This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEB63085_M.jpg

By Gina Lee

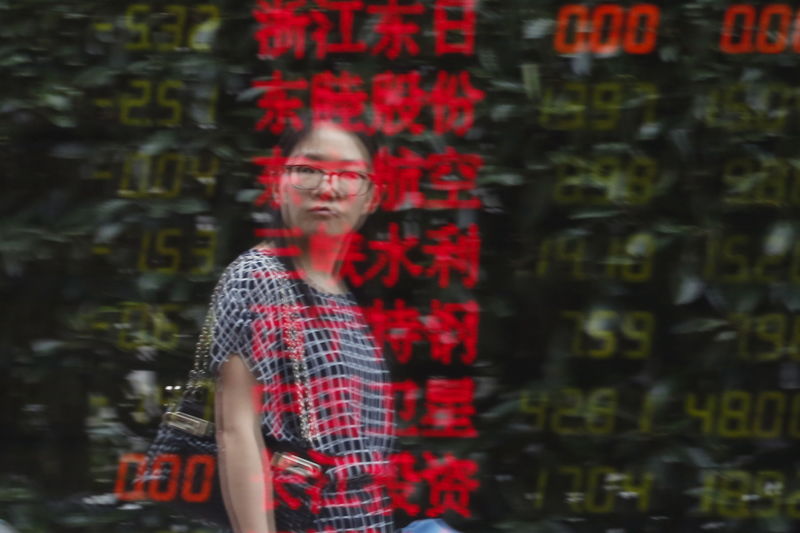

Investing.com – Asian stock markets managed to hold onto earlier gains on Friday as China’s economy reported its first contraction since 1992.

China reported earlier in the day that its shrank by 6.8% year-on-year. Analyst forecasts prepared by Investing.com predicted a 6.5% contraction.

fell 1.1% year-on-year in March, less than the predicted 7.3%, as the country slowly increased its production capacity after months of lockdown to stem the spread of the COVID-19 virus. But the road ahead does not look easy for the Chinese economy as other countries extend their lockdowns, curtailing demand.

“The first quarter contraction is not a surprise, considering the nationwide lock down in late January and February,” Robin Xing, chief China economist at Morgan Stanley (NYSE:) Asia, told Bloomberg. “Most major economies are still in the lockdown stage. As a result, growth in the second quarter will be shallow, just marginally above zero.

But Asian stocks managed to hold onto their earlier gains despite the news. China’s was up by 0.67% by 10;47 PM ET (3:47 AM GMT) while the jumped 1.31%.

Elsewhere in Greater China, Hong Kong’s was up by 2.31%.

South Korea’s led the gains as it gained 3.2%. Japan’s rose 2.51% and the rose 2.17%.

Global stocks received a boost from a report stating that a Gilead Sciences (NASDAQ:) drug was proving effective at treating COVID-19. The company announced overnight that clinical trials of its antiviral drug Remdesivir showed promising results.

They also received a boost from U.S. President Donald Trump hinting at the reopening of the U.S. economy as he briefed U.S. governors on guidelines in “opening up America again”.

But some investors urged caution as the economic damage from COVID-19 continues to mount.

“The market is a bit optimistic right now,” and is underestimating the hit to earnings, David Bailin, chief investment officer at Citi Private Bank, told Bloomberg.

“Ultimately we have to have really great coordination in order to see any real improvement in the economy.”