This post was originally published on this site

A former top official for the Federal Reserve is warning about all the ways in which the central bank’s pause on interest-rate hikes could go wrong.

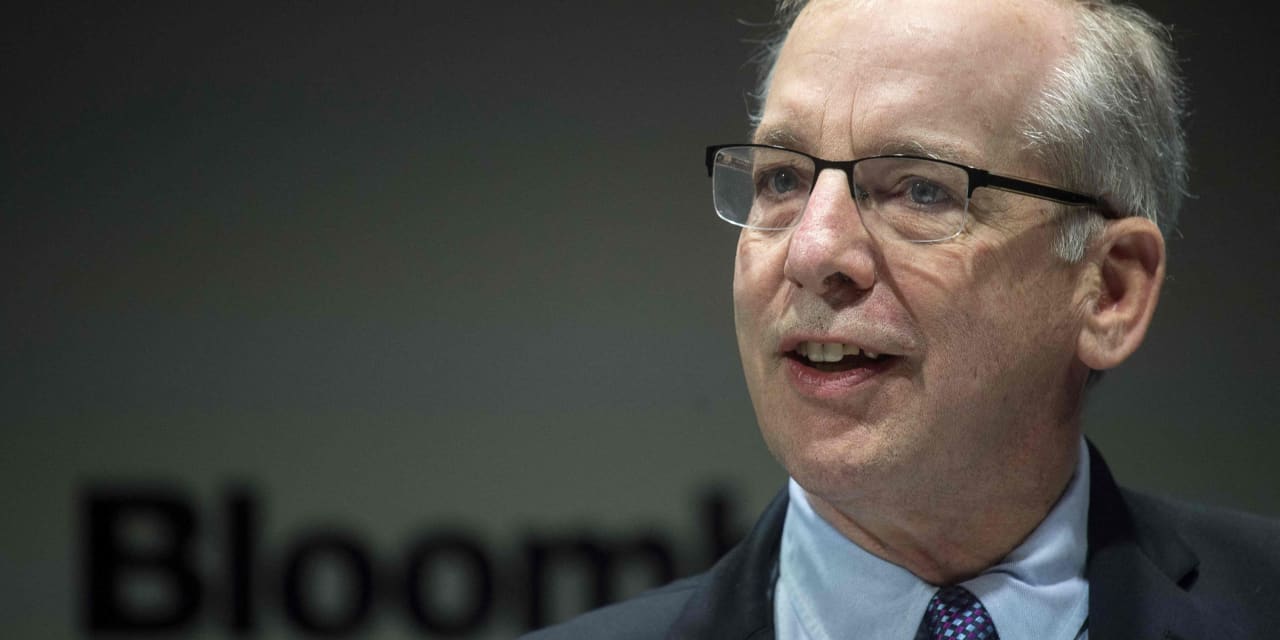

Bill Dudley, who led the Federal Reserve Bank of New York between 2009-2018, wrote in a Bloomberg column that he sees “four potentially fatal flaws” in policymakers’ thinking and that “they could be making a big mistake” by keeping rates on hold.

His warning came earlier on Wednesday, just hours before the policy-making Federal Open Market Committee voted unanimously to keep its main interest-rate target at a 22-year high of 5.25%-5.5%. One of the reasons for the Fed’s pause is the recent steep rise in long-term Treasury yields, which is helping to tighten financial conditions.

In a nutshell, Dudley said that Fed Chairman Jerome Powell is risking a repeat of the 1970s-1980s, when inflation spiraled out of control under Arthur Burns and required a severe U.S. recession under Paul Volcker.

Here is a rundown of Dudley’s views:

- The labor market is “still too tight” for the Fed to achieve its 2% inflation target, with nonfarm employers adding about 275,000 jobs a month, Dudley said. In September, the U.S. created 336,000 new jobs.

- The economy’s recent performance “strongly suggests that monetary policy isn’t sufficiently restrictive.” Dudley cited the third-quarter GDP increase of 4.9% on an annualized basis, which far exceeds the 20-year annual average of 2.1%.

- Monetary policy “doesn’t operate with the same lags that it used to.” Because Fed officials are more transparent about what they’re doing than in the past, financial conditions are moving faster as the market adjusts to expected changes in short-term interest rates.

- Whether higher long-term Treasury yields can work as a substitute for more monetary policy tightening depends on why those yields are going up in the first place. In any event, short-term rates also need to go higher to “exert the same degree of restraint.”

Dudley has been a nonexecutive director at Swiss bank UBS

UBS,

since 2019.

His views came on a day in which U.S. stocks

DJIA

COMP

finished the New York session higher. Meanwhile, Treasury yields fell, with the 2-year rate

BX:TMUBMUSD02Y

reaching its lowest close in almost two months, after the Fed’s policy statement was interpreted as being dovish.