This post was originally published on this site

https://d1-invdn-com.akamaized.net/content/picd51314803264ce58ff226d05b4cd0121.png

With the S&P 500 up 28% from its March trough and volatility fading, systematic trend followers are turning bullish on the U.S. benchmark, according to Nomura Holdings (NYSE:NMR) Inc.

Typical models tracked by commodity trading advisers — a regulatory term for the $300 billion world of futures speculators — are flashing buy signals as U.S. stocks enjoy a rapid rebound a month after their sharpest correction in history.

All told this year’s wild pandemic-driven markets are burnishing the cohort’s reputation for delivering “crisis alpha,” albeit modestly.

“The buying of equities we are seeing has a strongly technical flavor,” Masanari Takada, a quantitative strategist at Nomura, wrote in a note on Tuesday. “With human market participants staying at home (both literally and figuratively), the machines have proceeded on their own to systematically buy up equities.”

The Nomura analysis chimes with that of JPMorgan Chase (NYSE:JPM) & Co., which suggests CTAs are poised to finish covering their short bets — a stepping stone toward building longs.

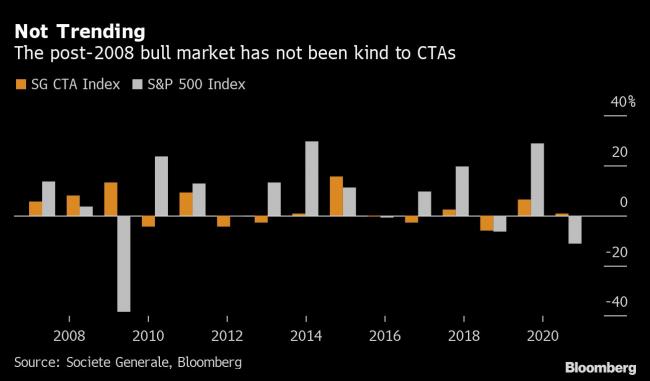

Extraordinary monetary action to combat the pandemic fallout has succeeded in powering a decisive cross-asset uptrend while bringing volatility lower, enabling CTAs to return to bullish stock bets. The group have posted a 1% gain this year, a Societe Generale (OTC:SCGLY) SA index of the largest managers shows. That’s nothing like 13% for 2008 overall but a source of solace next to double-digit losses across equity hedge funds and benchmarks.

After years trailing the raging bull market amid crowding and choppy trends — with some pronouncing the strategy dead — its practitioners are in better spirits.

Just ask Steeve Brument, head of multi-asset quantitative strategies at Candriam, a unit of New York Life Investments. Mostly thanks to long-bond and short-oil bets, his Candriam Diversified Futures fund has racked up a nearly 8% gain this year.

“We do see prospective clients coming to us and having a renewed interest for trend followers,” he said from Paris.

His fund has been cutting short positions in stocks and is now nearly positive on the Nasdaq 100 but still slightly bearish on the S&P 500.

Similar strategies overseen by AlphaSimplex Group LLC, Man AHL and AQR Capital Management LLC have also notched gains of at least 5% year to date. A handful of short-term trend followers, which can pounce on sharp market moves more quickly, have posted even stronger returns.

Whether the rest of 2020 will usher in sustained trends is the question. As countries ease lockdowns to contain the outbreak, the measures could unleash either an economic recovery or a fresh plunge in markets sparked by another wave of the virus.

While trend followers like sharp moves, it’s hard to build all-weather strategies that can capture the turning points through bull and bear runs when markets are choppy.

This is the conundrum weighing on Metori Capital Management, another relative winner in the turmoil. After reaping decent profits — its Lyxor Epsilon Global Trend fund is up almost 8% in 2020 — the fund has been downsizing exposures in a sign of continuing risk aversion.

“The model is very much risk-off, very little overall leverage and waiting for the next trend to start before increasing again the exposure,” said managing partner Laurent Le Saint.

It’s cut long wagers in U.S. and German government bonds, stuck with small long positions in U.S. large caps and remains short mid-caps.

The upshot? For believers in the long-suffering quant strategy, 2020 so far is turning into a victory of sorts. But while CTAs are back riding the U.S. equity rebound, price-momentum strategies are at the mercy of renewed pandemic-spurred reversals.

“There are some periods when it doesn’t really work, but the name of the game in those periods is to avoid losing too much money,” said Le Saint.

©2020 Bloomberg L.P.