This post was originally published on this site

The House Judiciary Committee issued subpoenas Monday to Vanguard Group and Arjuna Capital for documents and communications related to its investigation into possible illegal collusion to deprive funding to fossil fuel companies.

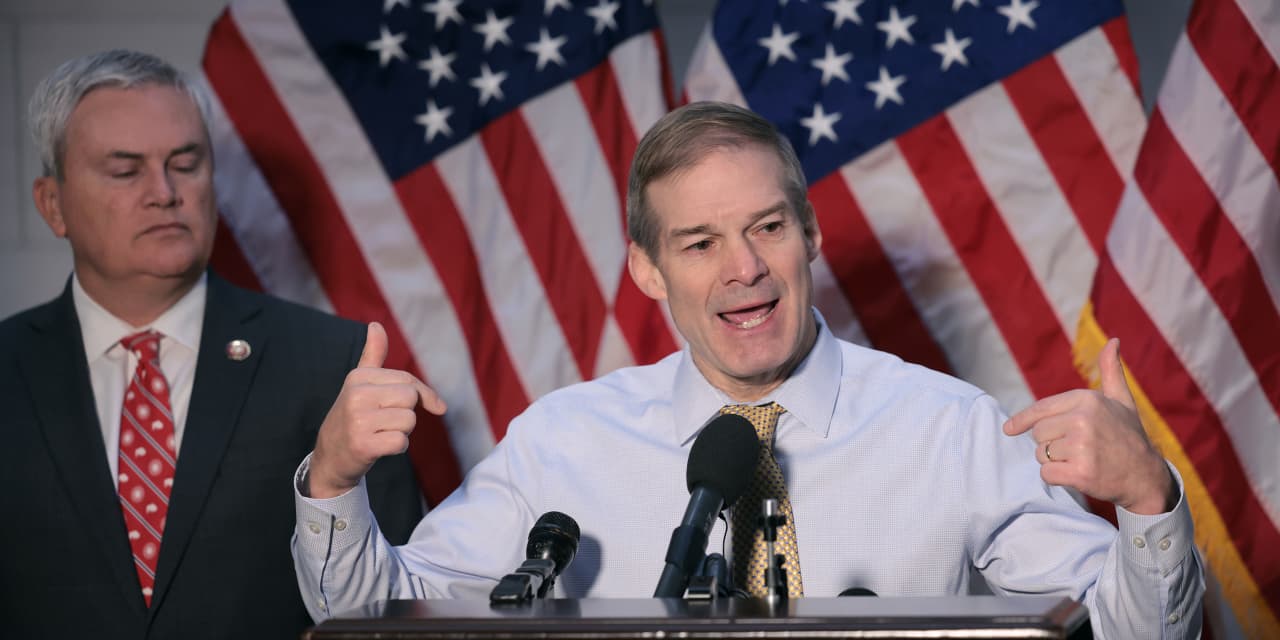

“Corporations are collectively adopting and imposing progressive environmental, social and governance-related goals, and the Vanguard Group appears to have entered into collusive agreements to decarbonize its assets….in ways that may violate U.S. antitrust law,” House Judiciary Committee Chairman Jim Jordan wrote in a subpoena cover letter to the company.

Jordan, an Ohio Republican, launched an investigation this year into Vanguard, BlackRock

BLK,

State Street

STT,

and other asset managers over concerns that their participation in the Net Zero Asset Managers Initiative violated U.S. competition law.

NZAM is an international group of asset managers committed to the goal of net-zero carbon emissions by 2050 or sooner and to limit global warming to 1.5 degrees Celsius.

Jordan initially sent an information request in July to Vanguard and other asset managers, and wrote in his Monday letter that Vanguard’s response so far has been “inadequate,” despite the company producing more than 3,600 documents.

He argued that participation in the decarbonization agreement could violate U.S. antitrust laws because it’s a coordinated activity that “prevents its victims from making free choices between market alternatives” and generally harms competition for the provision of energy products and services.

Last December, Vanguard announced that it was leaving NZAM because its association with the group created “confusion” about its attitudes toward climate risk and how those concerns impact its core business of managing index funds.

“Vanguard is committed to working constructively with lawmakers and has cooperated with the Committee’s requests, including producing tens of thousands of pages of relevant documents to date,” said Vanguard spokesman Netanel Spero, in an email. “As an independent asset manager owned by the investors in our funds, we remain focused on helping everyday investors achieve their long-term financial goals.”

A spokesperson for Arjuna Capital told MarketWatch that “we have responded to and intend to fully comply with the House Judiciary Committee’s request.”