This post was originally published on this site

Qualcomm’s wares on display, January 9, 2019.

AFP via Getty Images

A mixed start for Wall Street is on tap, thanks to news of a setback on the COVID-19 vaccine front (see buzz).

But technology stocks look fired up, on the heels of the Nasdaq’s COMP, +2.55% best day in weeks and third-highest close in history. That was due to optimism that continues ahead of Tuesday’s two big technology events — a possible a new 5G iPhone from Apple, and the start of Amazon.com’s Prime Day shopping event. Those stocks are both up in premarket trading.

Onto our call of the day, which offers up stock ideas from a portfolio that has returned 34.1% year to date, versus 9.4% for the S&P 500. The so-called “Granny Shots” portfolio from Fundstrat Global Advisors gets its name from National Basketball Association legend Rick Barry, who shot free throws underhanded, “granny style,” for a career percentage of around 90%.

As Fundstrat founderThomas Lee explains, the “Granny Shots” portfolio is about “the best of the best” of their portfolios — stocks that have an attractive long-term thesis, though at times gain traction slowly, therefore require patience. Since its inception in January 2019, the portfolio has been beating the S&P by 2,470 basis points.

Note, that the granny portfolio has gotten a boost from some of those all-star tech performers this year — Apple, Alphabet GOOGL, +3.58%, and Microsoft MSFT, +2.59%.

Fundstrat rebalanced the portfolio for the third quarter to add five new names and deleting six. Lee highlights these 35-year charts to illustrate how these stocks might be ready for a revival. Among the new additions is semiconductor equipment maker KLA Corp. KLAC, +1.66%.

Fundstrat/Bloomberg

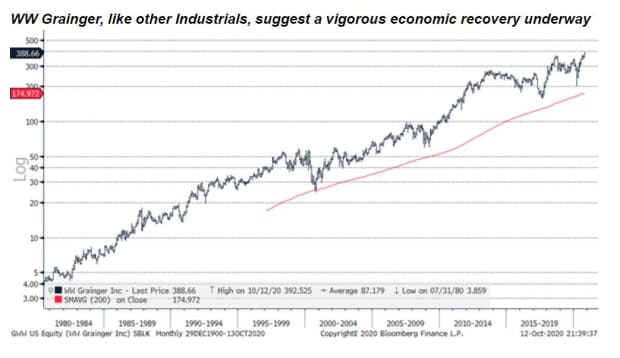

Also included is global media group Omnicom OMC, +1.86%, which Fundstrat notes has suffered some big “headwinds” from the pandemic this year. Another pick is WW Grainger GWW, +0.84%, an industrial that plays into the idea of an economic rebound:

Fundstrat/Bloomberg

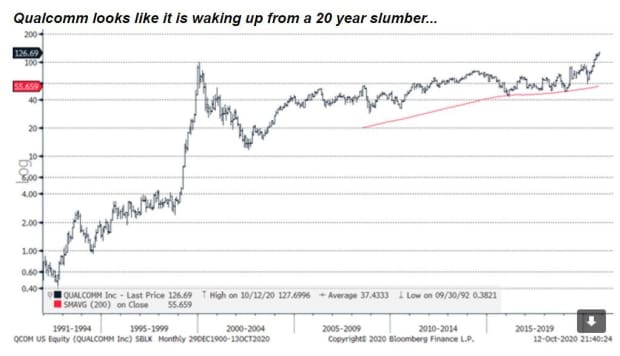

They also added chip makers — Intel INTC, +2.00%, which appears to be “shaking off its 2020 setbacks,” and Qualcomm QCOM, +1.45%, which seems like it is “waking up from a 20-year slumber.”

Fundstrat/Bloomberg

As for those leaving the portfolio, online travel group Booking Holdings BKNG, +1.49%, multinational Emerson Electrics EMR, -0.52%, hardware and software company HP HPQ, +2.37%, automotive parts supplier BorgWarner BWA, -0.50%, fertilizer maker CF Industries CF, -5.77%, and consumer goods group Procter & Gamble PG, +1.09% are out.

The markets

Dow and S&P stock futures YM00, -0.49% ES00, -0.20% are down, but Nasdaq-100 futures NQ00, +0.81% are flying higher, with European equities SXXP, -0.17% lower. Gold prices GOLD, -0.03% are also weaker.

The buzz

Banks JPMorgan JPM, +1.22% and Citigroup C, +2.11% are kicking off third-quarter earnings, alongside airline Delta DAL, -0.51%. JPMorgan shares are up after the bank topped earnings forecasts. Shares of fund giant BlackRock BLK, +0.54% are up after a profit and revenue beat.

Upbeat earnings are out from pharmaceutical group Johnson & Johnson JNJ, +0.57%, which halted late-stage clinical trials for its COVID-19 vaccine candidate after a participant’s unexplained illness. Meanwhile, a 25-year old Nevada man has become the first published U.S. case of COVID-19 reinfection, with his second case worse than the first.

Disney DIS, -0.00% says it will reorganize its media and entertainment units to focus on streaming. Shares are surging in premarket.

Personal computer demand saw the biggest growth in a decade due to the coronavirus pandemic. The virus also means global carbon emissions will hit a decade low in 2020, but other big climate targets will miss the mark, says the International Energy Agency.

President Donald Trump resumed election campaigning in Florida late on Monday, after his doctor said he has had several negative COVID-19 tests.

Random read

Fans of former boxing champion Mike Tyson are worried after an odd television interview.

U.K. government forced to pull advertisement suggesting ballet dancers retrain.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.