This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEC0S0AR_M.jpg

This rise followed Thursday’s market downturn where the Dow Jones Industrial Average fell by 1.08%, the S&P 500 declined by 1.64%, and the Nasdaq Composite dropped by 1.82%. Over the past three days, the S&P 500 has seen a total decrease of 2.8%.

The Federal Reserve’s decision to hold interest rates but increase the median projection for expected rates in 2024 by half a point triggered the selling spree earlier this week. This decision led to Wall Street experiencing its most significant slump in half a year as 10-year benchmark Treasury yields reached 4.5% for the first time since 2007.

Thursday also saw an unexpected drop in jobless claims, which drove the two-year Treasury yield to its highest level since 2006 and pushed the ten-year yield to its highest since 2007. As a result, the likelihood of future rate cuts has now decreased to just 75 basis points.

Despite the bearish trend, strategists from Saxo Bank noted that both the S&P 500 and Nasdaq 100 closed at technical support levels, suggesting a potential for minor rebounding.

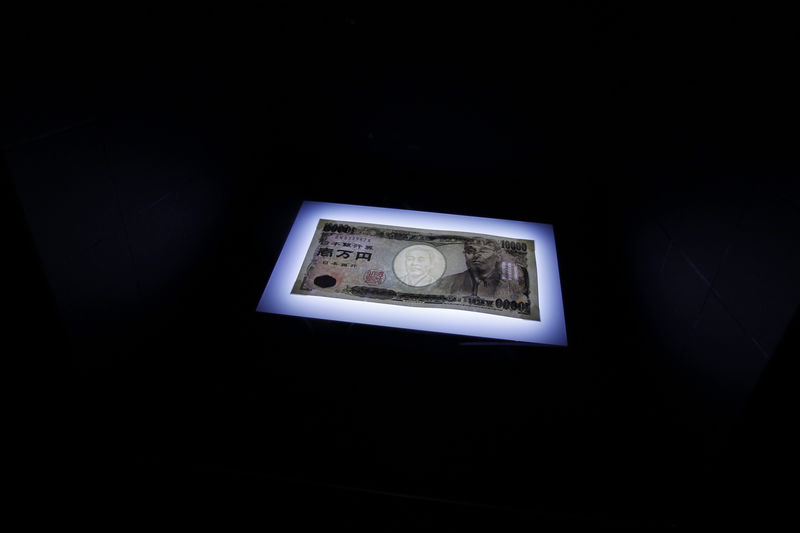

In other economic news, this week the Bank of Japan decided to maintain its ultra-loose monetary policy stance. This decision resulted in some gains for the dollar against the yen. On the U.S. economic calendar, preliminary readings of manufacturing and services purchasing managers indices are expected, along with a speech from Federal Reserve Governor Lisa Cook at an artificial intelligence conference.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.