This post was originally published on this site

AMC Entertainment Holdings Inc. bonds have been seeing bullish activity recently, according to information from the market-data company BondCliQ.

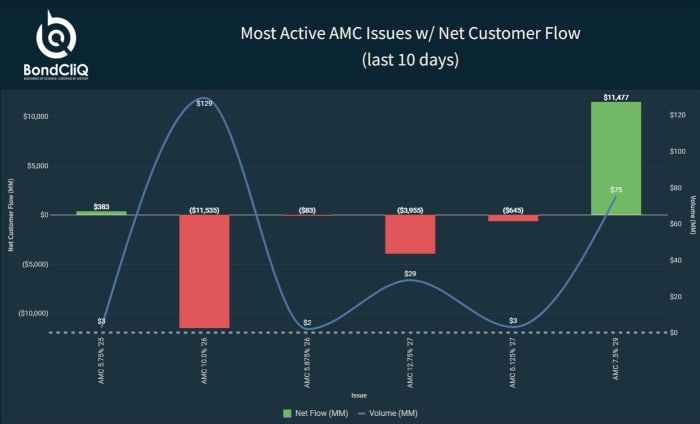

“The [AMC] bonds haven’t been quiet,” BondCliQ relationship manager John Brown-Christenson told MarketWatch. “In the last 10 [business] days, there has been better selling on the short end, the 2026 bond, and more buying on the longer 2029 bond.”

This, Brown-Christenson explained, is typically a bullish sign.

The AMC

AMC,

bonds have benefited from “[a] general better tone to the fixed-income market,” according to Brown-Christenson.

Related: AMC’s stock climbs after rival Cinemark’s third-quarter earnings beat

AMC has also been in the spotlight as it reaps the benefits of Taylor Swift’s record-breaking concert film, which opened Oct. 12. In addition to showing “Taylor Swift: The Eras Tour” in its theaters, AMC is also the theatrical distributor for the movie. AMC Theatres Distribution and subdistribution partners Variance Films, Trafalgar Releasing, Cinepolis and Cineplex Inc.

CPXGF,

CGX,

have clinched deals with movie-theater operators representing more than 8,500 theaters globally to show the film, according to AMC.

The most-active AMC issues with net customer flow over the last 10 business days.

BondCliQ

Set against this backdrop, shares of the movie-theater chain and meme-stock darling have risen 10.4% in the last five days, outpacing the S&P 500 index’s

SPX

gain of 4.6% over the same period.

Last week, AMC’s stock climbed after rival Cinemark Holdings Inc.’s

CNK,

third-quarter top- and bottom-line beat, which was boosted by the performance of summer blockbusters “Barbie” and “Oppenheimer.”

Related: AMC’s stock up more than 5%, on pace for longest win streak in almost four weeks

It has been an eventful few months for AMC. Following a months-long court battle, the company’s stock underwent a 1-for-10 reverse stock split in late August, and AMC also completed the conversion of its AMC Preferred Equity units to common stock.

In September, AMC completed a $325.5 million equity offering, which it said boosts its cash reserves, addresses liquidity concerns and fortifies the balance sheet. AMC CEO Adam Aron has repeatedly warned that the company faces liquidity challenges.

AMC reports third-quarter results after market close Wednesday. Analysts surveyed by FactSet are looking for sales of $1.26 billion and a loss of 25 cents a share.

Shares of AMC are up 2.6% Monday and are on pace to extend their win streak to three days, the longest since a five-day win streak that ended Oct. 12.

Related: AMC’s debt-to-equity, late payments, could be ‘red flags,’ warns Creditsafe