This post was originally published on this site

Early Friday futures suggest stocks will start December on a cautious note. The last month of the year tends to be positive for Wall Street, though it will be some feat if it can beat November’s 8.9% jump for the S&P 500

SPX.

Equity investors have reveled in the sight of U.S. benchmark bond yields

BX:TMUBMUSD10Y

dropping from more than 5% in October to roughly 4.3% amid hopes cooling inflation means the Federal Reserve will start cutting interest rates by the spring of next year.

Indeed the 53 basis-point fall in 10-year borrowing costs in November was the biggest monthly decline in more than four years, according to Dow Jones Market Data.

So, great for shareholders, but that does mean yield seekers are not getting anywhere near the bang for their buck enjoyed just several weeks ago?

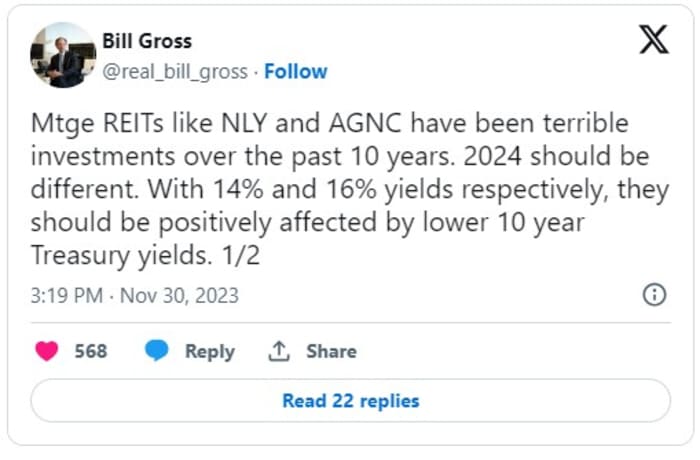

Fear not, Bill Gross, the billionaire investor and Pimco co-founder, has the answer. He’s spied some opportunities lurking in a more esoteric corner of the market: mortgage REITS.

First, a quick explanation. Real estate investment trusts (REITS) are securities that own and often operate real estate or real-estate related assets. Buying REITS allows private investors to participate in the sector without having to go down the capital intensive and legally complicated route of purchasing property or buying property-related financial assets themselves.

Many investors are familiar with equity REITS, which just own and operate property. Less well known are mortgage REITS, which invest in mortgages and related financial assets such as mortgage-backed securities, or MBS.

A particularly attractive aspect of REITS for those investors keen on yield is that they must pay out 90% of taxable income to shareholders. This makes for some juicy dividends, and it’s partly what’s got yield-focused Gross excited.

In a message on X, Gross highlighted two mortgage REITS, Annaly Capital Management

NLY,

and AGNC Investment

AGNC,

that should benefit from falling benchmark bond yields.

Gross does warn that because the stocks have been poor performers in 2023, with Annaly down 14.3% and AGNC off 14.8%, they may attract some tax-loss selling pressure into the end of the year.

But he adds: “[P]rices in 2024 could go up by 10% along with mid-teen yields. Mtge. REITs get a mildly favorable tax break as well.”

Now, most investors know that yields in the mid-teens are usually a result of the market pushing down the share price because it is worried about a company’s prospects.

And as the chart below shows, the mortgage REIT sector as a whole, as represented by the iShares Mortgage Real Estate ETF

REM,

has had a rough time over the last two years, during which the Fed hiked interest rates by more than 5%.

The Fed’s rate increases not only made mortgage REITS relatively less attractive by pushing up the so called risk-free rate available from Treasurys, but it also hurt the property sector, particularly commercial property, increasing the chances of loan defaults. The prospect of the Fed selling its MBS holdings as it reduces its balance sheet have also weighed on sentiment.

Importantly, though, Gross is not alone in spotting value among the mortgage REITS. In a note from mid September, UBS upgraded Annaly and AGNC from neutral to buy.

“With the Fed’s exit from the MBS market priced in, spreads historically wide, and significant book value damage already in the books, we see the sector set up for period of robust and sustainable total returns,” the Swiss bank said.

Markets

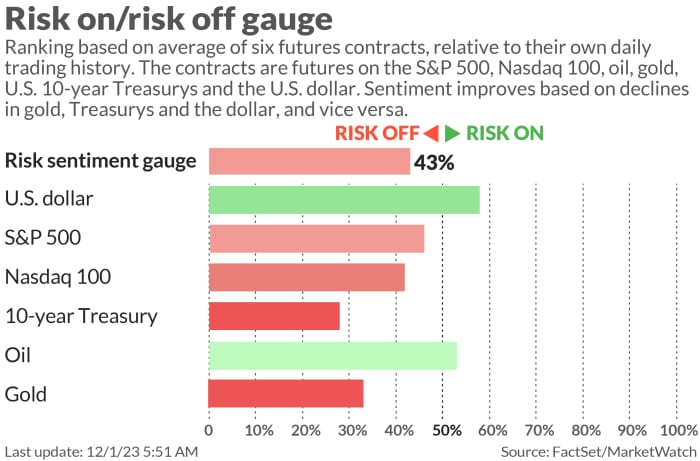

U.S. stock-index futures

ES00,

NQ00,

are softer as benchmark Treasury yields

BX:TMUBMUSD10Y

move off session lows. The dollar

DXY

is little changed, while oil prices

CL.1,

rise and gold

GC00,

holds near $2,040 an ounce.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Fed Chairman Jerome Powell is due to make a speech at Spelman College in Atlanta at 11 a.m. Eastern and then take part in a discussion alongside Fed Governor Lisa Cook at 2 p.m. Traders will be keen to see whether Powell pushes back against the market’s expectations for rate cuts by the spring of 2024.

Other Fed officials making comments on Friday include Austan Goolsbee, Chicago Fed President, talking at 10 a.m.

U.S. economic data due on Friday include the S&P Global manufacturing purchasing managers index for November at 9:45 a.m., and the ISM manufacturing report for November alongside October construction spending at 10 a.m.

Shares in Ulta Beauty

ULTA,

are bouncing nearly 12% in premarket trading after the retailer posted better-than-expected sales in the third quarter and raised the lower end of its sales and profit outlook for the year.

Shares of Dell Technologies

DELL,

and Marvell Technology

MRVL,

are down nearly 5% and just over 5%, respectively, after the two delivered poorly-received results after Thursday’s market close.

Best of the web

Inside the operation to bring down Truth Social.

Oil’s wild ride is driven by a disruptive band of bot traders.

How Huawei surprised the U.S. with a cutting-edge chip made in China.

The chart

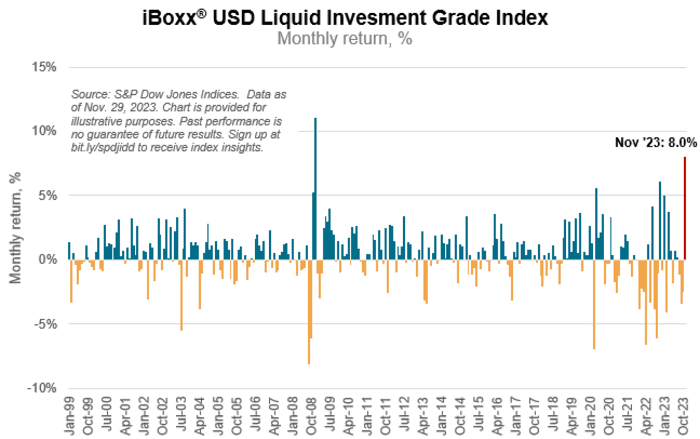

It’s not just equities that last month enthusiastically welcomed the slide in interest rates. The chart below from Benedek Vörös, director of index investment strategy at S&P Dow Jones Indices, shows that the performance of investment grade bonds in November was, in his words, “nothing short of historic.”

By midweek, the iBoxx USD Liquid Investment Grade Index was up 8% month-to-date, and on track for its best monthly return since December 2008, and the second best since its start date in December 1998, Vörös notes.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

RDHL, |

RedHill Biopharma ADR |

|

NIO, |

NIO ADR |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

GGE, |

Grand Gulf Energy |

|

PLTR, |

Palantir |

Random reads

Making simple things even better: folding coat hangers.

Yes, the Great British Baking Show has a fantasy league.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.