This post was originally published on this site

AFP via Getty Images

An upbeat start to the week is fading, with technology stocks poised to lead the market south. That is as a report makes the rounds that some Democratic lawmakers may be pushing for an effective breakup of big tech firms.

“Political pressure is building — lawmakers sniff votes in tackling big tech,” says Neil Wilson, chief market strategist for Markets.com. In other words, if Democrats win the White House and the Senate in November, that push could turn into real laws.

Now isn’t the time to abandon tech stocks, says our call of the day, from strategists at Citigroup led by Robert Buckland. He has moved the bank’s sector recommendation on tech stocks back to overweight (bullish).

“Of course, valuations look expensive, but the sector is likely to outperform if EPS (earnings per share) downgrades resume elsewhere,” said Buckland and the team. That positive view on tech stocks means they are also staying bullish on U.S. equities.

Citi believes cyclical stocks — tied to the economy’s fortunes — are most vulnerable to EPS cuts, which they see resuming within months. The strategists think consensus EPS estimates are too high and a second wave of COVID-19 infections may likely disrupt the economic recovery.

“In addition, IT [information technology] is a key beneficiary of lower real rates,” Buckland said. Real rates refer to the interest an investor or saver gets after adjusting for inflation. The charge higher for tech stocks has reflected a “relentless drop” in real yields, he said.

In a separate note, Buckland noted that tech stocks outperformed in 2019 as the Federal Reserve cut interest rates and real yields fell, and in March as equities and growth expectations dropped and those yields continued to fall. That outperformance has continued as quantitative easing has held down nominal yields — the interest an investor can expect to get from a bond.

What could finally burst the tech bubble, said Buckland, is if central banks tapering off that QE push up nominal and then real yields.

The analysts are also bullish on consumer staples, which they view as the best defense against rising inflation.

Read: Wall Street sees Biden win speeding U.S. shift to clean energy

The markets

Stock futures ES00, +0.03% YM00, +0.31% are pitching lower, notably those for the Nasdaq-100 NQ00, -0.26%. European stocks SXXP, +0.24% are struggling, and Asian markets had a largely positive session.

Read: Here’s what’s really moving the stock market right now

Federal Reserve Chairman Jerome Powell is due to deliver a speech on the economic outlook to the National Association for Business Economics at 10:40 a.m. Eastern. The trade balance and Job Openings and Labor Turnover Survey (JOLTS) for August are also ahead.

President Donald Trump is back at the White House to carry out his COVID-19 treatment. His tweet saying “Don’t be afraid of COVID” triggered some outrage on Twitter TWTR, +2.58%, and scientists said people should be very afraid of the pandemic.

The White House has blocked the Food and Drug Administration from introducing tougher guidelines that would have likely stopped the release of any COVID-19 vaccines ahead of the election. A new poll finds that only half of Americans would try a COVID-19 vaccine anyway.

While much of the world languishes in COVID-19 problems, Chinese holidays saw travel return to 80% of where it was in 2019.

Don’t miss Barron’s Health Care Roundtable. Influential health-care investors look at how COVID-19 has sped up health-care innovation and created new opportunities for investors. Register here.

The chart

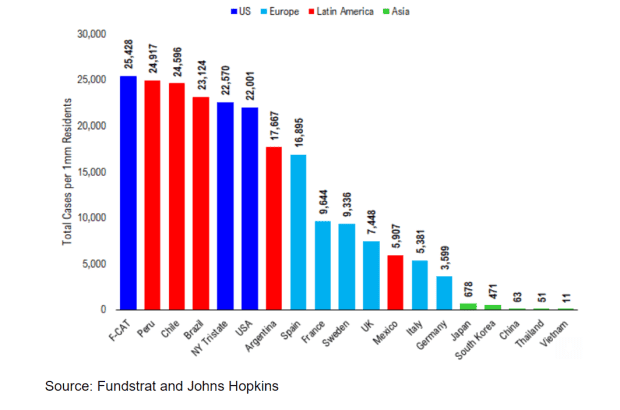

Here’s one for the COVID-19 “herd immunity” camp — those who believe nations with higher cases can be less vulnerable to big outbreaks. Thomas Lee, founder of Fundstrat Global Advisors, shares this chart that shows how U.S. cases tower over those of Europe right now.

Random reads

An iconic Central Park restaurant in New York City shuts its doors.

Japan pulls the plug on fiercely competitive mascot contest.

124-year-old snowball fight still hits the spot.