This post was originally published on this site

https://i-invdn-com.akamaized.net/content/picad02fc48167be4fae584b8483d4e3523.jpg

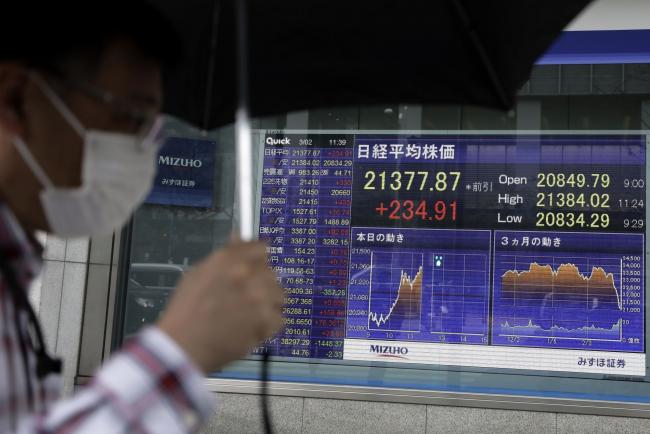

(Bloomberg) — Volatility continued to reign in markets Wednesday, with sovereign bond yields falling after yesterday’s surge, the sliding and U.S. stock futures dropping.

Contracts on the Index fell more than 2% after the U.S. administration failed to offer details on what President Donald Trump said would be “major” measures to combat the economic impact of the coronavirus. European futures rose after the near 5% rally on Wall Street Tuesday. Asian equities fell, while the surged and held most of Tuesday’s rebound.

The reversed an earlier gain to edge lower after the Bank of England cut interest rates.

Australia joined peers from Japan to Brazil to Italy that have sunk into a bear market this month.

“We saw a relief rally yesterday that just hasn’t been sustainable,” Kerry Craig, global market strategist at JPMorgan (NYSE:) Asset Management in Melbourne, told Bloomberg TV. A delayed response raises the risk that “employment growth starts to fall, unemployment starts to rise — and that’s a more difficult story to try to reverse and see growth come back later in the year,” he said.

Meantime, Joe Biden cemented his position as front-runner for the U.S. Democratic presidential nomination with primary victories Tuesday, further easing concerns among those opposing Bernie Sanders’s progressive platform.

Here are some key events coming up:

- The European Central Bank’s policy decision comes Thursday amid expectations it may ease policy.

- The U.K. Chancellor of the Exchequer unveils the government’s 2020 budget on Wednesday.

- The U.S. core consumer price index, due Wednesday, is expected to remain subdued in February.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.