This post was originally published on this site

Jerome Powell, chairman of the U.S. Federal Reserve, right, arrives to a Federal Reserve Board meeting next to Richard Clarida, vice chairman of the U.S. Federal Reserve, in Washington, D.C., U.S., on Oct. 31, 2018.

Andrew Harrer/Bloomberg News

Tuesday’s session was a landmark for what it achieved — a record high for the S&P 500, meaning all of the losses from the pandemic are gone for the leading U.S. stock market benchmark — but not really for what actually happened.

The index SPX, +0.23% edged up 0.2%. The combined volume at the New York Stock Exchange and the Nasdaq didn’t even meet the August average, yet alone being less than half of the late February peak. Retailers Walmart WMT, -0.65% and Home Depot HD, -1.12% both posted impressive earnings, and both stocks sagged lower.

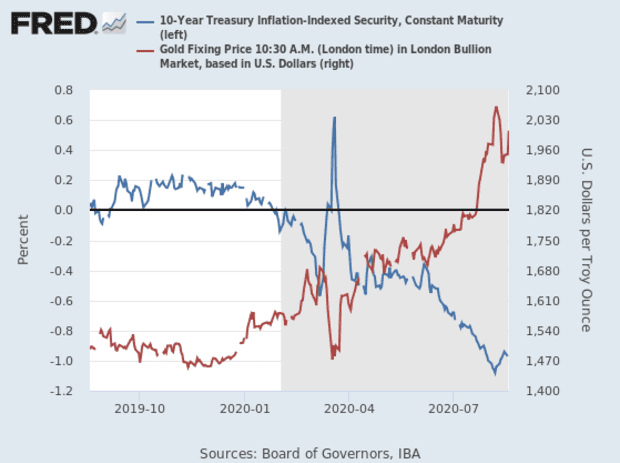

The real story in markets right now is that the increasingly negative inflation-adjusted U.S. government bond yields are driving the U.S. dollar DXY, +0.01% lower and sending investors scurrying into other assets, notably gold and stocks.

The minutes of the Federal Open Market Committee meeting, due at 2 p.m. Eastern, will get more attention than usual, as traders focus on what was said about the policy framework change expected in September. Chairman Jerome Powell has already said that was a topic during the July meeting.

Strategists at ING said the market’s entire narrative — of governments aggressively spending and central banks aggressively easing — is on the line.

“The driving narrative of negative U.S. real yields devaluing the dollar and reflating financial assets will be challenged when the minutes of the July 29 FOMC are released,” said strategists led by Chris Turner, ING’s global head of markets. They said the question is what clues are left that average inflation targeting will be adopted.

Average inflation targeting would mean the Fed aiming to return the average of inflation over some period, rather than getting inflation to 2% over the medium term. It implies the Fed allowing inflation to run hot to make up for past periods undershooting the target.

“Any clues from the July minutes as to its likelihood and any insights on what it would take for the Fed to initiate yield curve control could see dollar losses extend,” they said.

But they conceded that the biggest risk is “probably stretched short dollar positioning. A short-term correction cannot be ruled out if the switch to [average inflation targeting] is more an ‘evolution than a revolution.’”

They don’t expect any strength in the greenback to last for long, however. “We doubt any short, sharp dollar rallies are sustainable and that the dollar should stay pressured into a very contentious presidential election in November.”

The buzz

House Speaker Nancy Pelosi told Politico that Democrats in Congress were willing to cut their coronavirus relief bill in half to get agreement with Republicans. President Donald Trump said he was the one who canceled the planned U.S.-China trade talks last weekend, as the State Department warned university endowments to divest China holdings ahead of possibly more stringent action.

The U.S. Treasury is auctioning off $25 billion in 20-year notes, which could draw market attention after last week’s disappointing auction of 30-year securities.

Discount retailer Target TGT, -0.48% and home-improvement chain Lowe’s LOW, -0.31% highlight the earnings calendar. Lowe’s topped analyst earnings forecasts as U.S. same-store sales jumped 35%. Target’s earnings also exceeded analyst expectations, as comparable-store sales jumped 24%.

The Gilead Sciences GILD, -0.13% investigational treatment for moderately to severely active rheumatoid arthritis won’t be approved by the Food and Drug Administration in its current form, said its partner Galapagos GLPG, -2.36% GLPG, -28.84%, which plunged in Amsterdam trade.

Regeneron REGN, -0.34% is teaming with Roche ROG, +1.15% to increase distribution of its COVID-19 drug.

The market

U.S. stock futures YM00, +0.20% NQ00, +0.13% edged higher.

The euro EURUSD, +0.09% was steady, and the yield on the 10-year Treasury TMUBMUSD10Y, 0.653% was 0.66%.

The chart

The Dogs of the Dow strategy is a simple one — pick the 10 stocks with the highest dividend yield in the Dow Jones Industrial Average DJIA, -0.24% on the last day of the calendar year, invest an equal amount in them, and hold for a year. As this table from Horan Capital Advisers shows, it has been a terrible strategy for 2020, with every component losing ground and the strategy underperforming both the broader Dow and S&P 500 indexes.

Random reads

The National Basketball Association playoffs are off to a wild start, after the top seeds in the Eastern and Western Conferences both lost.

A huge fire broke out at an industrial complex west of Dallas, Texas.

An asteroid made the closest Earth flyby a space rock has ever survived.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.