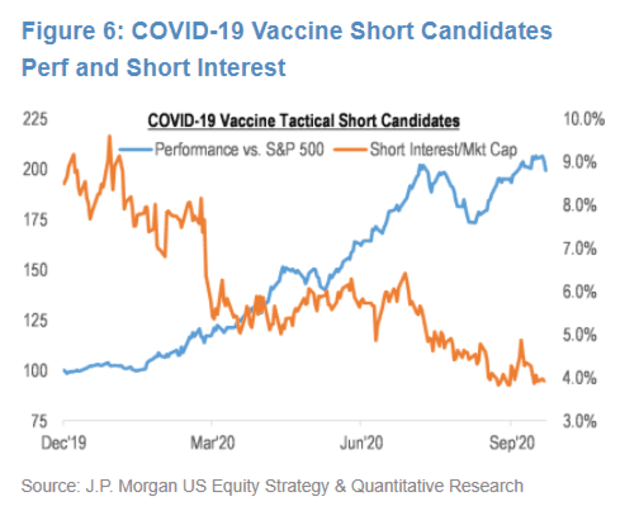

Strategists at JPMorgan have put together a list of companies that are at risk of steep drops. They are at the “upper echelon of momentum and have crowded positioning, that could see the second derivative of their profit growth decrease as consumer / corporate activity normalizes,” said the JPMorgan team. Some of the names, like Zoom Video Communications ZM, +4.09%, are obvious, but the list also includes companies including education technology provider Chegg CHGG, -11.05% and Central Garden and Pet Co. CENTA, +0.08% that aren’t as well known.

This group of stocks has outperformed the S&P 500 by about 9% this year.

The strategists also discussed the U.S. election, and pointed out their basket of stocks tied to a victory by former Vice President Joe Biden is outperforming the basket tied to a victory by President Donald Trump by 66% this year.

“Given the large divergence between these two baskets (i.e. similar to momentum/value), coupled with our expectation that COVID-19 headline risk likely declines postelection, we see an increasingly compelling case for value in the coming period. Deep value, namely energy and financials, would likely be key beneficiaries of an ‘orderly’ Trump victory and could see a large short squeeze. Under a Biden scenario we could also see profit-taking from high momentum stocks, especially as investors start to price in risk of higher capital-gains tax,” they said.