This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEC0L0PD_M.jpg

U.S. equities surged Tuesday, implied volatility dropped for a fourth day and investment-grade credit premiums fell in the aftermath of the Federal Reserve’s historic new stimulus program.

Policy firepower to forestall the economic fallout from the spreading coronavirus is lifting dollar liquidity and cross-asset price swings are easing. All that is helping market players look past the recent frenzy of panic selling.

“These more wide-ranging measures look much more likely to allow the free-fall in risk assets to at least stabilize,” said Mizuho strategists led by Peter Chatwell.

So while evidence of a brewing recession piles up, virus cases across the world surge and a fiscal stimulus plan fights its way through Congress, reasons for cautious optimism exist. From quant investing to the volatility market, there are signs that a calmer and more orderly state of trading is around the corner to absorb any fresh wave of selling.

Here’s some evidence on that front, with judicious caveats.

Vol Crunch

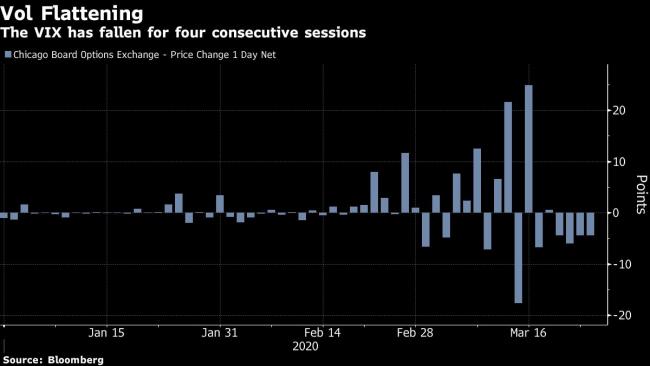

Price swings in recent sessions have been easing in the midst of the stock bear market, an unusual development. The Cboe Volatility Index, or VIX, is dropping for the fourth day in a row, a streak that includes two days when U.S. stocks slumped.

While that isn’t evidence of a market bottom, it could hint that the worst of the selling is over, according to Michael Purves of Tallbacken Capital Advisors LLC. Add realized volatility slipping from historic highs, and it’s looking less fearful out there.

“We can see the moves are fading from the ‘limit down’ days of last week,” wrote Purves.

Systematic Selling

With many systematic players taking their cues to sell from high implied or realized volatility, this may mean peak quant selling is behind us.

Systematic clients on Credit Suisse (SIX:CSGN) Group AG’s prime-brokerage platform have seen their equity exposure drop by 45% this month compared with the end of last.

As cross-asset correlations normalize — stocks were up and bonds down on Tuesday — and price swings calm, strategies that are sensitive to volatility, such as risk parity, will not have to deleverage as quickly.

Fed Buying

Stock investors taking their cues on the health of Corporate America from credit traders may also rest a little easier given the Fed’s resolve to boost company balance sheets.

As part of its stimulus package, the Fed said it will purchase up to 10% of an issuer’s outstanding bonds and up to 20% of the assets of any ETF that primarily holds investment-grade debt.

Right on cue, the $30 billion iShares iBoxx Investment Grade Corporate Bond ETF, ticker LQD, surged by 7.4% on the news — the most since 2008. The fund had been hammered in part because some investors likely ditched their most liquid assets to shift into cash.

The gains for the ETF also helped to close a yawning gap between the price of the fund and its underlying assets that had sparked consternation among traders. The fear was that rampant redemptions by passive investors could have exacerbated the sell-off in the underlying bonds in recent weeks.

The Fed may have acted as a circuit-breaker in that regard. “Expanding buying into ETFs will help stem the doom-loop caused by passive-money selling, and is a promising step,” Mizuho’s Chatwell wrote.

Anecdotally, liquidity in certain credit products may also be rising after a collapse that helped intensify the March turmoil. Purves at Tallbacken notes that options on BlackRock’s iShares iBoxx High Yield Corporate Bond ETF “were $2 wide a couple of weeks ago; today many strikes are down to $0.25 or $.30 bid/offers.” That’s “not great, but better” than the dire trading conditions seen in recent weeks, he wrote.

Metals Rally

There’s a counterintuitive reason for cheer that’s a sign of these disruptive times: Gold and silver, traditional havens, have been rallying.

That’s likely an indication that forced liquidations have subsided. The yellow metal had been declining over the past two weeks despite the wider market turmoil, because investors were favoring the dollar and sold gold to raise cash.

Basis Blues

A combination of margin calls, liquidations and companies and investors opting to hoard cash has soaked up dollar liquidity — sparking a tightening of international financial conditions at a pace rarely seen before.

The Fed’s bazooka, including beefed-up emergency swap lines, has eased short-end funding stresses as seen by the tentative normalization in the market for cross-currency basis swaps.

A gauge of the dollar’s strength against major currencies is now on course for its first decline in 11 days, suggesting an improved risk climate.

For liquidity conditions to normalize from here, a steeper yield curve, higher market-derived inflation expectations and real rates at minus 2% are all needed, according to Jefferies LLC strategists led by Sean Darby. On that basis, American policy makers have more stimulus work to do, they wrote in a note.

For now, market participants are continuing to adjust to a new world of oncoming defaults and a sudden stop in consumer demand and investment, and that’s creating all manner of crisis-era bumps. The so-called Ted spread surged to scary levels Tuesday — a sign of rising counterparty risk in one corner of the funding market.

But at least the pace of selling appears to be easing.

©2020 Bloomberg L.P.