This post was originally published on this site

Traders are expecting the Federal Reserve to get closer to 2% inflation next year, as measured by annual core and headline readings from the consumer-price index.

Derivatives-like instruments known as fixings are around levels which imply that core CPI will come in at a 2.6% annualized rate over the first 10 months of 2024, traders said. The fixings market matters because it has been more accurate than many in the financial market about the likeliest path of inflation, particularly during the 2021-2022 runup in price gains.

Fixings traders also expect annual headline inflation to fall back to the Fed’s 2% target by next October, after factoring in a flat path for energy prices because of uncertainty over which way they’ll go.

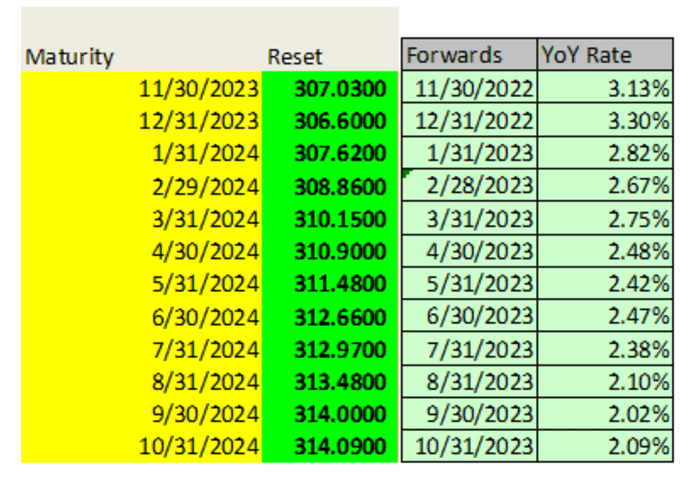

Market-implied expectations for the annual headline rate of CPI from fixings traders. The maturity column reflects the month and year that the CPI year-over-year projection is based upon. The forwards column reflects the year-earlier starting point for each YoY forecast.

Bloomberg

Fed policy makers generally base their 2% inflation target on the annual change in their preferred gauge, known as the personal consumption expenditures price index. But they have many other ways to measure price gains. They pay attention to headline CPI because of its ability to impact household expectations, and regard core rates as a better reflection of underlying trends.

As of Monday, fed funds futures traders were pricing in a 72.8% chance of three to five quarter-point rate cuts by December 2024. Fed officials release their next round of interest-rate projections on Wednesday, when they are also expected to take no action and keep borrowing costs between 5.25%-5.5%.

“The market appears to be expecting the Fed to still cut rates methodically,” perhaps as a risk-management strategy like 2019’s trio of preemptive rate cuts that were designed to keep the U.S. out of a recession, said Gang Hu, an inflation trader at New York hedge fund WinShore Capital Partners.

Given how many cuts are priced in and the uncertainty over the future path of inflation, Fed officials are “not going to show too much incentive to cut immediately,” Hu said via phone on Monday. “In fact, their chief concern now is probably to firmly control inflation expectations to avoid wage inflation spiral, so I think they are more likely to push back on rate-cut expectations and be behind the curve.”

Tuesday’s CPI data for November is expected to reflect a 0.3% monthly rise in core inflation versus the 0.2% gain seen in October, and to leave the annual core rate at an elevated 4%. Meanwhile, falling gas prices last month have been nudging headline inflation lower.

Read: Falling gasoline prices will help ease consumer inflation again in November

Also read: Gas prices may fall below $3 a gallon, a ‘nice surprise’ for holiday travelers

Treasury yields finished Monday’s New York session little changed as traders turned their attention to Tuesday’s November CPI report. Meanwhile, all three major U.S. stock indexes

DJIA

COMP

closed higher for a third straight session.