This post was originally published on this site

Tech-driven earnings rally halved in two sessions

FactSet

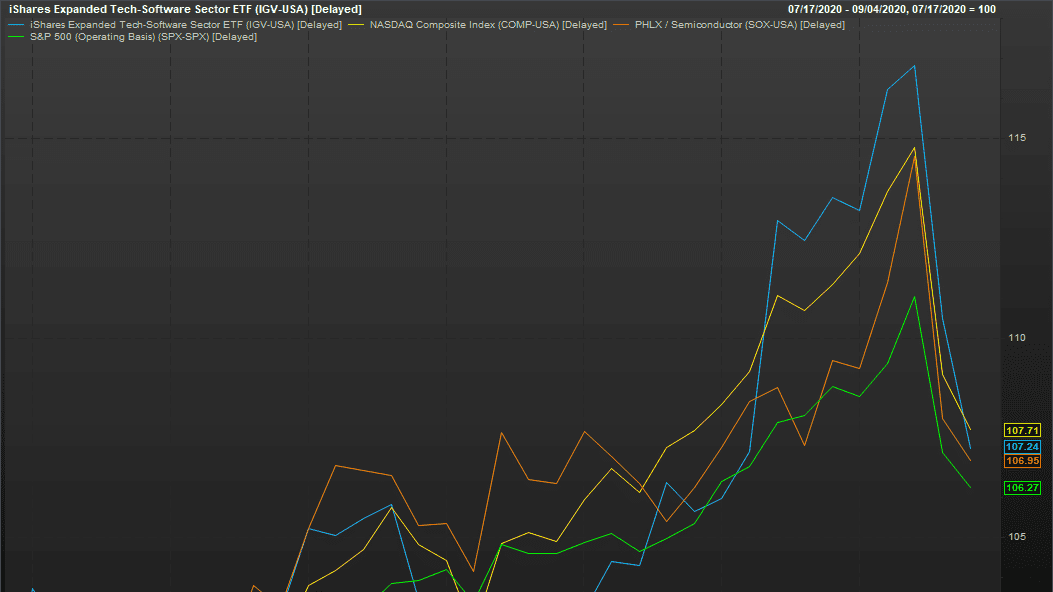

The downturn in tech stocks Thursday and Friday may have been jarring, but the end effect was bringing overheated software and chip stocks back into line with the broader market.

Tech stocks started rallying in earnest on July 20 leading up to Microsoft Corp.’s MSFT, -1.40% earnings as several analysts hiked price targets on the stock, and forecast windfalls for tech companies due to the COVID-19 pandemic. Until Thursday, it was pretty much full steam ahead for the sector as the tech-heavy Nasdaq Composite Index COMP, -1.26% gained 14.8% to peak at 12,056 on Wednesday, with the Dow Jones Industrial Average DJIA, -0.56% rising 9.1% and the S&P 500 index SPX, -0.81%, with more than a quarter of its weight in tech companies, gaining 11% over the same period.

By Friday’s close, gains in the Nasdaq were pared back to 7.7% from July 20, while the Dow was up 5.5%, and the S&P 500 was up 6.3%.

Much of the strength from tech earnings was due to the fact that the infrastructure backbone that allows millions to work and play from home during the COVID-19 pandemic is made possible by the hardware and software that makes up data centers and the devices that connect to them.

Gains in tech were clearly driven by software sector as the iShares Expanded Tech-Software Sector ETF IGV, -2.94% rallied 17.1% from late July up to Wednesday, following strong earnings from companies like Salesforce.com Inc. CRM, -3.89% and Workday Inc. WDAY, -3.22%. Additionally, the First Trust Cloud Computing ETF SKYY, -2.70% gained 14.3% over that time.

Chip makers also rallied as the PHLX Semiconductor Index SOX, -0.96% gained 14.5% following strong earnings from Advanced Micro Devices Inc. AMD, -0.64% and Nvidia Corp. NVDA, -3.01%. Even with the announcement that next generation chips would be delayed because of manufacturing problems, Intel Corp. INTC, -0.61% still reported strong earnings for the quarter and issued a similarly strong forecast.

Meanwhile, the ETFMG Prime Cyber Security ETF HACK, -2.57% rose on par with the S&P 500 with a 11% gain, following earnings from companies like CrowdStrike Holdings Inc. CRWD, -3.14% and Palo Alto Networks Inc. PANW, -2.70%

By the close Friday, though, outsize gains in the tech sector were brought back into parity with the rest of the market. Compared with late July, the IGV software index was up 7.2%, the SKYY cloud index was 4.9% higher, the SOX chip index was up 7%, and the HACK cybersecurity index was up 2.4%.

“It is logical to assume a key driver is profit-taking, as the best performing stocks have experienced the steepest losses this morning,” Katie Nixon, chief investment officer at Northern Trust Wealth Management, said on Friday.