This post was originally published on this site

Bonds issued by Paramount Global Inc. have seen significant spread tightening — and higher prices — in strong volume in recent weeks, amid reports that Chairwoman Shari Redstone is in talks on selling a controlling stake in the company.

Holders of the bonds could cash out handsomely if there’s a change of control and the credit is downgraded, thanks to a special provision in their terms.

The reports emerged last week when Deadline reported that media and entertainment group Skydance — which is run by David Ellison, son of Oracle Corp.

ORCL,

Founder Larry Ellison — and RedBird Capital were kicking the tires on National Amusements and Paramount

PARA,

National Amusements is the Norwood, Mass.-based exhibitor that owns 77% of Paramount’s Class A shares.

Then on Sunday, Puck and the New York Times said the talks had been going on for weeks. Skydance is one of Hollywood’s top independent studios, and has produced Paramount blockbusters such as “Mission: Impossible—Dead Reckoning” and “Top Gun: Maverick.” RedBird is a financial backer of Skydance.

A sale would be a major reversal for Redstone, the daughter of late Paramount CEO Sumner Redstone, who waged a bitter battle for control of the company in 2016, and who later led the effort to merge CBS Corp. and Viacom, which led to the creation of the current Paramount Global.

A deal could signal the start of a major shake-up across the media industry, as traditional TV companies are struggling to make money in the streaming age. Comcast Corp.

CMCSA,

which owns NBCUniversal, could be looking to expand, while Warner Bros. Discovery

WBD,

could be a potential seller. Disney

DIS,

CEO Bob Iger recently floated the idea of selling ABC, but quickly walked that back.

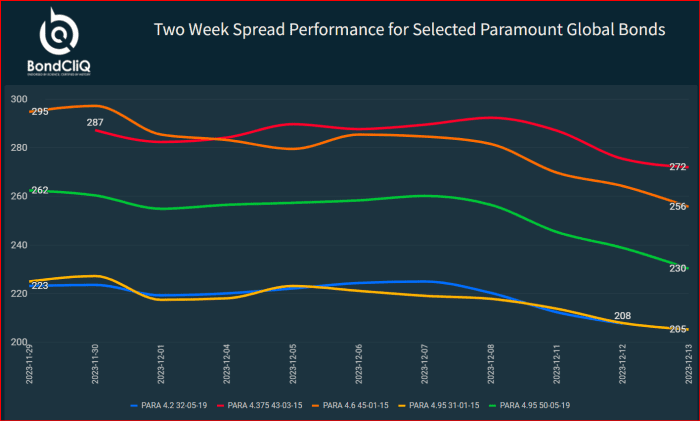

Paramount’s bond spreads have been tightening for the past two weeks, as the following chart from data solutions provider BondCliQ Media Services shows.

Paramount’s bond spreads trade wide of sector peers that include Charter Communications Inc.

CHTR,

Netflix Inc.

NFLX,

T-Mobile US Inc.

TMUS,

and Warner Bros, according to Bloomberg Intelligence. That’s despite the fact that the company has adequate liquidity, is past the stage of peak investment in streaming and is forecasting growth in Ebitda, or earnings before interest, taxes, depreciation and amortization, in 2024. Ebitda is often viewed as a measure of a company’s ability to cover interest payments.

Two-week spread performance for select Paramount global bonds.

BondCliQ Media Services

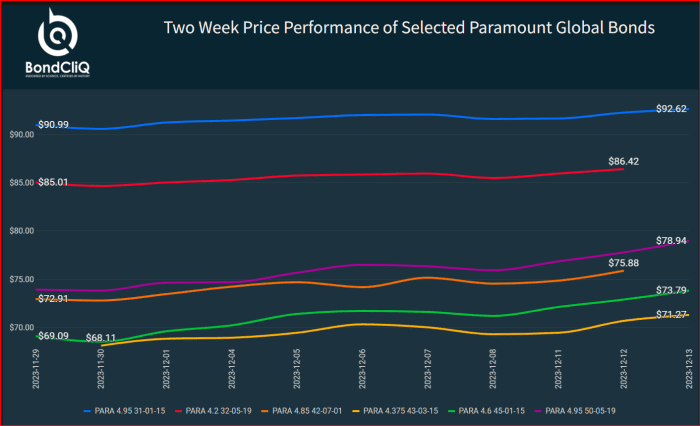

Prices of the bonds have climbed, although they remain below par. That’s because the recent rise in interest rates sent prices lower due to the inverse relationship between the two, and not because of any credit quality issues.

The bonds have a change-of-control provision that obliges the company to offer to repurchase them at 101 cents on the dollar if there is a change of control at the company and the credit is downgraded. The bonds are currently rated at Baa3/BBB-/BBB.

Two-week price performance of select Paramount Global bonds.

BondCliQ Media Services

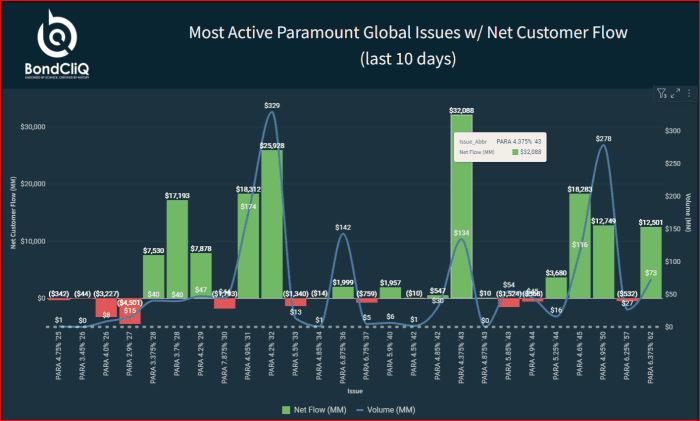

The bonds have seen net buying over the last two weeks, a trend that continued on Tuesday.

Most active Paramount Global issues with net customer flow (last 10 days).

BondCliQ Media Services

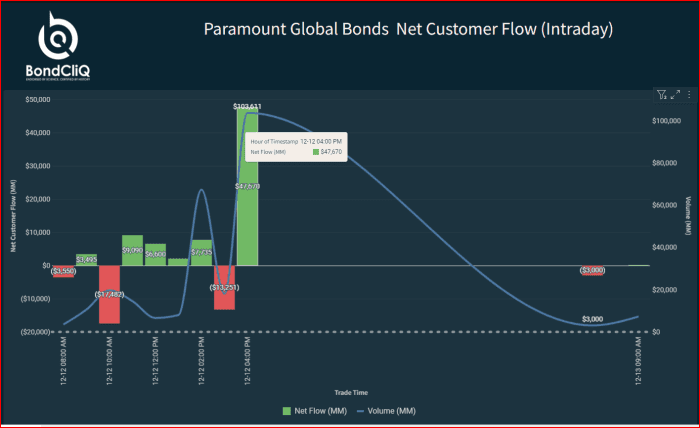

The buying spiked on Tuesday before becoming more subdued so far Wednesday.

Paramount Global bonds net customer flow (intraday).

BondCliQ Media Services

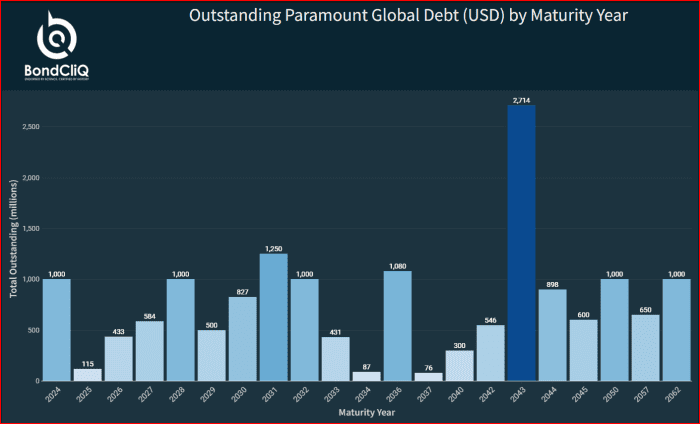

Paramount has about $16 billion of outstanding bonds with maturities that stretch out to 2062.

Outstanding Paramount Global debt (USD) by maturity year.

BondCliQ Media Services

Paramount’s stock, meanwhile, has struggled this year and is down 11%, underperforming the S&P 500

SPX,

which has gained 21%. The stock has gained 25% in the month to date.

Research company Lightshed Partners, which specializes in technology, media and telecoms companies, said Paramount has a bleak future ahead as it does not see any obvious strategic buyer who would purchase the entire company.

That’s assuming a transaction could attain regulatory clearance, which is not guaranteed in the current regulatory environment, not to mention what could happen if there’s an administration change, analysts Richard Greenfield, Brandon Ross and Mark Kelley wrote in commentary on Tuesday.

“While a strategic combination with one of Paramount’s peers would yield significant synergies, any legacy media company who buys more broadcast/cable network assets will suffer (especially if they acquire the declining assets using leverage),” they wrote.

Lightshed is skeptical that a tech platform would want broadcast and cable network assets, although the studio might appeal to one or more buyers.

“However, we would think the first move in such a scenario would be to shutdown Paramount+ and become an arms dealer,” said the analysts. “This would help juice studio free cash flow, unencumber the studio assets and make for a more viable remain Co.

“It seems odd to sell now with the studio making virtually no money and Paramount+ bleeding $1.7 billion,” they added.