This post was originally published on this site

https://images.mktw.net/im-36559446The historic stock-market rally has shown few signs of stopping since October — with the S&P 500 advancing in 16 of the last 18 weeks for the first time since 1971.

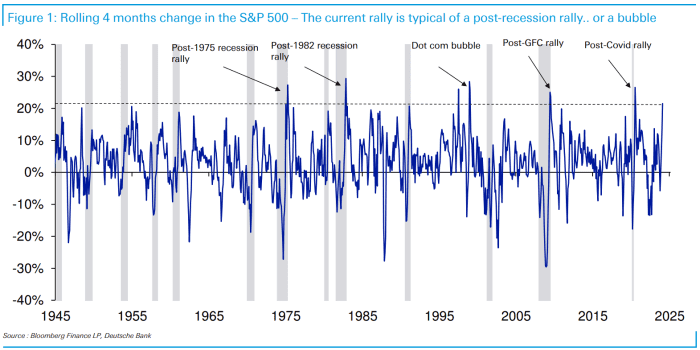

There have been only two other scenarios when U.S. stocks climbed this fast over any four-month period since World War II, and the recent rally has “strong parallels” to both, according to a Deutsche Bank analyst.

The first scenario was when the economy was emerging from recession, such as after the COVID-19 pandemic or the 2007-2008 global financial crisis, while the second was during the dot-com bubble era in the late 1990s, when stocks saw rapid gains that proved unsustainable, said Henry Allen, macro strategist at Deutsche Bank.

Post-recession periods

“The last time we saw the S&P 500 advance this rapidly over four months was up to July 2020,” when equities staged a “sharp recovery” after slumping on growing instability due to the onset of the COVID pandemic earlier that year, Allen said in a Monday client note.

The mid-2020 rally was supported by massive amounts of monetary and fiscal stimulus, with the S&P 500

SPX

rising 26.6% between April and July, almost taking the index back to its pre-COVID peak, according to FactSet data.

Looking further back, U.S. stocks also rallied after the S&P 500 fell to fresh lows in 2008 following the global financial crisis — with the index gaining more than 25% over the four months that ended in June 2009 once “the most acute phase” of the crisis had passed, according to data compiled by Deutsche Bank.

“Unsurprisingly, recessions normally lead to significant equity selloffs, then when the economy begins to improve again, there’s usually a fast recovery for the stock market,” Allen said.

SOURCE: BLOOMBERG FINANCE LP, DEUTSCHE BANK

The dot-com bubble era

Allen said the seemingly relentless equity rally also brings to mind the dot-com bubble from over two decades ago, which saw the S&P 500 rise by 26% over the four months that ended in July 1997.

The rally later was followed by a bursting of the bubble, with stocks falling for three years in a row from 2000 to 2002.

See: S&P 500’s breadth ‘still narrow’ after record peak — with these four stocks driving February gains

The large-cap benchmark S&P 500 has risen 21.5% since it bottomed in October 2023, spurred on by growing hopes for a soft landing for the U.S. economy, expectations that the Federal Reserve will soon start cutting interest rates and investor enthusiasm for artificial intelligence.

“It’s rare to see a rally this fast, and when they happen it’s usually because the economy is emerging from recession and the stock market has just been through a slump,” Allen said on Monday, adding that the only time in the post-World War II period that this wasn’t the case was during the dot-com bubble era.

Their rarity may raise fears that the recent stock-market rally is also a bubble, Allen noted.

Indeed, market participants have been debating whether the rush over the past year into the so-called Magnificent Seven stocks — a group that includes chip maker Nvidia Corp.

NVDA,

and other megacap technology companies — resembles the dot-com bubble era, a period when equities also rode a wave of tech hype only to come crashing down, triggering a mild recession.

While the Deutsche Bank analyst didn’t draw a direct parallel between the recent stock rally and any of the two prior scenarios of rapid gains, Allen admitted this rally has similarities to them. The U.S. economy also has remained surprising resilient during this cycle, even with the Fed’s policy rate steady at a 22-year high since July.

The three major U.S. stock indexes finished lower on Monday afternoon, with the S&P 500 and the Nasdaq Composite

COMP

retreating from their record highs to start the week, down by 0.1% and 0.4%, respectively. The Dow Jones Industrial Average

DJIA

dropped 0.3%, according to FactSet data.