This post was originally published on this site

It was the day before payrolls, when all through the house, not an asset was stirring, not even a mouse. (We will for poetic license ignore the movements in Japan; more on that later.)

| Date | Initially reported nonfarm payrolls (in thousands) | Economist expectations (in thousands) | S&P 500 reaction |

| 1/6/23 | 223 | 200 | 2.30% |

| 2/3/23 | 517 | 185 | -1% |

| 3/10/23 | 311 | 215 | -1.50% |

| 4/7/23 | 236 | 240 | 0.10% |

| 5/5/23 | 253 | 178 | 1.90% |

| 6/2/23 | 339 | 188 | 1.50% |

| 7/7/23 | 209 | 215 | -0.30% |

| 8/4/23 | 187 | 195 | -0.50% |

| 9/1/23 | 187 | 170 | 0.20% |

| 10/6/23 | 336 | 162 | 1.20% |

| 11/3/23 | 150 | 180 | 0.90% |

| Data: FactSet | |||

It’s worth reviewing how markets have reacted to jobs numbers this year. In the early part of the year, good news was bad news — blowout jobs growth spooked markets, fretful of more rate hikes. That hasn’t always been the case, though — particularly, as in the report released in October, when other sections of the report (average hourly earnings) were more bond friendly.

Economists polled by the Wall Street Journal expect a 190,000 rise in nonfarm payrolls — remember, there will be a boost from returning auto workers — an unchanged jobless rate of 3.9% and a 0.3% rise in average hourly earnings.

John Flood, a managing director at Goldman Sachs who works in its trading business, says there is a “new dynamic” in that the market will dislike extreme results in either direction.

A rise of more than 250,000 would lead to a sell-off in the S&P 500

SPX

of at least 0.5%, but so will a gain of fewer than 50,000, he said. The sweet spot would be a rise between 50,000 and 150,000, he says, which would trigger a gain of at least 1%.

That said, there is always the possibility some other element of the jobs report could take the spotlight. It’s “worth noting our best macro people think the unemployment rate is most important slice of Friday’s report.”

The unemployment rate has already risen a half-point from its low. Note that the Sahm Rule recession indicator is when the three-month average of the unemployment rate is at least a half point above its three-month minimum over the last 12 months, and the latest reading is 0.33%.

It would take a particularly large jump in the jobless rate, to 4.3%, to trigger the Sahm Rule with Friday’s report, though it seems like the recession indicator will be triggered early next year.

The market

Japanese stocks

JP:NIK

fell and the yen

USDJPY,

rose Thursday after comments from Bank of Japan officials helped stir expectations the country could exit its decades-long negative interest-rate policy as early as next week. Apart from that, stock futures

ES00,

NQ00,

inched higher, oil

CL.1,

was right around $70, and the 10-year

BX:TMUBMUSD10Y

was 4.15%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Alphabet’s

GOOGL,

Google launched Gemini, a new artificial intelligence model that will be incorporated into its Bard chatbot and its Pixel 8 Pro smartphone.

Advanced Micro Devices

AMD,

rolled out new chips for AI usage, in what may be the first challenge to Nvidia

NVDA,

AbbVie

ABBV,

said it’s going to buy Cerevel Therapeutics

CERE,

in an $8.7 billion deal.

GameStop

GME,

missed revenue expectations in the third quarter, as the videogame retailer said it would be able to invest in stocks, managed by new Chairman and CEO Ryan Cohen.

JetBlue Airways

JBLU,

shares rose after the airline boosted its outlook.

McDonald’s

MCD,

CosMc’s spinoff launches this month.

Initial jobless claims rose by 1,000 to 220,000. Consumer credit data will be released later in the day.

Best of the web

A leaked memo shows Amazon’s plans to advance its California interests.

UFC owners paid themselves hundreds of millions every year.

Crypto exchange co-founder pleads guilty to U.S. charge and will dissolve exchange

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

AMD, |

Advanced Micro Devices |

|

PLTR, |

Palantir Technologies |

|

AMZN, |

Amazon.com |

|

MLGO, |

MicroAlgo |

The chart

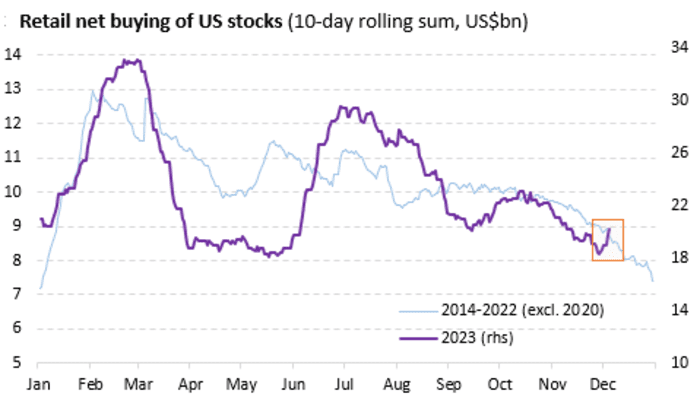

Vanda Research

Retail investors are buying stocks — which is unusual for this time of year, according to analysts at Vanda Research. That “has helped smaller cap names outperform big tech, especially those stocks tied to the crypto and the software/AI space,” say the analysts, who identify Marathon Digital

MARA,

Riot Platforms

RIOT,

and Coinbase Global

COIN,

among the crypto names being purchased, alongside other companies including PDD Holdings

PDD,

Workday

WDAY,

and Snowflake

SNOW,

Random reads

Brenda Lee may not see much money from her No. 1 hit, “Rockin’ Around the Christmas Tree.”

“Purrson of the year” — Taylor Swift’s cat steals the limelight.

A woman was sentenced to work at a fast-food restaurant after hurling a burrito bowl at an employee’s face.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.