This post was originally published on this site

https://images.mktw.net/im-694259So much for the inflation scare! The stock market’s dive after Tuesday’s U.S. consumer prices report came in hotter-than-expected has been swiftly recouped. Friday could see the S&P 500 index secure its 12th record high of the year.

Benchmark Treasury yields of 4.27% may be near to the top of the range in which they have been vacillating since the start of December — as hopes for an imminent Federal Reserve interest rate cut are dashed — but equity investors seem to be relaxed about that.

As Adam Turnquist, chief technical strategist at LPL Financial explains: “Market expectations and Federal Reserve monetary policy projections have become closer aligned, alleviating a source of market volatility. Furthermore, better-than-expected economic data has been a driving force of the market’s repricing of rate cuts, reducing the likelihood of a hard-landing scenario.”

But are traders becoming too sanguine, as tends to be their wont at times of stock market ebullience?

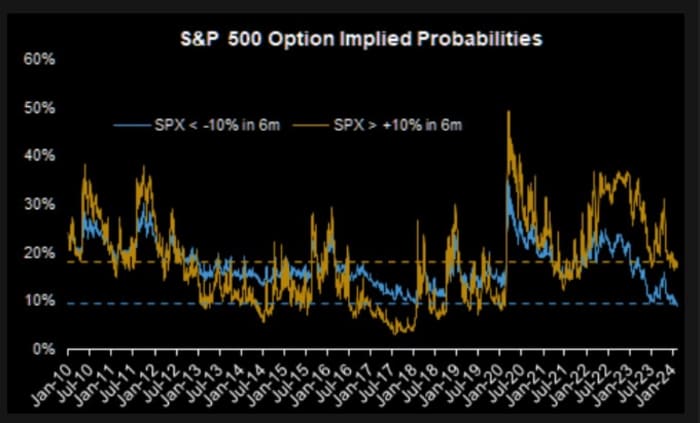

Consider the chart below, courtesy of the The Market Ear.com. It illustrates option-derived implied probabilities of the S&P 500 falling 10% or more over the next six months or rising by that measure over the same period. As the blue line shows , the implied probability of a big fall is just 9%, way below the average since the 2008 financial crisis of 17.5%. In essence, this can mean traders don’t think a slide is near and/or investors don’t feel they need to pay up to protect their portfolios.

This is part of a trend that sees traders selling volatility. And it’s worrying Sevens Report’s Tom Essaye.

An important reason why the S&P 500 dropped 1.4% on Tuesday, according to Essaye, was an an overcrowded short side of the options market, which exacerbated the selling.

The action, says Essaye, “was reminiscent of the 2018 ‘Volmageddon’ event that ultimately resulted in several ‘short-volatility’ ETF’s being forced to liquidate as volatility exploded higher amid a more than 10% drop in the S&P 500 in just two weeks.”

To recap, the short volatility trade became very popular after 2010 when a steadily rising stock market kept volatility low. Traders could regularly sell out of the money call options or CBOE VIX futures and watch the derivatives value decline into expiry.

Source: Sevens Report

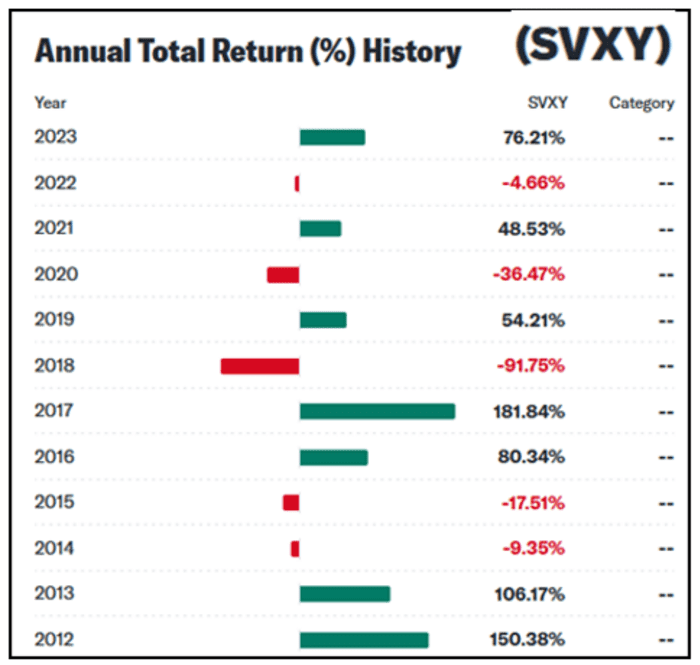

Demand for exchanged traded funds that exploited this strategy, such as ProShares Short VIX Short-Term Futures ETF

SVXY,

surged in the mid-2010s. As the table above shows, the SVXY jumped 80% in 2016 and 182% in 2017. But as noted above, a brisk fall for the stock market in 2018 caused a sharp short squeeze in low-volatility bets, at one point causing the CBOE VIX to jump 450% and leaving the SVXY nursing losses of 92% for that year.

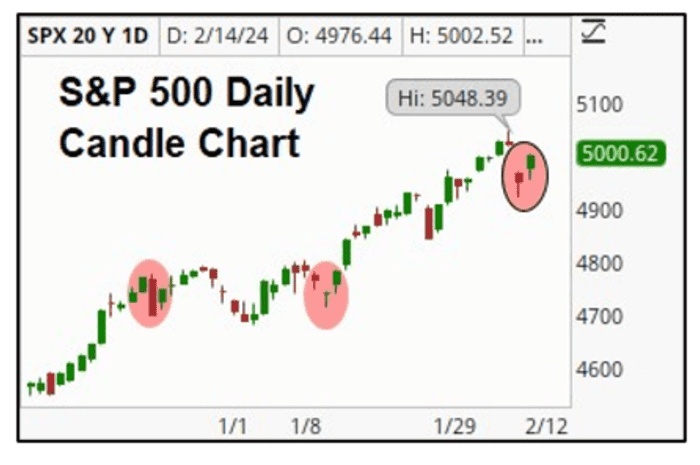

“Fast forward to late 2023 and early 2024 and we are once again seeing similar, volatile price action into certain derivatives expirations, namely the monthly VIX futures expirations,” says Essaye. The chart below shows the sharp gap-down sell-offs for the S&P 500 into each of the last three VIX expirations.

Source: Sevens Report

Essaye accepts that so far upticks in volatility have not been a big deal as the stock market sell-offs have been short lived, with losses quickly recovered.

“But based on the magnitude of the move in VIX futures on Tuesday, there is an increasing threat that the rising level of greed in the ‘short-volatility’ trade, similar to what we saw in 2018, could result in an air-pocket drawdown of 5% or more in the S&P 500,” he concludes.

Markets

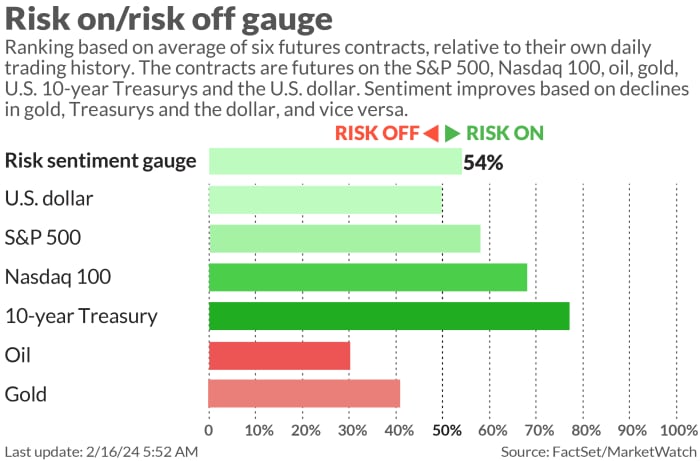

U.S. stock-index futures

ES00,

NQ00,

were higher early Friday as benchmark Treasury

BX:TMUBMUSD10Y

yields rose. The dollar

DXY

was a touch firmer, while oil prices

CL.1,

slipped and gold

GC00,

traded around $2,010 an ounce.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,029.73 | 0.64% | 5.20% | 5.45% | 22.96% |

| Nasdaq Composite | 15,906.17 | 0.71% | 5.65% | 5.96% | 34.16% |

| 10 year Treasury | 4.265 | 9.79 | 13.42 | 38.45 | 44.39 |

| Gold | 2,017.80 | -1.03% | -0.69% | -2.61% | 8.99% |

| Oil | 77.39 | 1.03% | 5.39% | 8.50% | 1.08% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

U.S. economic data due on Friday include January housing starts and building permits, alongside the January producer price index, all published at 8:30 a.m. Eastern. The preliminary February consumer sentiment survey will be released at 10 a.m.

Fed Vice Chair for Supervision Michael Barr will make comments at 9:10 a.m. and San Francisco Fed President Mary Daly is due to speak at 12:10 p.m.

Coinbase Global shares

COIN,

were up 14% in Friday’s premarket action because the crypto-trading platform made a profit in the fourth quarter.

An earnings beat and optimistic guidance pushed Applied Materials

AMAT,

stock up 12%. But shares in Roku

ROKU,

were down 15% after earnings that contained a cautious outlook.

U.S. markets will be closed on Monday for Presidents’ Day.

Best of the web

China revives socialist ideas to fix its real-estate crisis.

‘I tried out an Apple Vision Pro. It frightened me.’

S&P 500 chart is still bullish — even as stronger headwinds hit the market.

The chart

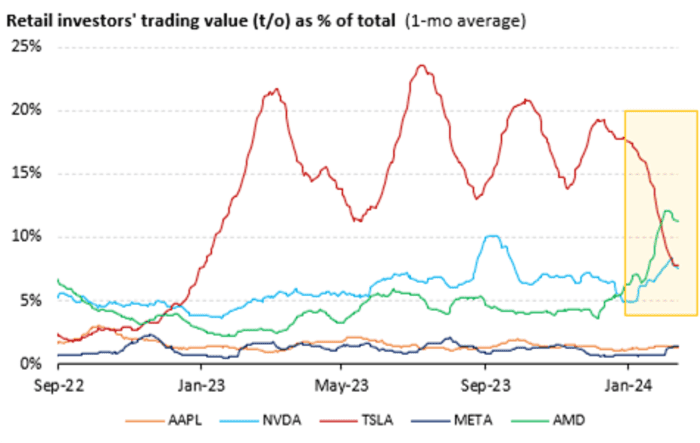

Retail investors appear to be falling out of love with Tesla

TSLA,

The chart below from Vanda Research shows retail trading of Tesla as a share of total traded value has declined to pre-2023 levels. Within the large-cap space, attention has turned to semiconductor plays, with activity in Nvidia

NVDA,

and Advanced Micro Devices

AMD,

surging.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

SMCI, |

Super Micro Computer |

|

COIN, |

Coinbase Global |

|

AAPL, |

Apple |

|

NIO, |

NIO ADR |

|

AMC, |

AMC Entertainment |

|

PLTR, |

Palantir Technologies |

|

ARM, |

Arm Holdings ADR |

|

AMZN, |

Amazon.com |

Random reads

Your AI girlfriend just wants your data.

The incredible rescue of Ralphie the cat.

Paul McCartney reunited with guitar stolen 51 years ago.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.