This post was originally published on this site

Renting is a far cheaper and smarter option for many Americans today in the face of high homeownership costs, according to a new analysis by the real-estate technology platform Cadre.

With mortgage rates over 7% and elevated home prices, as well as intense competition among buyers over a low number of home listings, many renters hoping to buy a house are finding it too expensive.

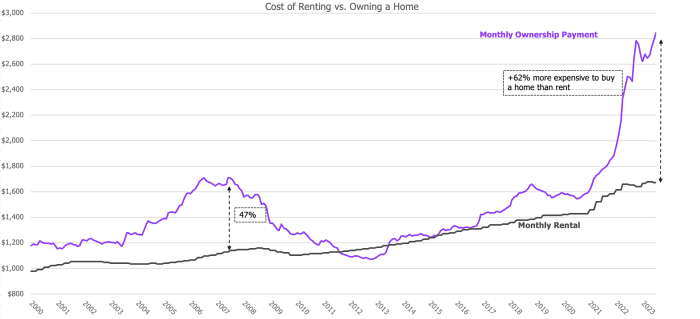

The chart below from real-estate technology platform Cadre shows the yawning gap between owning and renting and how it has shifted since 2000.

The difference in monthly costs between buying a home and renting is wider than it has ever been, a new analysis by the real-estate technology platform Cadre shows.

Cadre

It was 62% more expensive to buy rather than rent in July 2023, Cadre found.

Cadre’s sources include data from the real-estate information provider CoStar Group, the St. Louis Fed, and Zillow

Z,

Cadre’s founder and CEO Ryan Williams said that the company’s investments team analyzed the average spread in monthly costs between homeowners and renters across the U.S.

They also looked at CoStar rent data and made assumptions based on average insurance costs, home prices, and mortgage rates, as well as the cost of home maintenance, property taxes, and closing costs to calculate a true cost of ownership.

“Interestingly, as of August 2023, our team found the spread in monthly costs between homeownership and renting reached its widest point since 2000 with it being approximately 70% more expensive to own a home than rent,” Williams told MarketWatch.

The median price of a home in the U.S. in July was $406,700, according to the National Association of Realtors.

The median asking renting rent in August was $2,052, according to Redfin

RDFN,

The company estimated the median monthly mortgage payment to be $2,632 in September.