This post was originally published on this site

https://images.mktw.net/im-26542704

“‘Not my problem.’”

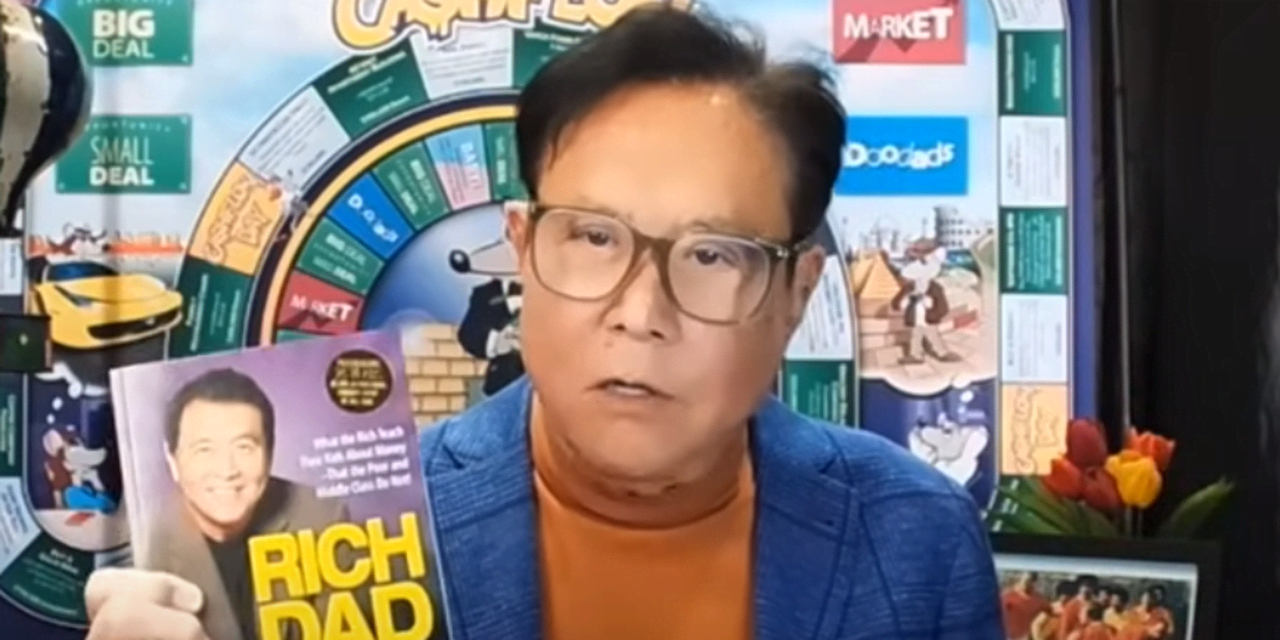

A best-selling personal-finance author and entrepreneur admits that he has more than $1 billion in debt — and doesn’t think that’s a bad thing.

“If I go bust, the bank goes bust,” said “Rich Dad, Poor Dad” author Robert Kiyosaki in a Nov. 30 Instagram reel. “Not my problem.”

That’s because his debt has been used to purchase assets, he said in the video. He compared that with using debt to purchase liabilities, such as his Ferrari or Rolls-Royce vehicles — expenses he’s paid off in full, he said.

“I’m a billion dollars in debt because debt is money,” Kiyosaki said during an interview on the “Disruptors” podcast. It connects to his strategy of using cash earnings to purchase precious metals like gold or silver, which Kiyosaki argues will retain their value while the U.S. dollar fluctuates. “Toilet paper,” he called it.

Kiyosaki is one of the country’s best-known personal-finance personalities. His 1997 book “Rich Dad, Poor Dad,” originally self-published, has sold more than 40 million copies.

Good debt, bad debt

In his books and public appearances, Kiyosaki has preached the value of “good debt” as opposed to “bad debt.”

So-called good debt, as his company’s website explains, is used to invest in assets like real estate or a business venture — expenditures that “put money in your pocket.”

On the other hand, “bad debt” is used to fund a liability — something that costs you money each month, like a car or a new TV.

“I was taught to use debt to get rich,” Kiyosaki said in an interview in August. “Most people use debt to get poor.”

Unique views on wealth

In “Rich Dad, Poor Dad,” Kiyosaki disputed the notion that a high income was the only path to wealth and instead vouched for the benefits of entrepreneurship, calculated risk taking and passive income earned from investments.

Kiyosaki has continued to espouse those financial views (and has explored extreme political perspectives, including adopting right-wing-media talking points in his call for the impeachment of President Joe Biden).

He’s told his followers that “cash is trash” and that he doesn’t trust the U.S. dollar, calling it “fake.” Instead, he’s recommended investing in assets like precious metals, bitcoin or Wagyu cattle.

He’s also issued several warnings of an upcoming market crisis over the last few years. In a separate podcast appearance last month, he mentioned that the United States was experiencing “the end of an empire” that could threaten the financial system.

Kiyosaki’s own empire has been the subject of controversy. His company, Rich Global LLC, filed for bankruptcy in 2012 following a legal dispute. He’s faced criticism that his seminars do not deliver on promises to help attendees build wealth, and some called for a boycott of his book after a 2020 tweet about Black Lives Matter.

Kiyosaki’s company did not immediately respond to a request for comment.