This post was originally published on this site

https://images.mktw.net/im-626343Goldman Sachs thinks the U.S. economy will be growing by more than double market consensus at the end of 2024, and has a list of 10 reasons that it’s more optimistic than most.

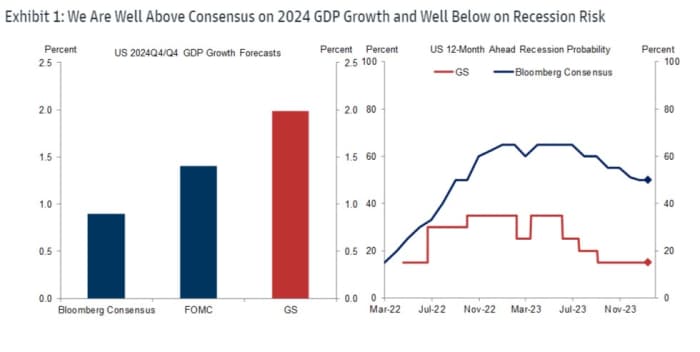

In a note published over the weekend, a Goldman economics team led by Jan Hatzius said it sees U.S. GDP expanding on an annualized basis by 2% in the fourth quarter of this year, compared with a consensus of about 0.9% in a Bloomberg poll of economists.

Goldman also sees a less than 20% probability of a U.S. recession in the next 12 months, while the Bloomberg consensus is at about 50%.

This prompts Goldman to ask this question: “What are other forecasters worried about that we aren’t?” To answer, it looked at 10 risks for 2024 that are often highlighted by other forecasters and explained why it’s less worried than others.

Source: Goldman Sachs

The first risk perceived by many is a consumer slowdown if spending proves unsustainable, the saving rate rises from a low level, or households run out of excess savings.

But Goldman says it expects 2% consumption growth this year because real wage growth will remain positive as nominal wages rise but inflation falls, all while a solid jobs market encourages spending and, contrary to expectations, the exhaustion of excess savings will not have the impact some fear.

“While spending by low-income households whose incomes were boosted most by pandemic stimulus initially rose above trend, it normalized a while ago,” says Goldman.

That links to the second concern of rising consumer delinquency and default rates. “[These] mostly reflect normalization from very low levels in recent years, higher interest rates, and riskier lending, not poor household finances,” the bank contends.

Next is the fear of a sharper deterioration in the labor market. Goldman thinks this is unlikely given that job openings are still running high and the rate of layoffs still slow.

“While a few recent data points have been weaker, more statistically reliable signals such as trend payroll growth and our composite job growth tracker remain strong,” say Hatzius and the team.

Some observers have expressed concerns about the narrow breadth of job growth, which of late has been dominated by healthcare, leisure and hospitality and government.

But Goldman says there are several reasons this is not such a problem, including that those three sectors are hardly modest in scale, accounting for 40% of employment, and a big reason they have attracted labor is that they were understaffed and raised relative pay to workers.

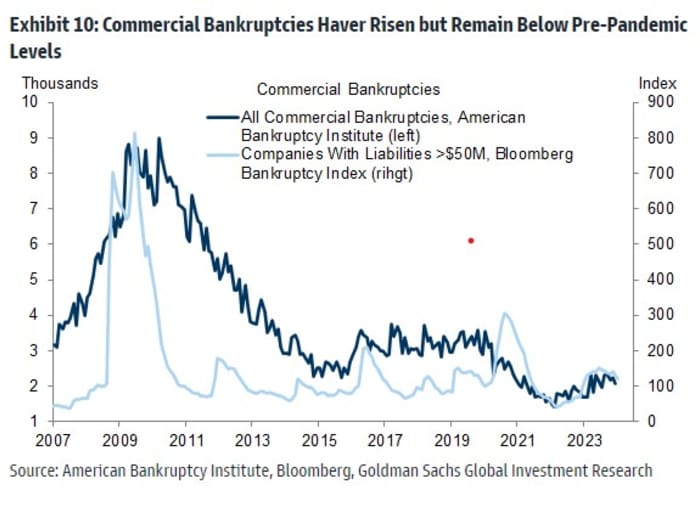

Fifth on the list is the prospect of rising corporate bankruptcies. Goldman contends that large and small companies are generally on “solid financial footing” and that the current number of bankruptcies is still well below the pre-pandemic level. “While large company bankruptcies are somewhat higher, they have only returned to their 2019 levels,” says Goldman.

Source: Goldman Sachs

One reason some observers fear corporate stress is the looming debt maturity wall as companies have to refinance at higher interest rates. Goldman thinks the impact will be modest, with higher corporate interest expense reducing capex growth by 0.1 percentage point in 2024 and 0.25 in 2025, and hiring by 5,000 jobs a month in 2024 and 10,000 jobs a month in 2025.

“The effect is small in part because the increase in interest expense should only be moderate and in part because increases in interest expense have only modest effects on capital investment and hiring,” says Goldman.

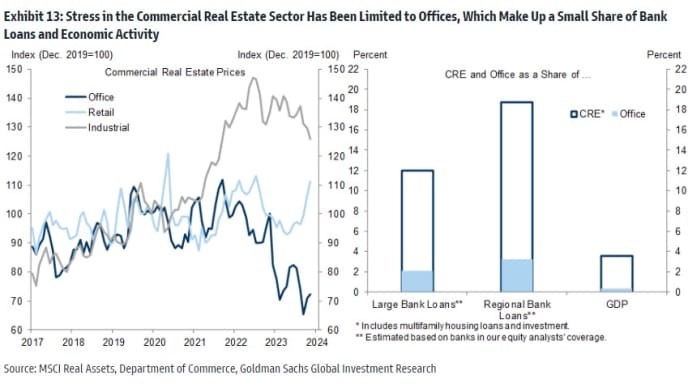

An area of severe concern is commercial real estate, as remote work leaves many office buildings half-empty and financially unviable. There are worries that some lenders will struggle to absorb the losses on their commercial real-estate portfolios.

But Goldman stresses that it is offices specifically and not commercial real estate broadly that face a big problem and that office loans account for only 2% or 3% of banks’ loan portfolios.

“As a result, banks should be able to manage the headwind from lower office values. Indeed, the Fed’s 2023 stress test found that the banks subject to these tests would have enough capital to weather even an extreme scenario where [commercial real estate] prices declined 40% and the unemployment rate rose to 10%,” Goldman says.

Source: Goldman Sachs

Other factors that Goldman thinks are not such a problem: something finally breaks, but peak pain from higher interest rates has already passed; fading fiscal support will not be the drag observers fear; a bank credit crunch, but small business have not reported a severe lack of access to credit.