This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEFAI04F_L.jpg

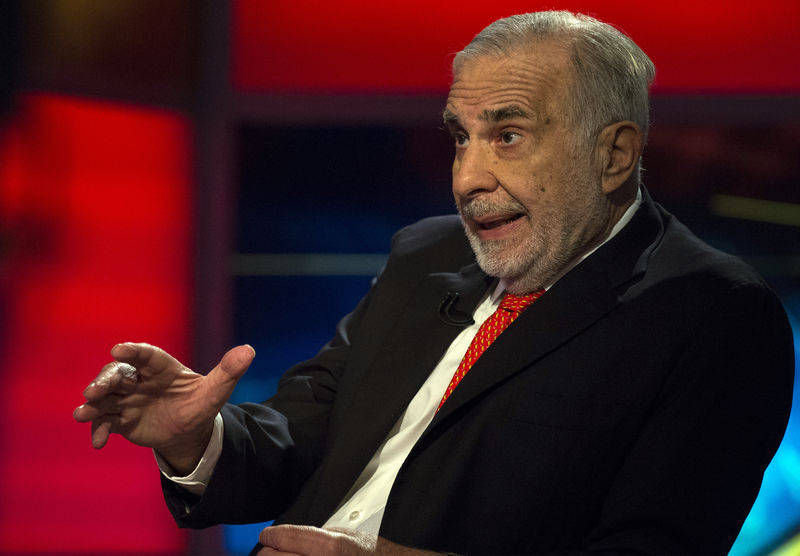

(Reuters) – Billionaire activist investor Carl Icahn on Monday urged the U.S. Securities Exchange Commission (SEC) to rethink a proposed rule change for proxy adviser firms, saying it would make activist investing “even more difficult and expensive to practice.”

The SEC earlier this month put forward new rules that would require proxy adviser firms to give companies a chance to review proxy materials before they are sent to shareholders.

“I believe the current proposal – which would subject proxy advisory firms to onerous regulations – is a dangerous misstep that will have disastrous repercussions for the U.S. economy,” Icahn wrote in an opinion piece for The Wall Street Journal.(https://on.wsj.com/2Qxjvlm)

“This odd arrangement would allow corporations to interfere with advisers’ research – a recipe for disaster,” Icahn wrote, asking the regulator to “rethink” the proposal.

Proxy advisory firms tell investors how to vote on governance issues in corporate elections and cast ballots on behalf of some asset managers. The role of proxy advisers has gained more attention in recent years as the firms have become more influential.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.