This post was originally published on this site

https://images.mktw.net/im-31544347U.S. stocks capped off a wild 2023 with a two-month sprint that has carried the Dow to record highs and the S&P 500 index to within a whisker of a similar milestone.

But after such a powerful advance, some portfolio managers and strategists are concerned that the market could suffer its own post-New Year’s Eve hangover once the calendar turns to January 2024.

Instead of providing a tailwind for the market, several who spoke with MarketWatch worried that the “January effect” might work in reverse as investors scramble to lock in gains after the S&P 500 rose 24% in 2023, according to FactSet data.

“Any time you have a big burst like that, I think you’re vulnerable to some profit-taking,” said James St. Aubin, chief investment strategist at Sierra Investment Management, during an interview with MarketWatch. “It wouldn’t surprise anybody to see the market cool off a bit after a strong run.”

From high valuations, to bullish sentiment indicators, to economic data, to geopolitics and beyond, here are a few things that could trip up the market in January.

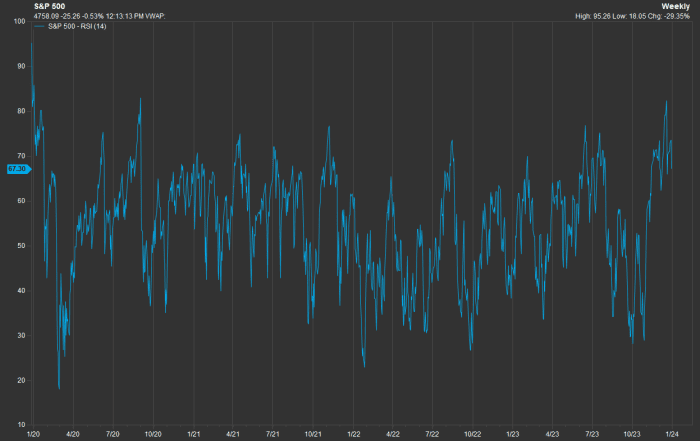

U.S. stocks are already overbought

A technical gauge that’s widely followed by Wall Street portfolio managers and technical analysts has been screaming that U.S. stocks are overbought for a month.

The 14-day relative strength index on the S&P 500, a momentum indicator that’s supposed to help put the magnitude of the index’s latest moves into context, climbed as high as 82.4 on Dec. 19, its highest since 2020, according to FactSet data.

FACTSET

Although the RSI has since pulled back, it continues to hover around 70, seen by analysts as the threshold for when something can be considered “overbought.”

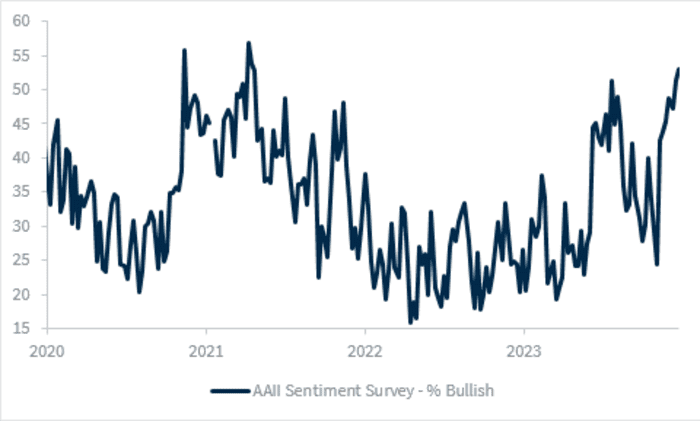

Sentiment has swung from extremely bearish to extremely bullish

In the span of just two months, investors have gone from incredibly bearish to incredibly bullish, according to the American Association of Individual Investors’ weekly sentiment survey.

That should give investors pause, since the gauge is seen as a reliable counter-indicator. When sentiment becomes stretched in either direction, it can signal that the market is about to turn. Investors say that is what happened back in July, and also in October after the S&P 500 touched its 2022 bear-market nadir.

RAYMOND JAMES

According to the AAII survey published ahead of the Christmas holiday, nearly 53% of respondents said they were bullish, the highest since April 2021. That number came down a bit this week, but it remains high relative to levels from October.

The VIX is extremely low

Wall Street’s favorite “fear gauge” is giving the all-clear. To some, that’s reason enough to worry.

The Cboe Volatility Index

VIX,

better known as the Vix, measures implied volatility, or how volatile traders’ expect the S&P 500 to be over the coming month based on trading activity in options contracts tied to the index.

In December, the Vix dropped below 12 for the first time since before the advent of the COVID-19 pandemic.

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, said in emailed commentary that she is keeping a close eye on the Vix. Once volatility starts to climb, investors should consider taking some chips off the table.

Progress on inflation could stall in January

Some investors are already anxious about the next U.S. inflation report, due Jan. 11.

The Cleveland Fed’s inflation nowcast has core CPI rising more than 0.3% in December. If this proves accurate, it would be the hottest inflation reading since May.

And even if core inflation comes in slightly cooler, stocks might not greet it with the same enthusiasm they have shown in the past.

“U.S. CPI for December will hopefully continue to show a disinflationary trend, although the question is: can we keep rallying on this same dynamic?” said Larry Adam, chief investment officer at Raymond James, in emailed comments.

Earnings season could disappoint

For three straight quarters beginning with the final three months of 2022, the largest U.S. companies saw their earnings shrink on a year-over-year basis.

This “earnings recession” finally came to an end in the third quarter, but the conundrum that investors now face is whether companies can manage to satisfy Wall Street’s lofty expectations for 2024.

The artificial-intelligence software boom and the fact that the U.S. economy avoided a recession in 2023 has helped boost analysts’ confidence about earnings, strategists said.

According to the bottom-up consensus estimate from FactSet, analysts expect S&P 500 aggregate earnings to increase by 11.7% for the calendar year 2024.

“Markets have been baking in this 11.7% earnings growth figure for a while now. That’s a lot of optimism,” Goldman said during an interview with MarketWatch.

And that’s not all…

To be sure, this list is hardly comprehensive.

Politics and geopolitics also came up a lot in discussions with analysts. Investing professionals cited Taiwan’s upcoming presidential election, another looming federal debt-ceiling showdown in the U.S., the beginning of the 2024 Republican presidential primaries, the ongoing conflicts in Gaza and Ukraine, and more as potential threats to market calm.

Some expressed concern that the Treasury could spark a selloff in bonds and stocks with its next quarterly refunding announcement in early 2024.

But in the view of Cetera’s Goldman, a dynamic that Wall Street traders call it “buy the rumor, sell the news” could represent a bigger threat.

The thinking works like this: investors have already front-run aggressive Federal Reserve interest rate cuts. So, if the Fed delivers, the rush to take profits could drive stocks lower instead of propelling the main U.S. indexes to new highs. Put another way, many strategists believe investors have already priced in pretty aggressive Fed rate cuts.

So unless the central bank finds a way to deliver something even greater than what Wall Street is expecting, the main U.S. equity indexes could struggle to continue their advance.

“Markets are already buying the rumor that we’re going to have a better 2024, that the Fed is going to cut rates, that breadth is going to widen,” Goldman said.

“Maybe we’re already seeing that priced in.”