This post was originally published on this site

IBM Corp.

IBM,

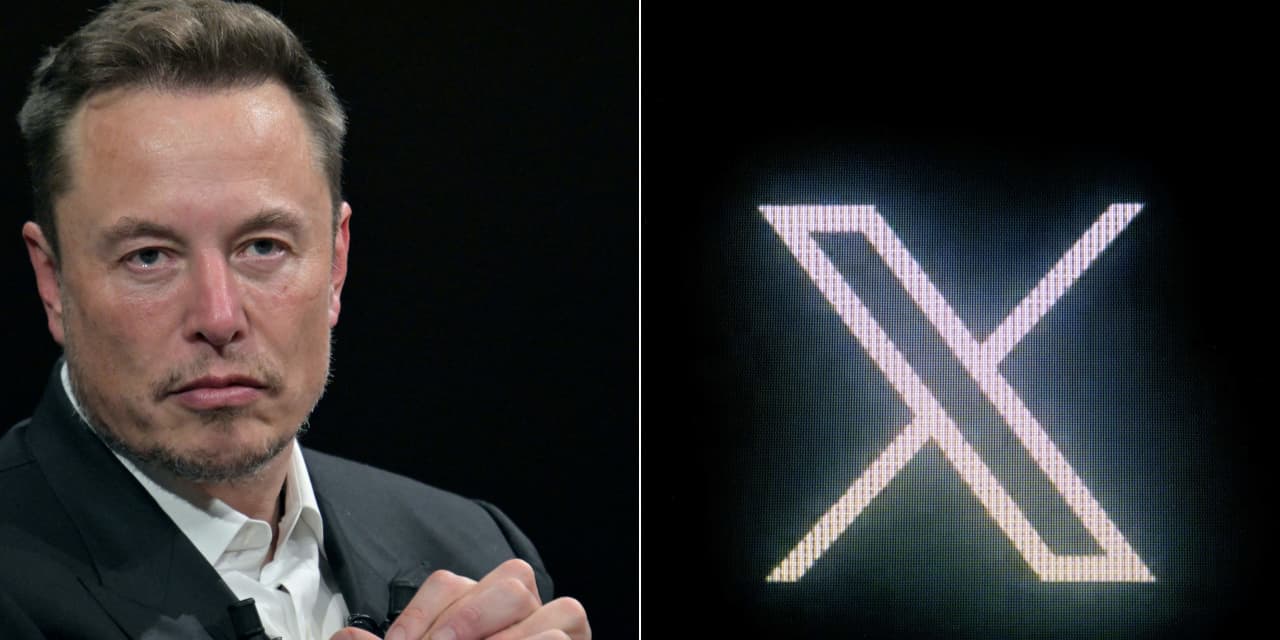

has abruptly pulled ads from X, formerly Twitter, amid a maelstrom of controversial comments from billionaire owner Elon Musk and the placement of IBM ads.

“IBM has zero tolerance for hate speech and discrimination and we have immediately suspended all advertising on X while we investigate this entirely unacceptable situation,” the company said in a statement emailed to MarketWatch.

IBM suspended advertising following a report by the Financial Times on Thursday that IBM ads appeared next to posts supporting Adolf Hitler and the Nazi Party. A Media Matters study also found ads from Apple Inc.

AAPL,

Oracle Corp.

ORCL,

and Comcast Corp.’s

CMCSA,

Xfinity and Bravo were adjacent to pro-Nazi content.

On Wednesday, Musk agreed with a post on X supportive of an antisemitic conspiracy theory that Jewish people hold a “dialectical hatred” of white people. “You have said the actual truth,” Musk wrote in response to the post.

Compounding matters, Musk on Thursday said on X it was “super messed up” that white people are not, in the words of one far-right user’s tweet, “allowed to be proud of their race.”

Adding fuel to the fire, Musk said on Wednesday that the Jewish advocacy group the Anti-Defamation League “unjustly attacks the majority of the West, despite the majority of the West supporting the Jewish people and Israel.” (Musk has threatened to sue the ADL because of its criticism of lax moderation practices on X that it says have allowed antisemitism to spread.)

The cascading conflagration prompted Tesla Inc.

TSLA,

bull and investment adviser Ross Gerber to grumble on X: “Getting a flood of messages from clients wanting out of tesla and anything to do with Elon Musk. Many saying they are selling their cars as well. What is he doing to the tesla brand??!!?!?”

Earlier this year, Gerber backed down from his “friendly activist” efforts to join Tesla’s board, saying he felt his concerns had been addressed. His firm, Gerber Kawasaki Wealth and Investment Management, has its own ETF, AdvisorShares Gerber Kawasaki

GK,

which has Tesla as its top investment, and has attracted many clients with Tesla shares in its portfolios

In an interview on CNBC late Thursday, Gerber said that while he is not selling his Tesla stock, ” I’m not going to mince words about it anymore as a shareholder. It’s absolutely outrageous, his behavior and the damage he’s caused to the brand.”

Gerber said Musk has essentially abdicated his responsibilities as Tesla CEO: “It’s all about Twitter, and what he can tweet, and how many people he can piss off… What’s going to happen to Tesla over the next 10 years, are they gonna achieve their mission if the CEO isn’t actually the CEO? Because he’s certainly not acting as the CEO of Tesla.”

An X executive told MarketWatch that the company did a “sweep” of the accounts next to the IBM ads. Those accounts “will no longer be monetizable” and specific posts will be labeled “Sensitive Media.”

The executive said 99% of measured ad placements on X this year have appeared adjacent to content scoring “above the brand safety floor” criteria set by industry standards.

Late Thursday, X’s chief executive, Linda Yaccarino, tweeted: “X’s point of view has always been very clear that discrimination by everyone should STOP across the board — I think that’s something we can and should all agree on. When it comes to this platform — X has also been extremely clear about our efforts to combat antisemitism and discrimination. There’s no place for it anywhere in the world — it’s ugly and wrong. Full stop.”

The posts and ad placement come amid a wave of antisemitism on digital forums including X and a downturn in advertising on the platform linked to hate speech and misinformation. Musk said in July that ad revenue had plunged about 50%.

The latest kerfuffle is likely to complicate the efforts of Yaccarino, who was hired in June from Comcast Corp.’s

CMCSA,

NBCUniversal to sway advertising agencies and major brands to stay on, or initiate relationships with, the platform now known as X.

Tesla shares fell nearly 4% on Thursday but are still up about 90% to date in 2023.