This post was originally published on this site

A view of the Facebook thumbs-up ‘Like’ symbol in Menlo Park, California.

john g mabanglo/Shutterstock

Stock markets are setting records, and companies like Tesla are surging, at a time when the real economy is reeling from the coronavirus pandemic.

It isn’t easy for anyone to comprehend, and sometimes, it is worth stepping back at the broader picture rather than focusing on the daily or weekly moves. Michael Hartnett, chief investment strategist for Bank of America, has put together his annual list of the top stats on the size, composition, risks, returns, leverage, yields and valuations of the bond and equity universe.

Here are his top 20 “must-know” stats that Hartnett says “highlight the nihilistic bull market in bonds and equities, the Fed’s implicit desire for an asset price overshoot, how Wall Street is ‘too big to fail,’ how financial repression has averted debt deflation, the hubristic dominance of Big Tech in equities, and the epic polarization of asset returns, flows and valuations.”

- $1.4bn: central bank asset purchases every hour since COVID-19 March lockdowns

- $1.6bn: Nasdaq-100 NDX, +1.03% market cap gain every hour since COVID-19 March lockdowns

- 34 days: equity bear market in 2020 shortest ever

- $2000: gold best performing asset class in 2020, first year since 2010

- 56%: annualized return from 30-year U.S. Treasury TMUBMUSD30Y, 1.399% this year

- 100 years: corporate bonds hit 100-year highs versus commodities Apr. 2020

- 100 years: U.S. stocks almost at 100-year highs versus U.S. government bonds

- 59%: U.S. equities as share of MSCI global equity index (All Country World Index) at all-time high

- 42%: Chinese equities as share of Emerging Markets at all-time high

- 21%: gain in global stocks (ACWI ex. U.S.) required to match 2007 high

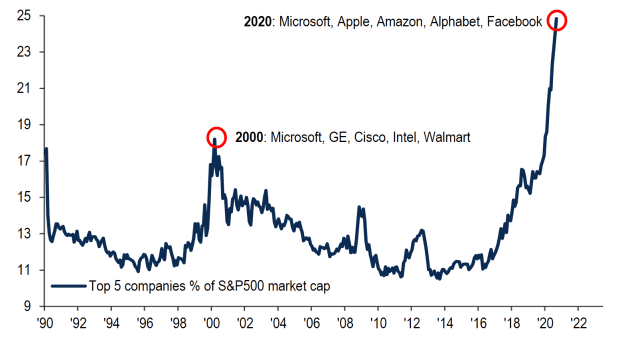

- 25%: market cap of FAAMG [Facebook, Amazon, Apple, Microsoft, and Alphabet’s Google] as % U.S. stocks, of U.S. stocks, record concentration

- $9.3tn: market cap of U.S. tech sector > entire market cap of Europe’s stock market

- 24x: trailing PE [price-to-earnings] ratio of S&P 500 SPX, +1.53% surpassed only Dec. 2021 (25x) & Jun. 1999 (30x)

- 1.7%: dividend yield on S&P 500 now same as 5-year break-even inflation rate

- 2021: global consensus forecasts for 2021…GDP 5.1%, EPS 29.0%…up big

- 2021: global consensus forecasts for 2021…CPI 1.3%, bond yield 0.5%…unchanged

- $258tn: size of global debt at record high, 280% of global GDP

- $212tn: value of global bonds & equities, an all-time high, 2.3x global GDP

- $14tn: value of global negatively yielding bonds

- 40%: Bank of Japan owns 40% of JGB [Japanese Government Bond] market; Fed owns 14% of Treasury market