This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXMPEA6606G_M.jpg © Reuters. New coronavirus: what markets should watch now

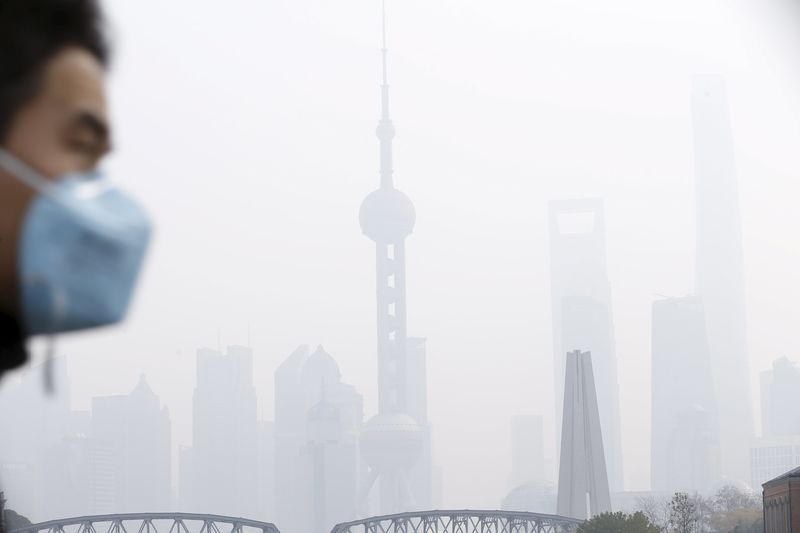

© Reuters. New coronavirus: what markets should watch now(Reuters) – World markets started shrugging off the worst of the coronavirus impact last week and stock markets have since reached record highs. China’s announcement that new cases of the so-called COVID-19 detected on Tuesday were at their lowest since Jan 30 has only consolidated those gains.

Here are some factors to watch in coming days:

HAS THE OUTBREAK PEAKED?

In short, no one can say. Disease epidemic models include factors such as the number of known infections, time passed, frequency of travel or human contact, the ease of spread and mitigating measures like quarantine or screening.

But even those who use such models to understand the evolution of the outbreak are always updating their datasets with new information.

“In a situation like this where there are so many unknowns, it’s fair to say it’s impossible to predict with any kind of precision at all when the peak is going to happen,” said Robin Thompson, a mathematical epidemiology specialist at Oxford University.

WHAT SHOULD WE LOOK FOR NOW?

World Health Organization epidemiologists are currently watching:

-anything that sheds new light on the ease of human-to-human spread, including new cases from people with no travel history to China and geographical “clusters” of cases

-the emergence of a highly contagious “super-spreaders”, such as the Chinese doctor who infected many others during a stay at a Hong Kong hotel at the height of the SARS outbreak in 2003. So far, WHO has not identified any super-spreading event and says such events should not be personalized.

-why some people die. People who are older or have underlying medical conditions are most at risk. The overall death rate among reported cases is 2% but WHO wants more data about the disease that in severe cases can cause pneumonia and organ failure.

CAN WE TRUST THE CHINESE NUMBERS?

A moot point. There has been skepticism both inside and outside China about the official tallies of new cases, without anyone coming forward with reliable alternative data. The Chinese government last week amended its case definition but it is not clear what impact that is having on the figures. Health experts also note the sheer strain on resources in some cities could mean delays in getting people tested.

WHAT’S THE IMPACT ON THE GLOBAL ECONOMY?

While the disruption caused to the world’s second-largest economy is already tangible, the bigger question is whether the economic output stalled by the outbreak will simply be postponed until later in the year or lost for good. The current market assumption is that the worst will be over soon enough for the former scenario to happen. JP Morgan for example thinks that China’s annualised GDP growth rate could fall to 1% in Q1 but rebound to as high as 9.3% in the second quarter as factories start making up for lost orders and travel resumes.

The hit elsewhere could be uneven, however. The combined drag from bushfires and the coronovirus fall-out could stunt Australia’s 28-year run of GDP growth, some economists fear.

Meanwhile, Federal Reserve chairman Jerome Powell says the U.S. economy appears to be “resilient” and EU officials see only “marginal” impact on Europe so far.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.