This post was originally published on this site

Let’s hear it for retail investors, who don’t get enough credit for taking care of business.

Citing Vanda Research, the Wall Street Journal reports that the average individual-investor stock portfolio is up 150% since the start of 2014, versus around 140% for the S&P 500’s

SPX

during the same period.

All that is largely thanks to love for tech biggies like Apple and Tesla, as savvy investors picked up on their importance. And who wouldn’t want to hop on the next big theme and be sitting on big gains in a decade or two.

That brings us to our call of the day, from JPMorgan, which is flagging a “$100 billion plus opportunity” from emerging weight-loss drugs, or GLP-1s — glucagon-like peptide-1 gut hormones that can help control blood sugar levels and lower appetites.

“We forecast U.S. sales for the GLP-1 category to exceed $100 billion in annual sales over time, split roughly 50/50 in diabetes and obesity. Our global market estimate is [more than] $140 billion by 2032,” said a team led by analyst Nicholas Rosato, whose estimates crush the $77 billion in sales by 2030 predicted by Morgan Stanley this summer.

His team is bullish on U.S. and Europe picks Eli Lilly

LLY,

and Novo Nordisk

NVO,

NOVO.B,

and they see plenty of upside earnings surprises ahead for that pair. Note, the WSJ points out that Novo Nordisk, Europe’s most valuable company, is vulnerable to selling in Europe at times as Danish fund managers can’t hold more than 10% of the drugmaker.

Laying out other beneficiaries, they tamp down worries over medtech device makers — they are bullish views on Insulet

PODD,

Dexcom

DXCM,

and Inspire Medical

INSP,

and Gerresheimer

GXI,

In life sciences, they like Thermo Fisher

TMO,

Catalent

CTLT,

and Avantor

AVTR,

which makes process ingredients used in those diabetes/weight loss drugs, and see incremental gains seen for Danaher

DHR,

Repligen

RGEN,

and Agilent

A,

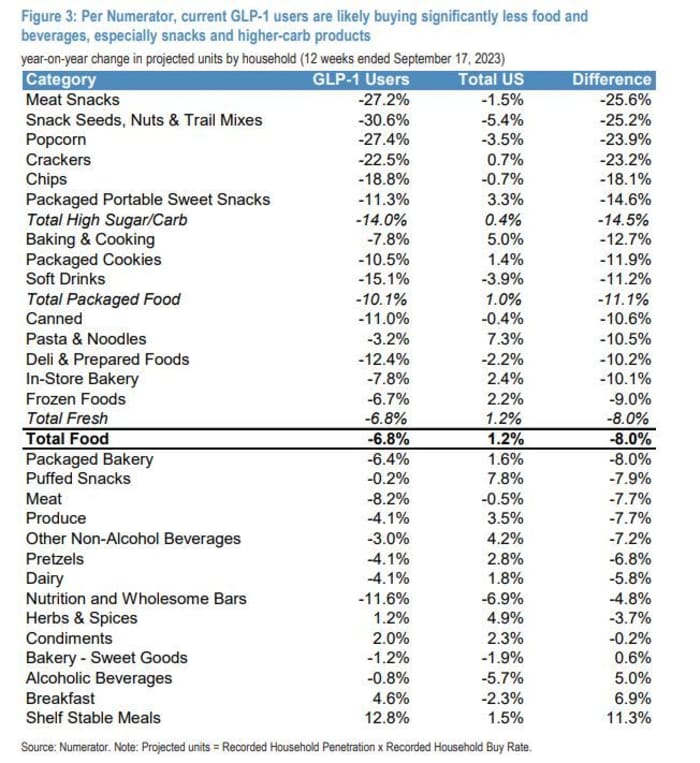

JPMorgan analysts then address the hot-button topic — how those drugs will cut into the American love for snack foods and drinks.

Walmart

WMT,

CEO John Furner sent shares of Coca-Cola

KO,

and PepsiCo

PEP,

tumbling a few weeks ago after he blamed GLP-drugs for lower spending on groceries and high-calorie snacks. (Coke lifted guidance as it reported forecast-beating results on Tuesday and shares are up) Morgan Stanley has been among Wall Street banks flagging this likely fallout.

Echoing this, JP Morgan analysts say the impact is “real and potentially not small,” and share a survey showing GLP-1 users prefer meat, produce and dairy to snacks, sugary drinks and high carb items. Some caveats here, just under 500 people were surveyed and they say it’s hard to tell if those category shifts will persist, they say:

JPMorgan/Numerator

To this effect, Rosato and the team are bullish on protein drink maker BellRing

BRBR,

and natural and organic grocery chain Sprouts Farmers Market

SFM,

(neutral rated). They are also bullish on Coca-Cola, which they see as “relatively more insulated” from GLP-1 fallout as around 80% of its volumes are international and 19 out of its 20 top drinks offer sugar free alternatives. They also like Keurig Dr Pepper

KDP,

as it’s less exposed to sugary drinks.

What else? Within U.S. food delivery they are prefer the more global player Uber

UBER,

to DoorDash

DASH,

and Instacart

CART,

for its potential from secular growth of online grocery delivery.

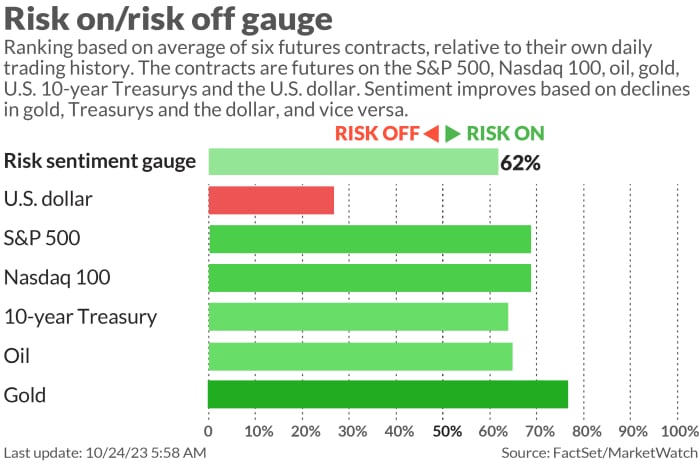

The markets

Stock futures

ES00,

NQ00,

are higher as bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

steady, following Monday’s dramatic 5% run for the 10-year note. Oil prices

CL.1,

are flat, and bitcoin

BTCUSD,

is climbing after reaching a nearly 18-month high on Monday over optimism that an ETF based on the crypto will soon be approved in the U.S.

The buzz

Earnings are rolling out from big names on Tuesday — GE

GE,

lifted guidance and the stock is climbing, 3M

MMM,

is up on a higher outlook and profit beat and General Motors

GM,

reported blowout earnings and shares are up. Xerox

XRX,

is up after swinging to a profit.

Alphabet

GOOGL,

(see preview), Microsoft

MSFT,

(see preview), Visa

V,

and Texas Instruments

TXN,

are due after the market close.

The S&P flash U.S. manufacturing and services purchasing managers indexes are due at 9:45 a.m.

Global demand for fossil fuels will peak before the end of the decade, as geopolitics hasten the move to renewable energy, says the International Energy Agency.

Best of the web

Israel-Hamas war sees investors shun most traditional havens, except for these two.

Microsoft and NBA offer menopause benefits to keep women working.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

SPOT, |

Spotify Technology |

|

PLTR, |

Palantir Technologies |

|

MSFT, |

Microsoft |

|

NIO, |

NIO |

Random reads

Skeletal, Taylor Swift-inspired Halloween lawn décor goes viral.

That 40 million year-old moon.

“Siren battles” blaring Céline Dion songs plague this New Zealand town.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.