This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXMPEE1C09I_M.jpg © Reuters.

© Reuters.By Gina Lee

Investing.com – Asian stocks slid on Tuesday morning as they reacted to oil’s slide into negative territory in the previous session.

In a “devastating day” for the industry, WTI futures for May delivery slumped to -$37.63 ahead of the contract’s expiry on Tuesday.

But there were other factors moving the stocks as well.

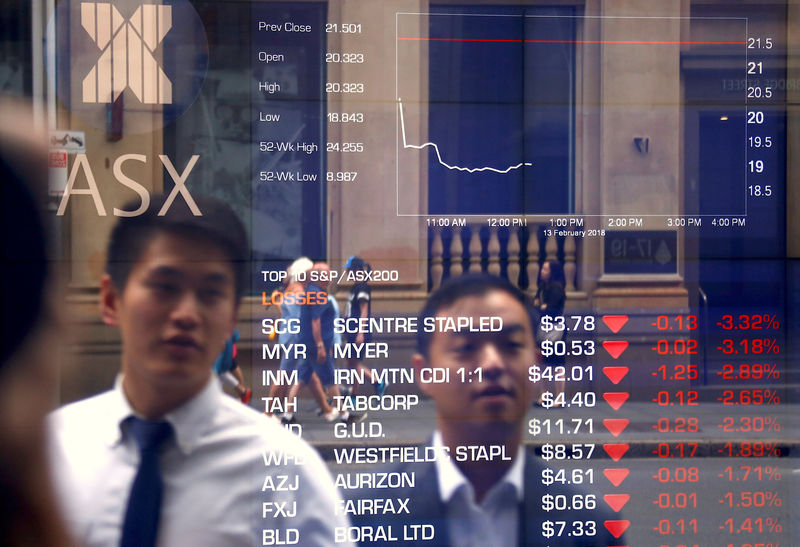

The dropped 1.77% by 11:01 PM ET (4:01AM GMT) as Virgin Australia Holdings Ltd (ASX:) announced that the firm has entered voluntary administration to “recapitalise the business and help ensure it emerges in a stronger financial position on the other side of the COVID-19 crisis.”

The Reserve Bank of Australia also released the minutes for its April meeting earlier in the day, which affirmed that its board “remained committed to supporting jobs, incomes and businesses” as the country responds to the coronavirus outbreak.

It also added that “the Australian banks were in a strong position to withstand the large economic shock” from the COVID-19 pandemic and the resultant financial market volatility.

South Korea’s lost 1.71% as reported abounded that North Korean leader Kim Jong Un is in grave danger after surgery while Japan’s dropped 1.98%.

In Greater China, Hong Kong’s slid 2.31%. China’s lost 1.06% while the dropped 1.34%%.

Investors are also monitoring news that lockdowns in some countries are being eased, and the COVID-19 death toll in New York as well as other parts of the world is decreasing.

Meanwhile, the U.S. Congress said overnight that it is close to agreeing on a new spending package to help with the virus’ economic impact.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.