This post was originally published on this site

While attending the virtual Retirement Coaches Association conference last week, I learned about the fascinating findings of two new surveys that contrast what preretirees and retirees say about retirement.

I was blown away by the differences between what preretirees expected retirement would be like and what retirees said they’ve actually experienced.

For example, 52% of preretirees in the Retirement Perspectives and Attitudes Survey said they thought the transition to retirement would be smooth. By contrast, only 32% of retirees surveyed said it was.

Transition into retirement: It’s harder than expected

The transition into retirement will likely be more challenging than preretirees expect, the authors of the March 2023 survey, Atlanta retirement coach Fritz Gilbert and Boston retirement coach Eric Weigel, wrote on their website.

“There’s an absolute blind spot on how difficult the transition can be,” noted Gilbert, the author of “The Ultimate Retirement Planning Guide.”

“Our society, especially the financial industry, talks about the ‘golden years.’ And when people think of retirement, they only think of the bright side,” said Weigel, the author of “Reimagining Retirement.” But when you find yourself retired, he added, “after you go through a bucket list of items, there’s a black hole, and people need to figure it out on the fly.”

The vast majority of retirees “wing it” into retirement, Weigel added, except for the financial-planning part.

The other survey, called the Great Retirement Disconnect, came to similar conclusions. That survey was conducted from February through April 2023 by Retirement Coaches Association founder Robert Laura. One caveat: The respondents to both surveys were largely retirement-coach clients, who tend to be more financially savvy and comfortable than preretirees and retirees in general.

At the conference, Laura summed up his study’s results this way: “People heading into retirement think it will magically come together, but people experiencing it see it from a completely different light.”

The disconnects the surveys found between preretirees and retirees were especially evident when it comes to how long the transition to retirement takes and to worries about retirement, including social connections in retirement.

Retirement Coaches Association

Retirement disconnect No. 1: The transition period

The preretirees surveyed often thought the period of transition to retirement would be pretty short. Many retirees said it wasn’t.

In Laura’s survey, 61% of preretirees thought it would take six months or less to feel comfortable with retirement. But half of retirees said it took a year or longer to adjust. As someone who left my full-time job 21 months ago, I side with those retirees.

Retirees’ top reasons for struggling in retirement, according to Laura’s research: loss of identity and lack of a daily routine.

When Gilbert and Weigel asked retirees in their survey about the challenges of transitioning into retirement, those respondents also cited the lack of a daily routine. In fact, they called “finding the right balance of structure” their biggest challenge. They were talking about going from workdays, where the calendar is pretty full and is scheduled either for or by you, to retirement days, where you need to figure out how to spend your time.

“It takes time to get structure right,” said Gilbert. I wholeheartedly agree. I’ve found creating a daily and weekly calendar to be among my biggest challenges in unretirement.

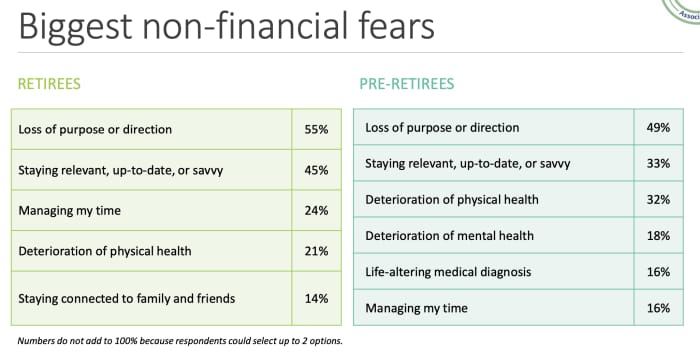

The retirees Laura surveyed also said managing their time was one of their biggest nonfinancial fears.

Retirement Perspectives and Attitudes survey

Retirement disconnect No. 2: Worries

Gilbert and Weigel’s survey also found that preretirees were more worried about the financial side of retirement than retirees.

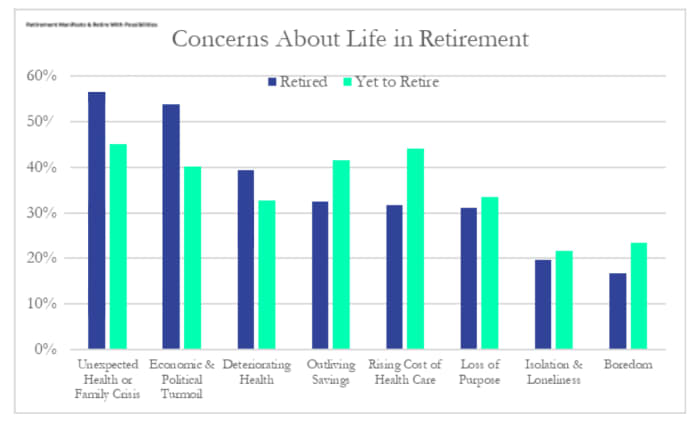

“Those who are already retired worried less about money and a lot more about health and the political and economic environment,” Weigel noted. His survey found that the combination of economic and political turmoil was retirees’ second-greatest concern about life in retirement, after “unexpected health or family crisis.”

Retirement disconnect No. 3: Social connections

When Laura surveyed retirees, 84% said they had seen a decline in their social network since retiring, and 40% said their daily social interactions had fallen by more than half.

Retirees also said that having few friends was among the top things they struggled with in retirement. But many preretirees weren’t worried about keeping or making social connections in retirement. In fact, 40% of preretirees told Laura they expected their social connections would increase in retirement.

Gilbert and Weigel saw a similar disconnect in their research.

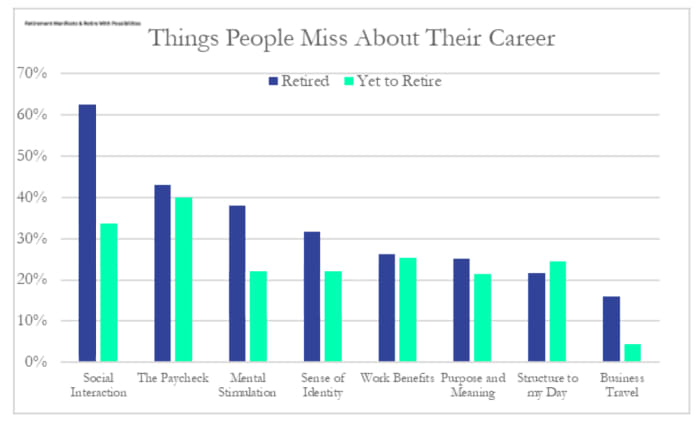

When they asked retirees for the biggest gaps in their retirement planning, in first place was “replacing lost work connections.” A stunning 62% of retirees said the thing they missed most after leaving their full-time jobs was the social interaction of work. In a distant second place: the paycheck.

But just 29% of preretirees thought they’d miss the social connections from their jobs. “A huge gap!” Gilbert said at the conference. Gilbert and Weigel’s advice for preretirees: Start cultivating new social connections and finding new sources of mental stimulation before you retire.

Retirement Perspectives and Attitudes survey

Where preretirees and retirees agreed

Loss of purpose or direction was the top concern among the retirees Laura surveyed and was also the biggest nonfinancial retirement fear among preretirees — no disconnect there.

Gilbert and Weigel wrote on their website that identifying meaning and purpose is “the critical driver to finding true joy in retirement.”

As I’ve written on MarketWatch, finding meaning and purpose in retirement is about searching for what the Japanese call your “ikigai” — your reason to get up in the morning.

What financial advisers and HR departments could do

The two studies make a convincing case that financial advisers and human-resources departments ought to do more to help preretirees with the nonfinancial aspects of retirement.

Retirees think so.

In Laura’s survey, 90% of retirees felt financial advisers should be addressing retirement holistically, helping clients with the nonfinancial parts, while 86% believed HR departments should do that.

But only 40% to 50% of preretirees agreed, demonstrating another retirement disconnect and the narrow way many preretirees view retirement.

New ways to help people retire better

At the conference, Laura introduced a beta program he’s creating for employers, called WorkPrint, to assist them in preparing employees for retirement.

The program’s five 60-minute sessions and three follow-up meetings will, he hopes, educate and train employees for their retirement transition and position employers as “thought leaders in the longevity economy.”

Laura wants to help create a new narrative around retirement that would lead companies to trash outdated policies fostering an ageist view of career transition and open up new lines of communication with older workers while retaining their wisdom through phased retirements and volunteer mentorships.

Starting in October 2023, the Retirement Coaches Association will also host virtual “identity and purpose labs” to foster community and connection for retirees. And the group’s Advisor Alliance and Talent Alliance initiatives aim to assist clients and employees in planning for the nonfinancial aspects of life after full-time work.

With luck, maybe efforts like those will resolve the retirement disconnect.