This post was originally published on this site

Ask any financial planner or Wall Street type and they’ll tell you U.S. Treasury bonds are the “safest” asset you can own.

In the halls of the financial establishment, the yield, or interest rate, on 10-year Treasurys is defined, literally as well as figuratively, as the “risk-free rate” of return.

The only real question at this point for anyone with eyes in the front of their head is: Why?

U.S. Treasury bonds haven’t just stunk for a year or two.

Few will tell you this, but they’ve actually stunk for nearly two generations. Even after the epic collapse of the past few years, they still don’t look great.

This is especially worrying for retirees, because in most cases, bonds underpin their entire portfolio. Treasury bonds, municipal bonds, investment-grade corporate bonds and high-yield bonds. They’re all pretty much in the same bag.

Consider some grim numbers: An investment in 10-year U.S. Treasury notes

BX: TMUBMUSD10Y

has lost a third of its value, in real, inflation-adjusted terms, in just over three years. Investments in long-term Treasurys have lost about half their value. They have fallen as much as U.S. stocks did during the global financial crisis.

10-year Treasury bonds have been a worse investment than gold bullion this year, last year, the year before that, and all the way back to 2018.

And this isn’t just a short-term phenomenon. Ten-year Treasurys have failed to keep up with inflation since the spring of 2008, before the collapse of Lehman Brothers. They have effectively made you no money, after inflation, since 2003: Not one lost decade but two, back to back.

This is before taxes on the interest payments.

Ten-year Treasury notes have now proved a worse investment than plain gold bullion going all the way back to the time of the first Gulf War, in 1990. Seriously. Based on New York University data, if you’d invested $10,000 in 10-year Treasurys at the start of 1990, you’d have just over $20,000 today (measured in constant dollars, meaning after adjusting for inflation).

The figure for gold bullion over the same period: $23,000. That’s about 15% more.

Incidentally, most of the people telling you U.S. Treasury bonds are “safe” have also been saying that gold is a speculative, risky asset. Many of them were also telling you to expect 5% a year from Treasury bonds, “in line with historical averages,” even when those bonds had yields of just 2% or less.

Typically, after such a long, dismal period of underperformance, you’d figure an investment is probably looking like cheap and a decent buy. But is it?

In the short term, quite possibly. Treasurys may prove an excellent trade over the next six months or year, especially if the U.S. economy goes into a recession.

But as a long-term investment?

Even after all this disastrous performance, to buy a 10-year Treasury bond today is to make a bet, explicitly, that inflation will crater any day now and then stay low. Based on the so-called “break-evens,” which compare the returns on regular Treasury bonds and inflation-protected Treasury bonds, anyone buying regular 10-year Treasurys is assuming that inflation will average 2.3% over the next decade.

Good luck with that.

Anyone betting on that should redirect their attention from the Federal Reserve, which has been monopolizing the bond market’s attention for years, to the unfunny “Duck Soup” reboot we call the modern U.S. political system.

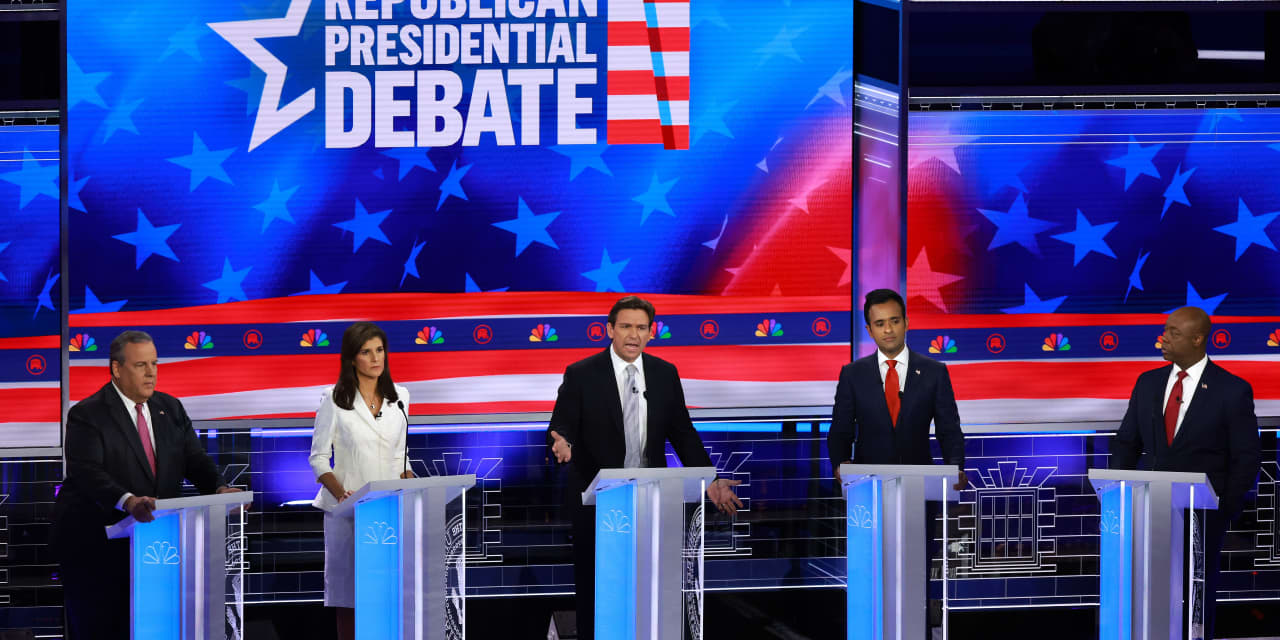

The Republican presidential candidates who bothered to turn up to the latest debate all promised to magic up miracle economic growth and painless, invisible cost savings to bring the skyrocketing deficits into line without raising taxes or making anyone in the middle class suffer.

Meanwhile, even though Social Security already has a funding hole in its accounts equal to the size of U.S. gross domestic product, Democrats have been lining up to propose ways of raising benefits still further.

Chicago-based money manager Josh Strauss puts it well. “On the one side you’ve got the Democrats, who want to tax and spend, and on the other side you’ve got the Republicans, who want to untax and spend. The U.S. citizen has gotten totally used to a government that spends a lot of money, and they think it could do it with less taxes.”

In the U.K. they have a term for this: “cakeism,” meaning a political program based on having your cake and eating it. Lower taxes? Higher spending? Why choose one when you can have both! Britain is no better run than the U.S. is, but at least they have the sense to call b.s. on their political class. Here in the U.S., someone can lay out an entire political program based on cakeism, and the audience just claps.

The results are plain for all to see. The federal government is currently running a bigger budget deficit, in relation to the economy, than Franklin Roosevelt ran at the depths of the Great Depression: 5.9% of GDP today, compared with 5.8% in 1934.

This during a period when unemployment is at historic lows, businesses can’t find staff and the Fed is desperately trying to slow growth to tame inflation. And yet in this environment, we apparently need massive budget deficits. More cake all around.

In its most recent report, the Congressional Budget Office predicted that these deficits would shrink to … er … 5% of GDP by 2027, and then rise again, every year, to 6.4% by 2033, and to over 8% by 2043, “reaching 10.0 percent of GDP in 2053.”

This, incidentally, is based on the assumption that the 2017 Trump tax cuts will all expire in 2026. How likely is that?

Federal budgets are not a sea of red ink but an ocean, stretching as far as the eye can see. The official national debt is already 98% of annual GDP, according to the CBO’s most recent figures. By 2029 it is expected to hit a new record high of 107%, surpassing the total level needed by previous generations to defeat, in quick succession, the Great Depression, Mussolini, Hitler and Hirohito. By 2053 it is scheduled to hit 180% of GDP.

The U.S. Treasury Department, in a report published earlier this year, said projected U.S. federal deficits for the next 75 years have a present value of $80 trillion in today’s money. That’s nearing 400% of GDP.

Nothing to see here, folks. Move along.

Oh, and that’s not even including interest costs.

Strauss and his fellow managers of the Appleseed Mutual Fund recently commented on this in their annual letter to investors. They noted that the volatility of the U.S. bond market has tripled in the last two years.

The reason? U.S. deficits. “It seems to us that colossal federal deficits are pressuring investors’ ability and/or willingness to absorb the enormous and increasing Treasury bond issuances that are taking place,” they wrote.

Foreigners, particularly the governments of China and Japan, are no longer buying as they once did. The Fed, another former buyer, is now selling vast amounts of Treasurys. Meanwhile the federal government is on a “borrowing bender,” Strauss and his fellow managers wrote, “raising $1.7 trillion in 2023 [to date], up a whopping 80% vs. 2022.”

Meanwhile, they added, the federal government — almost alone of major borrowers — failed to take full advantage of the low interest rates created by the pandemic by refinancing all its debts at long-term rates. As a result, the managers at Appleseed wrote, “nearly 29% of federal debt maturing in the next year will need to be refinanced from a near-zero cost to an interest-rate cost of 4.8%-5.6%, depending on the duration of bonds auctioned.”

In 2022, just 8% of federal spending went toward interest on the national debt. This year it will be 14% — more than is spent on the Department of Defense or on Medicaid. At the current trajectory, they calculate, within 30 years it will be nearly 40%.

When I spoke to Strauss, he doubled down on an assumption that is hard to fault. Given where our entire political system is today, there is really only one way out of this conundrum.

Inflation.

“No one’s going to cut the military. We’re fighting two wars,” he says. “We’re not going to cut Social Security and Medicare, as [politicians] want to get re-elected. What’s going to happen is — the only option is inflation.”

While Fed Chair Jerome Powell wants lower inflation, the rest of the establishment wants more of it. They need it. Inflation is the only way to square the circle. It reduces the actual value of the U.S. national debt in real, purchasing-power terms.

It’s no coincidence that one of the ways people in Washington want to cut Social Security benefits while pretending not to is by messing around with the inflation calculations. Your benefits will go up each year, but prices will go up even more.

In the last two years, the national debt has gone up 15% as measured in plain U.S. dollars. But during the same period, those dollars have lost about 15% of their purchasing power.

There’s no magic involved. That circle only gets squared because somebody loses. That somebody: Investors in U.S. Treasury bonds.

As we’ve seen.

And corporate bonds face a similar challenge. BAA-rated corporate bonds currently offer an interest rate that is less than 2% a year greater than the rate on 10-year Treasurys. By historic standards, that’s a low spread. If you think 10-year Treasurys are a poor deal, the same goes for corporate bonds. Maybe more so, because if we get a recession or a financial crisis, they are likely to get hammered, as happened in 2008 and 2020.

Where does this leave investors? Even though Powell is promising to do whatever it takes to squash inflation, the rest of the establishment needs it. You have to figure there’s a good chance they will get what they want — with the tacit connivance of the voters, who want to have their cake and eat it, too.

As in the inflationary 1970s, energy stocks may do well. Agricultural and mining stocks may do well. Real estate may do well. Gold may do well. Inflation-protected bonds may do well. Stocks may do well, especially in companies with strong pricing power. If this scenario comes to pass, the one asset likely to do very badly would be long-term Treasury bonds.

Something worth trading for a rally? Sure. But something that is “safe” and “risk-free?” Not a chance.