This post was originally published on this site

When it comes to managing your taxes, where you fall in one of the seven progressive tax brackets is the key to understanding how much you’re going to end up paying when you file your return.

The Internal Revenue Service announced new inflation-adjusted brackets for 2024 on tax rates that go from 10% to 37%. The dollar amounts of income separating the bands run from as little as $11,600 to more than $365,000, for those filing single, with similar ratios for those married filing jointly.

You can pay no attention to this at all, and just let your tax preparer or software figure out the math for you. Or you can delve into the details and potentially reduce the amount you owe.

A progressive tax system means you don’t pay the top rate on your whole income. Instead, you pay the rates for each band in a row as you go up the income ladder. If your taxable income as a single filer is $11,600 in 2024, you’ll pay 10% on the entire amount. Anything above that, and you pay the 10% tax on that first chunk, and then add each additional band on top of it.

Next year, for instance, if you have taxable income of more than $609,350, that puts you in the 37% bracket. You’ll pay $183,647.25 — the stacked combination of the 10%, 12%, 22%, 24%, 32% and 35% brackets — plus 37% of the excess over $609,350.

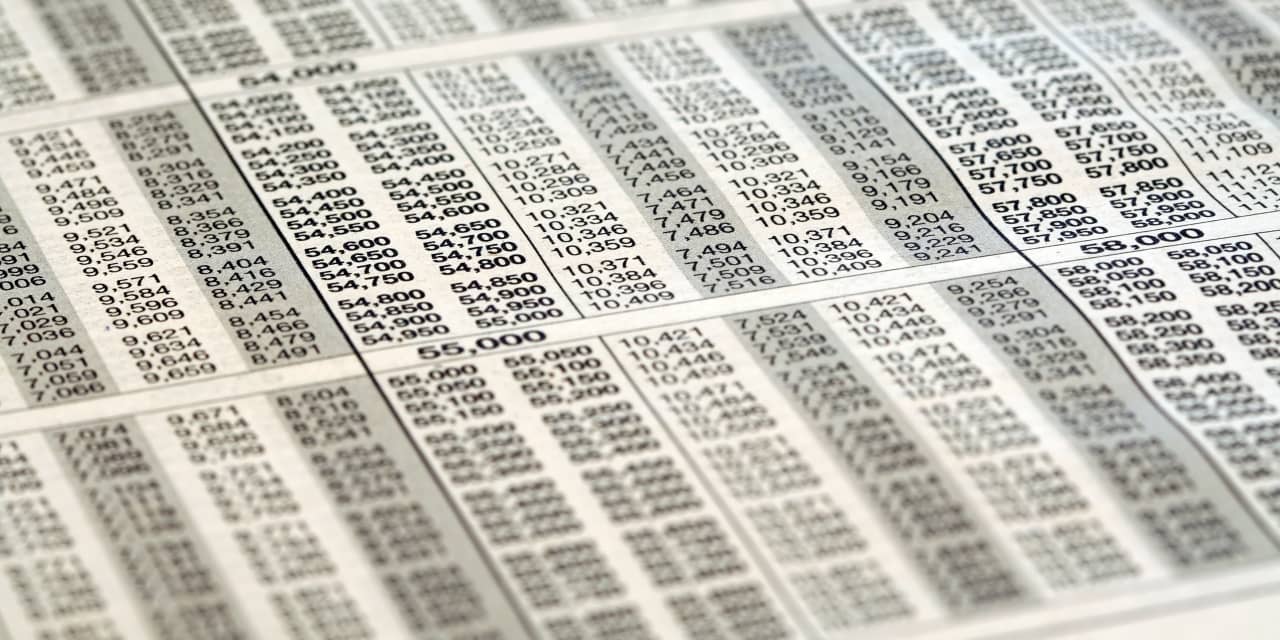

To figure out where you fall on the spectrum, you just need to estimate your 2024 taxable income or extrapolate from your previous tax returns. You can see the full tax-bracket charts here.

This may seem like just a curiosity for those with straightforward income, but you’ll need to pay close attention if you’re planning any atypical financial moves, such as a retirement, a conversion from a 401(k) to a Roth IRA or the sale of a business or significant piece of property.

“Everyone seems to care about tax brackets,” says Sri Reddy, the senior vice president of retirement and income solutions at Principal Financial Group. “But I wouldn’t tell you to worry about it. You should make as much money as you want, because you get to keep some portion of it. I’d just rather have you have an awareness of what it might mean to you.”

Here’s where tax-bracket management matters most:

Retirement savings

You can know your tax bracket now, but you don’t know what it will be in the future. Your retirement savings are stuck in the middle.

Should you pay tax on your retirement savings now and save in a Roth IRA or Roth 401(k), so the growth is tax-free after you’re 59½? Or should you save in tax-deferred accounts and pay tax down the road when you spend the money — or are forced to withdraw it yearly for required minimum distributions? And if you do this, at some point do you want to convert some of those funds to Roth, pay the tax and then let the funds grow tax-free into the future?

“If you’re in a high tax bracket now, doing a Roth contribution to your 401(k) makes no fiscal sense,” says Chris Chen, a Boston-based certified financial planner who runs Insight Financial Strategists.

Chen recently advised a couple in their 50s who wanted to shift all of their 401(k) contributions from tax-deferred accounts to Roth to save the hassle of converting the funds later. The challenge is they are currently in the 35% tax bracket, and must also pay Massachusetts’ 5% state income tax. They plan to retire early, at which point they’ll probably drop to the 12% bracket.

“So putting money in Roth now does not make sense from a tax standpoint,” says Chen. “They got persuaded to continue putting money into a traditional 401(k), and they deferred the Roth idea to later.”

Roth conversions

When you do come to the Roth conversion stage, you’ll need to look even closer at your tax bracket so that you can see how much income you can add without pushing into the next level. It’s a particularly steep increase from the 12% bracket to the 22% bracket, and then from the 24% bracket to the 32% bracket.

“You have to see at what point is it too painful to pay the tax,” says Ryan Losi, a CPA and executive vice president at PIASCIK, based in Glen Allen, Va. “We don’t want to go up to 32% or 35%, because that’s too big a payment.”

For example, if your taxable income for 2024 is going to be $80,000 as a married couple, you’d be in the 12% bracket. If you plan to convert $20,000 from your 401(k) or IRA to Roth, that pushes you over the $94,300 limit, and $5,700 would be taxable at 22%, to the tune of $1,254. So perhaps you’d want to only convert $14,000 instead, and by controlling the size of the conversion, you can minimize your tax liability.

You can do some of this tax-bracket management on the income side as well, Reddy says. You can employ a bunching strategy, meaning you make all your stock sales that would cause capital gains in one year and avoid transactions the following year. Or you might be due a lump-sum payment for disability or severance or from an annuity, and you can spread it out instead. “This is where awareness is important,” says Reddy.

Charitable giving

Bunching strategies also are helpful with charitable giving. Losi’s high-income clients are big users of donor-advised funds, which are charitable accounts that allow donors to take a deduction the year they deposit the funds and then distribute them later. “Clients will call and ask me, ‘What do I need to contribute this year to get me out of the 37% bracket?’” Losi says.

This works with the lower brackets, too, not just among the rich. If you’re in a high-tax state or paying a mortgage, it might benefit you to see where you are in your tax bracket. If you make a charitable donation of even a few hundred dollars, it could make sense for you to itemize instead of taking the standard deduction, and that extra amount could push you into a lower bracket.

Business owners and QBI

Business owners and sole practitioners are the ones who pay the most attention to their tax brackets, Losi says, especially because of the qualified business income deduction that can reduce taxes on business income by up to 20%. The rules are complicated, and it takes a lot to manage not only where you fall in the brackets, but also the phase-outs for specific trades.

For these taxpayers, it may make sense to try to get paid less by clients in a certain calendar year, and pay themselves more.

“You can invoice, but tell clients to hold off on payment,” Losi says. “You can accelerate deductions. You can deduct 100% of capital spent for automobiles, desks, chairs — everything [a business] needs to run.”

Losi also encourages business owners to pay themselves a healthy salary, which can reduce business income, and then set up solo qualified plans and cash-balance pension plans to put that money away pretax. “Heck yeah, cash-balance pension plans,” Losi says. “I’m the trustee of ours.”